Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Licensed Insurance Sales Agent position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

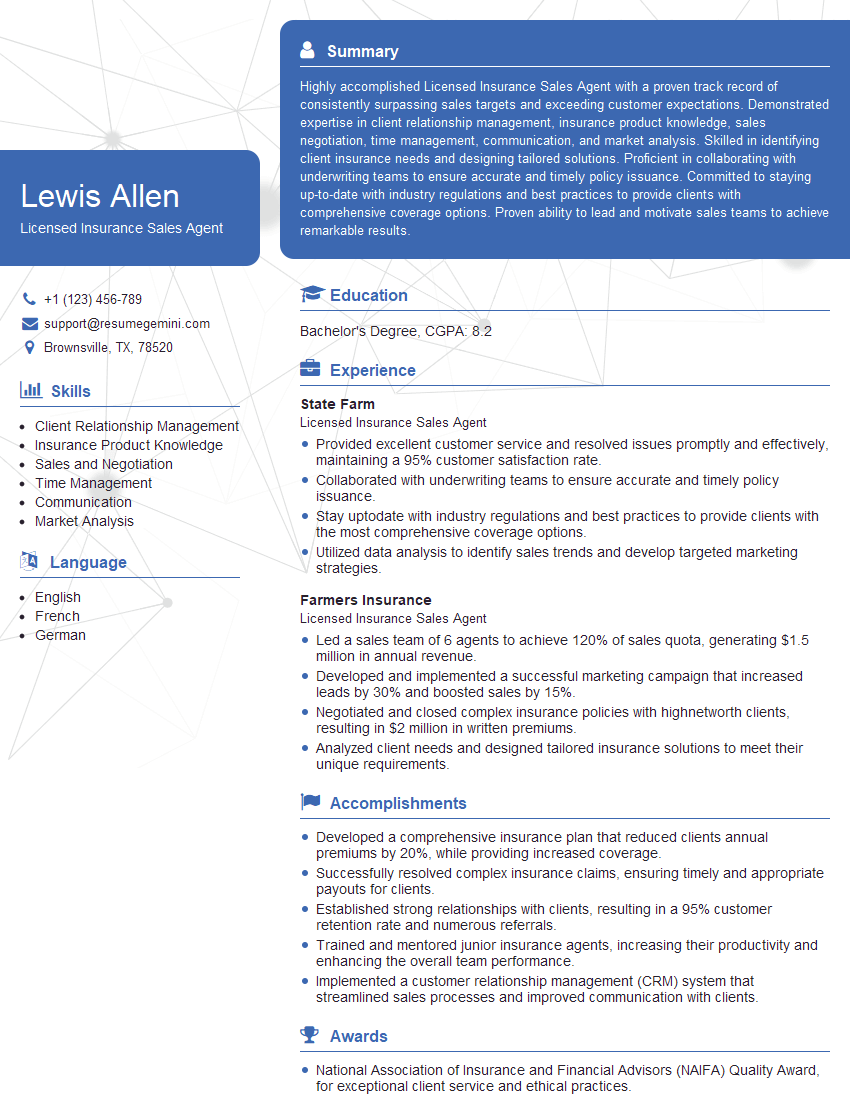

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Licensed Insurance Sales Agent

1. What are the key responsibilities of a Licensed Insurance Sales Agent?

- Prospect and qualify potential clients to identify their insurance needs.

- Develop and present insurance solutions that meet clients’ specific requirements.

- Negotiate and secure insurance policies on behalf of clients.

- Provide ongoing support and guidance to clients throughout the policy term.

- Stay up-to-date on industry regulations and best practices.

2. What are the different types of insurance products that you are familiar with?

Personal Insurance

- Homeowners insurance

- Auto insurance

- Life insurance

- Health insurance

- Disability insurance

Commercial Insurance

- Business property insurance

- General liability insurance

- Professional liability insurance

- Workers’ compensation insurance

- Commercial auto insurance

3. How do you approach lead generation and prospecting?

- Networking at industry events and local businesses.

- Utilizing social media platforms to connect with potential clients.

- Developing targeted email marketing campaigns.

- Offering free consultations or educational webinars to attract prospects.

- Collaborating with other professionals, such as financial advisors and attorneys.

4. What is your sales process for selling insurance products?

- Qualify potential clients: Identify their insurance needs and determine if they are a good fit for the products you offer.

- Develop a proposal: Outline the coverage options and premiums for the recommended insurance policies.

- Present the proposal: Explain the benefits and features of the policies and address any questions the client may have.

- Negotiate and secure the policy: Agree on the coverage terms and premiums and finalize the insurance contract.

- Provide ongoing support: Assist clients with claims, policy changes, and any other insurance-related needs.

5. How do you handle objections from potential clients?

- Listen attentively: Allow the client to fully express their concerns.

- Understand the objection: Determine the underlying reason for the client’s hesitation.

