Feeling lost in a sea of interview questions? Landed that dream interview for Pawn Broker but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Pawn Broker interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

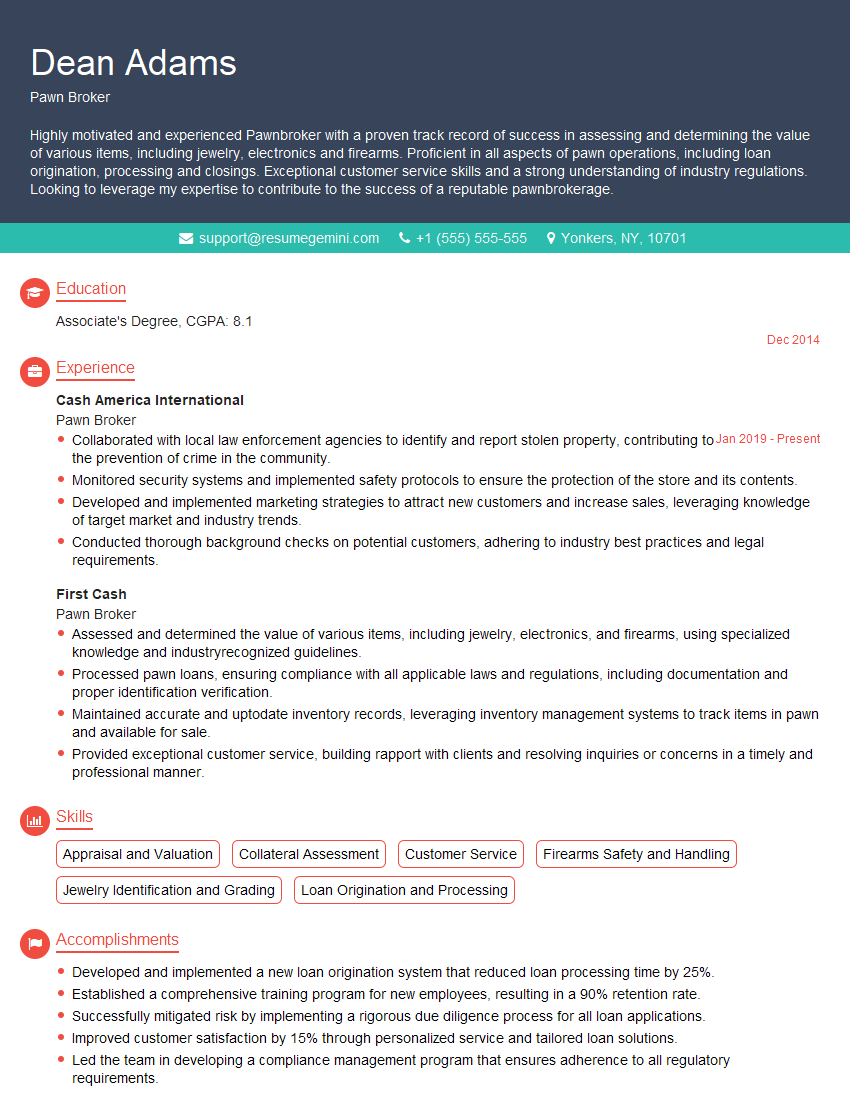

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Pawn Broker

1. Explain the key responsibilities of a Pawn Broker?

As a Pawn Broker, my key responsibilities include:

- Evaluating and assessing collateral offered by customers to determine its value and loan amount.

- Providing pawn loans to customers based on the valuation of their collateral.

- Storing and safeguarding collateral in a secure and controlled environment.

- Managing loan accounts, including tracking payments, calculating interest, and handling loan extensions.

- Communicating with customers to inform them of pawn loan details and provide customer service.

2. Describe the appraisal process you use to determine the value of collateral?

Methods of Appraisal

- Physical Examination: Inspecting the item, assessing its condition, age, authenticity, and verifying any identifying marks.

- Market Research: Consulting industry databases, auction records, and comparable sales to establish the current market value.

