Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Customs Import Specialist position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together.

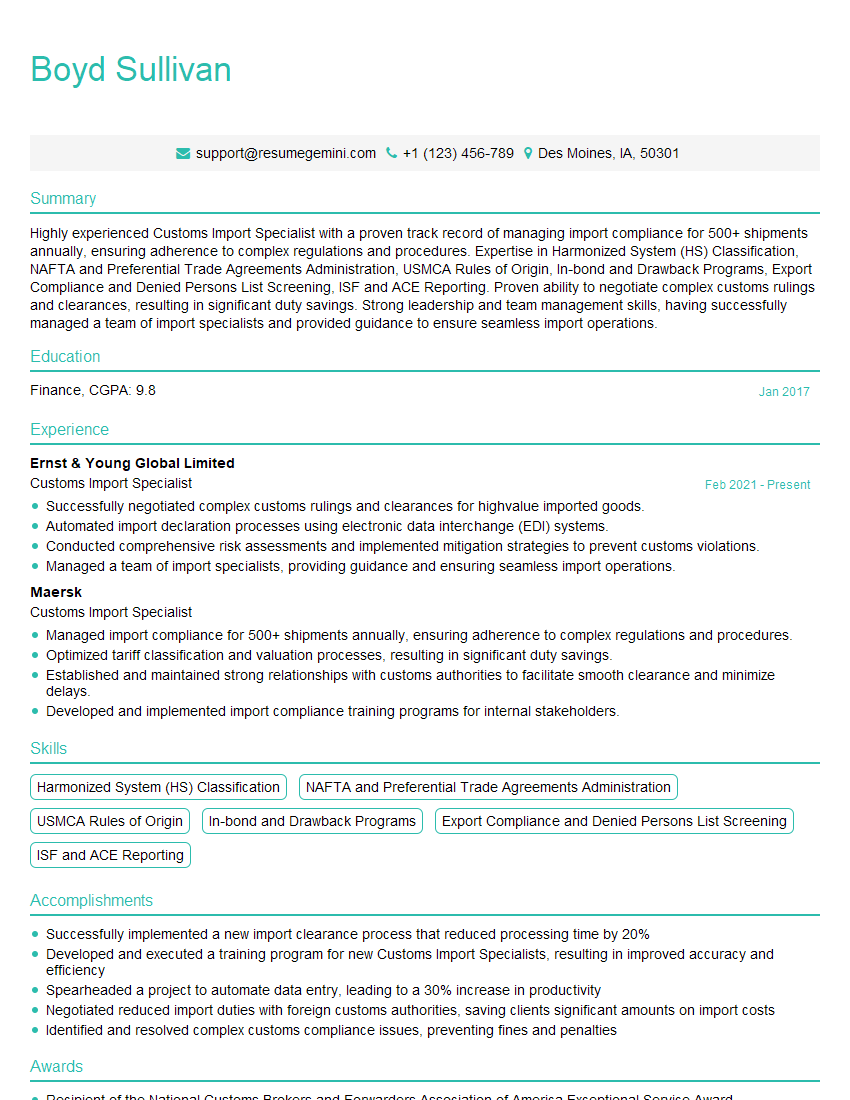

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Customs Import Specialist

1. What are the key responsibilities of a Customs Import Specialist?

- Classify and determine the value of imported goods.

- Calculate and assess duties, taxes, and other fees.

- Prepare and submit import documentation.

- Inspect imported goods to ensure compliance with regulations.

- Audit and review import records.

2. What are the different types of import entries?

Informal entries

- For goods valued at $2,500 or less.

- Can be made without a formal entry.

Formal entries

- For goods valued over $2,500.

- Require a formal entry document.

Temporary importations

- For goods imported for a temporary period of time.

- Must be re-exported within the specified time period.

Drawback entries

- For goods exported after being imported.

- Duty paid on the imported goods can be refunded.

3. What are the most common Harmonized Tariff Schedule (HTS) codes?

- 9801.00.10 – Toys

- 8528.12.10 – Laptops

- 8507.20.00 – Smartphones

- 6104.23.00 – Men’s suits

- 6110.20.00 – Women’s blouses

4. What are the different types of bonds used in international trade?

- Single-entry bonds

- Continuous bonds

- Term bonds

- Conditional bonds

- Immediate delivery bonds

5. What are the consequences of making false or fraudulent import statements?

- Monetary penalties

- Seizure of goods

- Criminal prosecution

6. What are the latest trends in international trade?

- E-commerce

- Growth of emerging markets

- Increased use of technology

- Focus on sustainability

- Rise of regional trade agreements

7. What are the challenges facing Customs Import Specialists?

- Increased volume of trade

- Complex and ever-changing import regulations

- Advancements in technology

- Need for increased security

- Globalization of supply chains

8. What are the qualities of a successful Customs Import Specialist?

- Strong attention to detail

- Ability to work independently and as part of a team

- Excellent communication skills

- Up-to-date knowledge of import regulations

- Ability to solve problems quickly and efficiently

9. What are your salary expectations?

- My salary expectations are in line with the market rate for Customs Import Specialists with my experience and qualifications.

- I am willing to negotiate a salary that is fair and equitable for both parties.

10. Why are you interested in working for our company?

- I am interested in working for your company because of its reputation as a leader in the import industry.

- I believe that my skills and experience would be a valuable asset to your team.

- I am eager to learn more about your company and how I can contribute to its success.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Customs Import Specialist.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Customs Import Specialist‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities of a Customs Import Specialist

Customs Import Specialists play a crucial role in facilitating international trade by ensuring that goods entering the country comply with customs regulations and tariffs. Their primary responsibilities include:

1. Import Documentation Review

Meticulously reviewing and analyzing import documents, such as invoices, packing lists, and bills of lading, to verify accuracy and ensure compliance with customs regulations.

2. Tariff Classification

Accurately classifying imported goods based on the Harmonized Tariff Schedule to determine applicable duties, taxes, and other fees.

3. Duty and Tax Calculations

Calculating and assessing import duties, taxes, and other charges based on the classified tariff code and declared value of the goods.

4. Customs Clearance

Submitting customs declarations and other required documentation to facilitate the release of imported goods from customs custody.

5. Compliance and Regulations

Staying abreast of changing customs regulations and ensuring compliance with all applicable laws and procedures.

Interview Preparation Tips for a Customs Import Specialist

Preparing thoroughly for a Customs Import Specialist interview is essential to showcase your knowledge and skills. Here are some valuable tips:

1. Research the Company and Industry

Familiarize yourself with the company you’re applying to, including its business model, industry trends, and specific customs requirements related to their operations.

2. Prepare for Technical Questions

Study customs regulations, tariff classification systems, and import documentation procedures to demonstrate your understanding of the core responsibilities of the role.

3. Highlight Relevant Experience and Skills

Emphasize your previous experience in import operations, customs compliance, or related fields. Highlight your analytical skills, attention to detail, and ability to work independently.

4. Demonstrate Problem-Solving Abilities

During the interview, be prepared to discuss specific situations where you successfully navigated customs challenges or resolved import-related issues.

5. Practice Common Interview Questions

Review common interview questions, such as “Why are you interested in this role?” and “What sets you apart from other candidates?” Prepare well-thought-out answers that showcase your qualifications.

6. Dress Professionally and Arrive on Time

First impressions matter. Dress professionally, arrive on time for your interview, and maintain a positive and confident demeanor.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Customs Import Specialist role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.