Are you gearing up for an interview for a Insurance Office Supervisor position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Insurance Office Supervisor and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

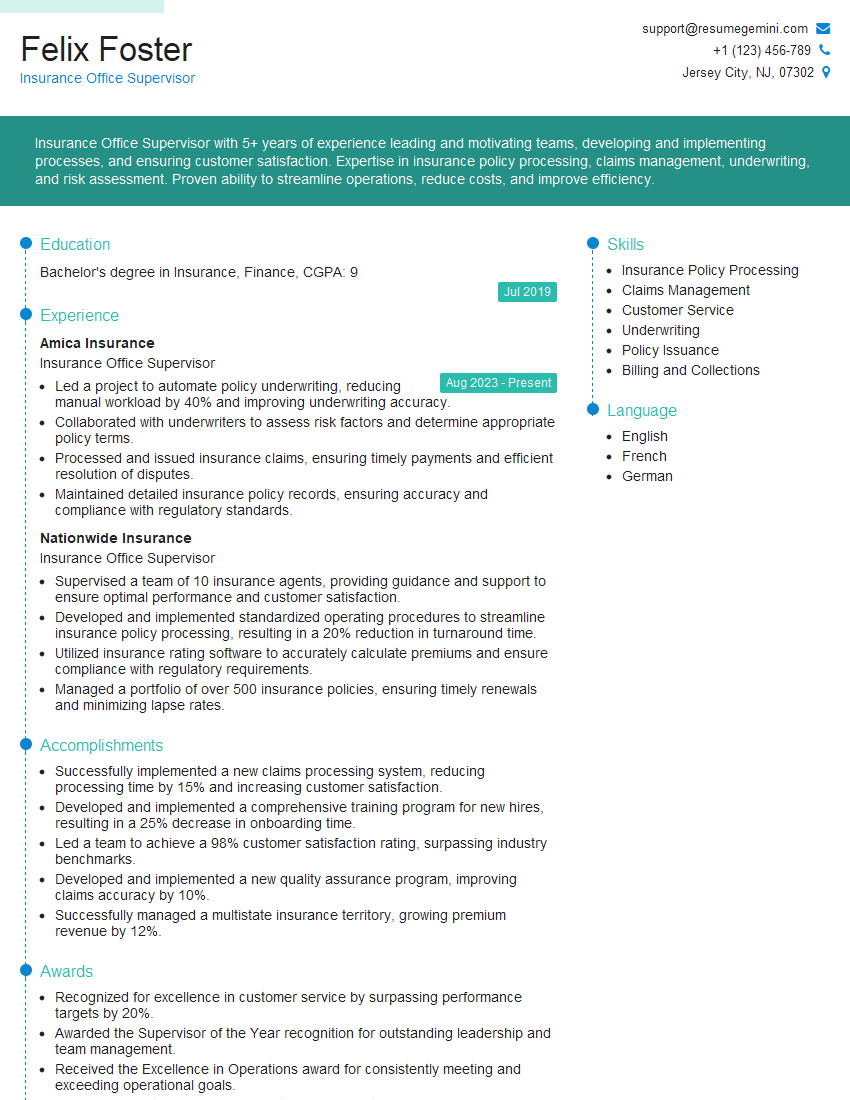

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Insurance Office Supervisor

1. How do you manage and prioritize multiple insurance policies and claims simultaneously, ensuring timely and efficient processing?

I have developed a comprehensive system to manage and prioritize multiple insurance policies and claims simultaneously, ensuring timely and efficient processing. I begin by assessing the urgency and complexity of each policy and claim. High-priority policies and claims are handled immediately, while less urgent matters are scheduled for a later date. I maintain a detailed log of all policies and claims, including their status and deadlines, to ensure that nothing is overlooked. I also delegate tasks to my team members based on their skills and experience, enabling us to handle a high volume of work while maintaining accuracy and efficiency.

2. Describe your experience in underwriting and risk assessment. How do you evaluate insurance risks and determine appropriate coverage?

Underwriting Expertise

- Thorough understanding of underwriting principles and risk assessment techniques.

- Proven ability to analyze financial statements, loss history, and other relevant data to evaluate risks.

Risk Assessment Process

- Conduct thorough due diligence to gather accurate and comprehensive information about potential policyholders.

- Utilize industry-standard risk assessment tools and techniques to identify and quantify potential risks.

- Develop and implement customized underwriting strategies to mitigate risks and determine appropriate coverage levels.

3. How do you handle complex insurance claims, including those involving fraud or subrogation?

I have extensive experience in handling complex insurance claims, including those involving fraud or subrogation. I begin by thoroughly investigating the claim to gather all relevant information. I work closely with policyholders, witnesses, and experts to establish the facts of the case. I am skilled in identifying potential fraud indicators and have a strong understanding of insurance fraud investigation techniques. In cases of subrogation, I work to recover funds from responsible third parties, ensuring that the policyholder is fully compensated. I am also adept at negotiating settlements and representing the insurance company in legal proceedings, if necessary.

4. Describe your knowledge of insurance regulations and compliance. How do you ensure that your team adheres to all applicable laws and industry standards?