- Address the objection: Provide factual information or alternative solutions to address the client’s concerns.

- Reframe the objection: Present the objection as an opportunity to highlight the benefits of the insurance product.

- Be patient and persistent: Continue to engage with the client and address their objections until they are satisfied.

6. What is your experience with using insurance software and quoting tools?

- Proficient in using insurance management systems (IMS) such as Vertafore, Applied Systems, and Salesforce.

- Experienced in utilizing quoting engines such as ISO, A++ Solutions, and Insureon to generate accurate and competitive quotes.

- Familiar with underwriting guidelines and rating factors used by different insurance carriers.

- Able to navigate industry databases and resources to retrieve policy information and track client history.

7. How do you stay up-to-date on industry regulations and best practices?

- Attend industry conferences and webinars.

- Read trade publications and subscribe to industry newsletters.

- Join professional organizations such as the National Association of Insurance and Financial Advisors (NAIFA).

- Obtain continuing education credits (CEs) through courses and seminars.

- Network with other insurance professionals and seek their insights.

8. What is your approach to customer service?

- Be responsive: Return calls and emails promptly and keep clients informed.

- Be empathetic: Understand clients’ needs and concerns and provide personalized solutions.

- Be knowledgeable: Stay up-to-date on insurance products and industry trends to provide expert guidance.

- Be proactive: Anticipate clients’ needs and proactively offer support and recommendations.

- Go the extra mile: Provide exceptional service that exceeds clients’ expectations.

9. How do you measure your success as an insurance sales agent?

- Sales volume: Total revenue generated through insurance policies sold.

- Customer satisfaction: Positive feedback from clients and high retention rates.

- Policy renewals: Maintaining a strong book of business with repeat clients.

- Referrals: Recommendations from existing clients leading to new leads.

- Insurance knowledge: Demonstrated expertise through industry certifications or continuing education.

10. What are your career goals as an insurance sales agent?

- Advance within the industry: Acquire additional certifications and take on leadership roles.

- Specialize in a particular insurance niche: Become an expert in a specific area, such as commercial insurance or high-net-worth individuals.

- Build a successful book of business: Establish a strong client base and generate a consistent stream of income.

- Contribute to the community: Use my insurance knowledge to support local organizations and educate consumers on insurance matters.

- Remain a lifelong learner: Continuously update my skills and stay abreast of industry trends.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Licensed Insurance Sales Agent.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Licensed Insurance Sales Agent‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities:

Licensed Insurance Sales Agents are crucial members of the insurance industry, responsible for selling and servicing insurance policies to clients.

1. Prospecting and Lead Generation

Identify potential clients through various channels such as networking, cold calling, and referrals.

- Maintain a database of potential clients and track their progress.

- Qualify leads to determine their insurance needs and interests.

2. Sales and Marketing

Develop and implement sales strategies to maximize revenue generation.

- Present insurance products and services to clients, explaining benefits and features.

- Negotiate and close deals, ensuring customer satisfaction and policy compliance.

3. Client Relationship Management

Maintain and nurture long-term relationships with clients.

- Provide ongoing support and guidance to clients on their insurance needs.

- Respond promptly to inquiries, concerns, and claims.

4. Regulatory Compliance

Stay abreast of insurance laws and regulations, ensuring compliance and ethical practices.

- Obtain and maintain required licenses and certifications.

- Follow industry best practices and guidelines.

Interview Tips:

Preparing thoroughly for an interview is essential to showcase your skills and increase your chances of success.

1. Research the Company and Role:

Gain a comprehensive understanding of the insurance company, its products and services, and the specific job requirements.

- Visit the company’s website, read industry news, and connect with current or former employees.

- Carefully review the job description and identify the key responsibilities and qualifications.

2. Practice Your Responses:

Anticipate common interview questions and prepare thoughtful answers that highlight your relevant experience and skills.

- Use the STAR method (Situation, Task, Action, Result) to structure your answers and provide specific examples.

- Practice aloud or with a friend to gain confidence and improve your delivery.

3. Showcase Your Industry Knowledge:

Demonstrate your understanding of the insurance industry, recent trends, and best practices.

- Discuss your knowledge of different insurance products, legal frameworks, and ethical guidelines.

- Share examples of innovative insurance solutions or industry initiatives that you are aware of.

4. Emphasize Client-Focused Approach:

Highlight your ability to build and maintain strong relationships with clients.

- Describe your experience in understanding client needs, providing tailored solutions, and resolving their concerns.

- Share examples of positive client feedback or testimonials that demonstrate your commitment to customer service.

5. Prepare Questions for the Interviewer:

Asking thoughtful questions shows your interest in the role and company.

- Inquire about the company’s growth plans, industry outlook, and opportunities for professional development.

- Ask about the team dynamics, company culture, and what makes the company unique.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Licensed Insurance Sales Agent interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!