Factors Considered

- Item Type: Identifying the category of collateral (jewelry, electronics, antiques, etc.).

- Brand and Model: Determining the manufacturer, design, and specific features of the item.

- Condition: Assessing the overall appearance, wear and tear, any damage, or repairs.

3. How do you handle situations where customers default on their pawn loans?

When customers default on their pawn loans:

- Contact the customer via phone, email, or mail to inform them of the default.

- Provide a grace period for customers to catch up on payments before foreclosure proceedings begin.

- If the customer fails to respond or make payments within the grace period, proceed with foreclosure procedures as per company policy and applicable laws.

- Notify the customer of the foreclosure process and provide them with an opportunity to redeem their collateral.

- If the collateral is not redeemed, arrange for its sale or disposal to recover the loan amount.

4. What are the ethical guidelines that govern Pawn Broking?

The ethical guidelines that govern pawn brokering include:

- Transparency: Clearly communicating loan terms, interest rates, and fees to customers.

- Fairness: Ensuring that valuations and loan amounts are reasonable and based on market value.

- Confidentiality: Protecting customer information and transactions from unauthorized disclosure.

- Responsible Lending: Assessing a customer’s ability to repay the loan before extending credit.

- Compliance: Adhering to all applicable laws and regulations related to pawn brokering.

5. How do you stay up-to-date on industry trends and best practices?

Here’s how I stay updated on industry trends and best practices:

- Attend Industry Events: Participate in conferences, workshops, and seminars related to pawn brokering and lending.

- Read Trade Publications: Subscribe to industry magazines, journals, and newsletters to stay informed about market trends, legal updates, and regulatory changes.

- Network with Peers: Connect with other pawn brokers and industry professionals to exchange knowledge and discuss best practices.

- Utilize Online Resources: Explore websites, online forums, and discussion boards dedicated to pawn brokering.

6. Describe your experience in identifying and preventing fraud in pawn transactions?

My experience in identifying and preventing fraud in pawn transactions includes:

- Verification of Identification: Requesting valid identification documents and comparing physical features to prevent stolen or counterfeit items.

- Physical Examination: Carefully inspecting items for signs of tampering, alterations, or reproduction.

- Verification of Ownership: Checking for ownership documents, proof of purchase, or registration certificates to confirm legitimate possession.

- Consultation with Experts: Utilizing the expertise of third-party appraisers or specialized equipment to verify authenticity and identify potential forgeries.

- Communication with Law Enforcement: Reporting suspicious transactions or stolen items to the police for investigation.

7. How do you ensure the security of the pawn shop and its assets?

I ensure the security of the pawn shop and its assets through the following measures:

- Physical Security: Installing security cameras, alarm systems, motion detectors, and sturdy locks to deter and detect unauthorized entry.

- Employee Training: Implementing comprehensive security protocols for employees, including background checks, daily inventory checks, and proper handling of firearms.

- Customer Screening: Using identification verification procedures and monitoring customer behavior to prevent suspicious activities.

- Insurance: Maintaining adequate insurance coverage to protect the business and its assets from theft, damage, and liability.

- Collaboration with Law Enforcement: Building relationships with local law enforcement agencies to facilitate quick response in case of emergencies or criminal activity.

8. What would you do to improve customer satisfaction in a pawn shop?

To improve customer satisfaction in a pawn shop, I would implement the following strategies:

- Exceptional Customer Service: Providing friendly, knowledgeable, and personalized service to make customers feel valued and respected.

- Competitive Rates: Offering fair and competitive interest rates on pawn loans to attract and retain customers.

- Transparency: Clearly explaining loan terms, interest rates, and fees to avoid confusion and build trust.

- Product Variety: Stocking a diverse range of items to cater to different customer needs and preferences.

- Feedback Mechanism: Regularly seeking customer feedback through surveys or reviews to identify areas for improvement.

9. How do you handle difficult customers or confrontational situations?

When dealing with difficult customers or confrontational situations:

- Remain Calm and Professional: Maintain a composed and respectful demeanor to de-escalate the situation.

- Active Listening: Listen attentively to the customer’s concerns and try to understand their perspective.

- Empathy and Validation: Acknowledge the customer’s feelings and show empathy to build rapport.

- Problem-Solving Approach: Focus on finding a mutually acceptable solution that meets the customer’s needs while adhering to company policies.

- Seek Support: If the situation becomes unmanageable, consult with a supervisor or call for assistance.

10. What are the top three qualities that make a successful Pawn Broker?

The top three qualities that contribute to a successful Pawn Broker are:

- Strong Communication Skills: Ability to interact effectively with customers, build rapport, and clearly explain loan terms.

- Business Acumen: Knowledge of pawn lending practices, financial management, and risk assessment.

- Empathy and Customer Service: Capacity to understand customers’ needs, provide personalized service, and foster positive relationships.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Pawn Broker.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Pawn Broker‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Pawnbrokers play a vital role in providing financial assistance to individuals in need of quick access to cash. They assess the value of items offered as collateral, determine loan amounts, and maintain accurate records of transactions. Here are the key responsibilities of a Pawn Broker:

1. Assess Value of Collateral

Pawnbrokers must possess a keen eye for detail and a deep understanding of various types of merchandise, including jewelry, electronics, and tools.

- Inspect and evaluate items offered as collateral, considering factors such as age, condition, rarity, and brand.

- Utilize knowledge of market trends and industry databases to determine fair market value.

- Consult with experts or appraisers for higher-value items to ensure accurate valuations.

2. Determine Loan Amounts

Based on the assessed value of the collateral, pawnbrokers calculate the loan amount.

- Determine the percentage of the collateral’s value that can be loaned, typically within industry standard guidelines.

- Consider the customer’s financial situation, credit history, and ability to repay the loan.

- Provide clear and transparent loan terms, including interest rates, loan durations, and payment options.

3. Maintain Accurate Records

Pawnbrokers are responsible for maintaining detailed records of all transactions and collateral.

- Create and store pawn tickets that document the loan details, collateral description, and customer information.

- Maintain accurate inventory records, including descriptions, values, and storage locations of all collateral.

- Comply with all applicable laws and regulations regarding pawn transactions and record-keeping.

4. Provide Customer Service

Pawnbrokers interact with a diverse range of customers and must provide exceptional customer service.

- Build strong relationships with customers by listening to their needs and providing personalized assistance.

- Explain loan terms, answer questions, and provide clear instructions for redeeming collateral.

- Maintain confidentiality and respect the privacy of customers.

Interview Preparation Tips

Preparing thoroughly for a pawnbroker interview can significantly increase your chances of success. Here are some tips and hacks to help you ace the interview:

1. Research the Company and Industry

Demonstrate your knowledge of the pawnbrokerage industry and the specific company you’re applying to.

- Visit the company website to learn about their services, history, and company culture.

- Read industry publications and articles to stay up-to-date on market trends and best practices.

2. Practice Your Valuation Skills

Pawnbrokers must be able to assess the value of items accurately. Practice your skills before the interview.

- Examine different types of items and research their approximate market value using online databases or catalogs.

- Consider factors such as age, condition, rarity, and brand when making your valuations.

3. Prepare for Behavioral Questions

Behavioral interview questions focus on your past experiences and behaviors in specific situations.

- Use the STAR method (Situation, Task, Action, Result) to answer questions about how you handled previous work challenges or provided excellent customer service.

- Highlight your ability to stay calm under pressure, problem-solve effectively, and build strong relationships.

4. Dress Professionally and Be Punctual

First impressions matter. Dress professionally and arrive on time for your interview.

- Wear business attire that is clean, pressed, and appropriate for the industry.

- Be punctual and show respect for the interviewer’s time.

5. Be Enthusiastic and Ask Questions

Demonstrate your enthusiasm for the pawnbrokerage profession and the company you’re interviewing with.

- Express your passion for helping customers and your commitment to providing excellent service.

- Ask thoughtful questions about the company’s policies, procedures, and opportunities for advancement.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Pawn Broker role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.