I have a deep understanding of insurance regulations and compliance. I stay up-to-date on all applicable laws and industry standards and ensure that my team adheres to them. I have developed a comprehensive compliance program that includes regular training, audits, and risk assessments. I also work closely with our legal counsel to ensure that we are in compliance with all regulatory requirements. I am committed to maintaining the highest ethical standards and ensuring that our business is conducted in a fair and transparent manner.

5. How do you motivate and manage a team of insurance professionals, fostering a positive and productive work environment?

I am a highly motivated and results-oriented leader with a proven track record of motivating and managing teams of insurance professionals. I create a positive and productive work environment by setting clear expectations, providing regular feedback, and recognizing employee achievements. I encourage collaboration and teamwork, and I am always willing to provide support and guidance to my team members. I am also committed to professional development and provide opportunities for my team to grow and advance their careers.

6. Describe your experience in using insurance software and technology to streamline operations and improve efficiency.

I am proficient in using a variety of insurance software and technology to streamline operations and improve efficiency. I have implemented several software solutions that have automated many of our processes, freeing up my team to focus on more complex tasks. I am also familiar with data analytics tools that can be used to identify trends and improve our underwriting and claims handling processes. I am always looking for new ways to use technology to improve our operations and provide better service to our customers.

7. How do you stay up-to-date on changes in the insurance industry, including new regulations and market trends?

I am committed to staying up-to-date on changes in the insurance industry, including new regulations and market trends. I regularly attend industry conferences and webinars, and I read trade publications and online resources. I also maintain a network of contacts in the industry, including regulators, insurers, and brokers. This allows me to stay informed about the latest developments and to identify opportunities for our business.

8. Describe your experience in customer service and how you handle customer inquiries and complaints.

I have a strong customer service orientation and am committed to providing excellent service to our customers. I am always polite and respectful, and I take the time to listen to customers’ needs and concerns. I am able to resolve most customer inquiries and complaints quickly and efficiently. In cases where a more complex issue arises, I will escalate the issue to my supervisor or another appropriate person. I am also always willing to go the extra mile to ensure that our customers are satisfied.

9. How do you measure the success of your team and what metrics do you use to track performance?

I measure the success of my team based on a number of metrics, including customer satisfaction, operational efficiency, and financial performance. I track customer satisfaction through surveys and feedback mechanisms. I measure operational efficiency by tracking the number of policies and claims processed per employee, as well as the average time to process a policy or claim. I track financial performance by monitoring our revenue, expenses, and profit margin. I use these metrics to identify areas where we can improve our performance and to make adjustments to our operations as needed.

10. What are your career goals and how do you see this role fitting into your long-term aspirations?

I am passionate about the insurance industry and I am always looking for ways to grow and develop my career. I am eager to take on new challenges and responsibilities, and I am confident that I can make a significant contribution to your company. I believe that this role is an excellent opportunity for me to learn and grow, and I am excited about the prospect of contributing to the success of your team.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Insurance Office Supervisor.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Insurance Office Supervisor‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

An Insurance Office Supervisor is responsible for overseeing the day-to-day operations of an insurance office. They ensure that all policies are processed correctly and that customers receive the best possible service. Some of the key responsibilities of an Insurance Office Supervisor include:1. Managing staff

Supervisors are responsible for hiring, training, and evaluating the performance of their staff. They must create a positive work environment and motivate their team to achieve their goals.

- Hiring, training, and developing staff

- Creating a positive work environment

- Motivating staff to achieve their goals

2. Processing insurance policies

Supervisors are responsible for ensuring that all insurance policies are processed correctly. They must review applications, underwrite risks, and issue policies.

- Reviewing applications

- Underwriting risks

- Issuing policies

3. Providing customer service

Supervisors are responsible for providing excellent customer service. They must answer questions, resolve complaints, and process claims.

- Answering questions

- Resolving complaints

- Processing claims

4. Managing the office budget

Supervisors are responsible for managing the office budget. They must ensure that all expenses are within budget and that the office is operating profitably.

- Creating and managing a budget

- Tracking expenses

- Ensuring that the office is operating profitably

Interview Tips

Here are some interview tips to help you ace your interview for an Insurance Office Supervisor position:Before the interview, take some time to research the company and the position. This will help you understand the company’s culture and the specific requirements of the job.

1. Dress professionally and arrive on time.

First impressions matter, so make sure you dress professionally and arrive on time for your interview. This will show the interviewer that you are respectful of their time and that you take the interview seriously.

2. Be prepared to answer questions about your experience and qualifications.

The interviewer will likely ask you questions about your experience and qualifications. Be prepared to answer these questions in a clear and concise manner. Highlight your skills and experience that are most relevant to the job. Use STAR (Situation, Task, Action, Result) examples to support your answers.

3. Be enthusiastic and positive.

Insurance is a customer service-oriented industry, so the interviewer will be looking for someone who is enthusiastic and positive. Be sure to smile and make eye contact when you are speaking. Show the interviewer that you are passionate about the insurance industry and that you are eager to help customers.

4. Ask questions.

Asking questions shows the interviewer that you are engaged in the conversation and that you are interested in the position. Ask questions about the company, the position, and the team. This will give you a better understanding of the company and the role, and it will also help you determine if the company is a good fit for you.

Next Step:

Now that you’re armed with the knowledge of Insurance Office Supervisor interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Insurance Office Supervisor positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini