Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Mutual Funds Agent interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Mutual Funds Agent so you can tailor your answers to impress potential employers.

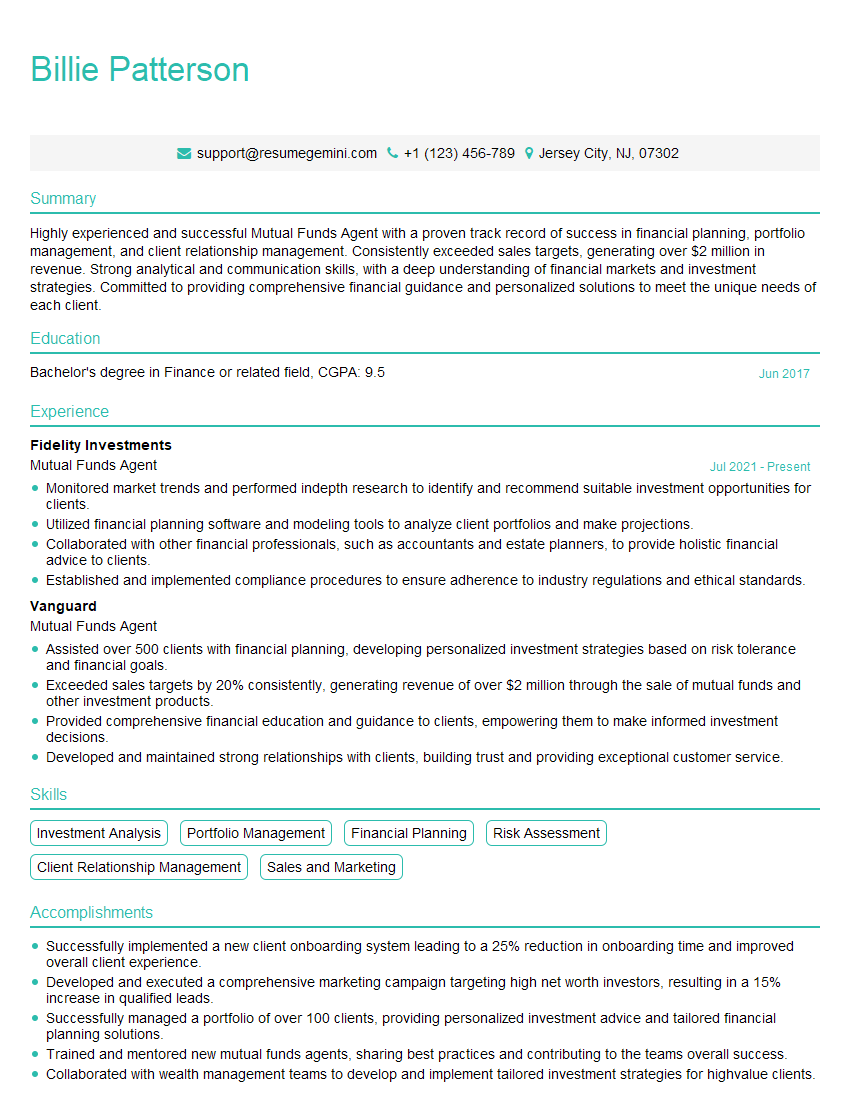

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Mutual Funds Agent

1. Describe the role and responsibilities of a Mutual Funds Agent.

A Mutual Funds Agent is a financial professional who provides advisory services to investors interested in investing in mutual funds. Their key responsibilities include:

- Understanding client financial goals and risk tolerance

- Recommending suitable mutual fund schemes based on client objectives

- Executing transactions, such as buying, selling, or switching mutual fund units

- Providing ongoing portfolio monitoring and review

- Staying updated on market trends and fund performance

2. Explain the different types of mutual funds available in the market.

Equity Funds

- Invest primarily in stocks

- Offer potential for higher returns, but come with higher risk

Debt Funds

- Invest in fixed-income securities, such as bonds

- Provide lower returns compared to equity funds, but offer lower risk

Hybrid Funds

- Combine features of both equity and debt funds

- Offer a balance of risk and return

Money Market Funds

- Invest in short-term debt instruments

- Offer low returns but provide high liquidity

3. How do you assess a client’s risk tolerance?

Assessing a client’s risk tolerance involves considering several factors:

- Investment goals and time horizon: Determine the client’s financial goals and the time frame for achieving them

- Income and financial situation: Understand the client’s income, expenses, and overall financial health

- Investment knowledge and experience: Assess the client’s understanding of financial markets and their previous investment experiences

- Emotional factors: Evaluate the client’s ability to handle market fluctuations and potential losses

4. What are the key factors to consider when recommending a mutual fund scheme to a client?

When recommending a mutual fund scheme, the following factors should be considered:

- Client’s risk tolerance and investment goals: The scheme should align with the client’s risk tolerance and financial objectives

- Fund’s investment strategy and portfolio: Analyze the fund’s investment approach, portfolio Zusammensetzung, and historical performance

- Fund management and track record: Consider the experience and track record of the fund manager and the asset management company

- Fees and expenses: Understand the fund’s expense ratio and any other associated costs

- Tax implications: Be aware of any tax implications of investing in the recommended fund

5. How do you stay updated on market trends and fund performance?

To remain abreast of market trends and fund performance, it is essential to:

- Read industry publications and reports: Keep up with financial news, market analysis, and fund research

- Attend industry events and conferences: Network with other professionals and learn about new products and trends

- Monitor market data and fund performance: Track stock market indices, bond yields, and the performance of relevant mutual funds

- Conduct regular portfolio reviews: Analyze client portfolios and make adjustments as needed

6. Describe the ethical responsibilities of a Mutual Funds Agent.

As a Mutual Funds Agent, it is crucial to adhere to the following ethical responsibilities:

- Client confidentiality: Maintain the privacy and confidentiality of client information

- Suitability: Recommend only those mutual funds that are suitable for the client’s individual circumstances

- Transparency: Disclose all relevant information about funds and fees to clients

- Objectivity: Provide unbiased advice and avoid conflicts of interest

- Compliance: Abide by all applicable laws and regulations governing mutual fund sales

7. Discuss the importance of ongoing portfolio monitoring for clients.

Ongoing portfolio monitoring is essential for the following reasons:

- Ensure alignment with goals: Monitor to ensure the portfolio remains aligned with the client’s financial objectives

- Manage risk: Identify potential risks and take corrective action if necessary

- Capture opportunities: Identify investment opportunities and make adjustments to enhance performance

- Rebalance portfolio: Periodically rebalance the portfolio to maintain the desired asset allocation

- Keep clients informed: Provide regular updates to clients on portfolio performance and any changes made

8. What are the common challenges faced by Mutual Funds Agents?

Some common challenges faced by Mutual Funds Agents include:

- Market volatility: Managing client expectations during periods of market fluctuations

- Competition: Dealing with competition from other financial advisors and platforms

- Regulatory changes: Staying updated with and adhering to changing regulations

- Client education: Helping clients understand complex financial concepts

- Ethical dilemmas: Balancing sales targets with ethical responsibilities

9. How do you handle objections or concerns raised by clients?

To handle objections or concerns raised by clients effectively:

- Listen attentively: Understand the client’s concerns and acknowledge their perspective

- Empathize: Put yourself in the client’s shoes and try to understand their emotions

- Provide facts and data: Use objective information to support your recommendations and address concerns

- Consider alternatives: Explore other options or solutions that may meet the client’s needs

- Document the conversation: Summarize the client’s concerns, your responses, and any agreed-upon actions

10. Why are you interested in working as a Mutual Funds Agent?

Explain your motivations for pursuing a career as a Mutual Funds Agent, highlighting your passion for finance, desire to help clients achieve their financial goals, and any specific skills or experiences that make you well-suited for the role.

- Passion for finance: Express your interest in the financial markets and your desire to use your knowledge to benefit others

- Helping clients achieve financial goals: Emphasize your passion for helping people manage their finances and achieve their financial aspirations

- Communication and interpersonal skills: Highlight your ability to build rapport with clients and communicate complex financial concepts effectively

- Market knowledge: Demonstrate your understanding of mutual funds, investment strategies, and market trends

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Mutual Funds Agent.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Mutual Funds Agent‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Mutual Funds Agents play a pivotal role in the financial industry by providing a crucial link between investors and investment opportunities in mutual funds. Their expertise in financial advisory and sales enables them to help individuals and organizations make informed investment decisions, manage their portfolios, and achieve their financial goals. Key responsibilities include:

1. Client Acquisition and Relationship Management

• Developing and maintaining a strong client base by identifying potential investors and converting them into long-term clients.

• Building rapport with clients, understanding their financial needs, and providing personalized investment recommendations.

• Conducting regular client reviews to monitor progress, make adjustments, and ensure satisfaction.

2. Financial Advisory and Sales

• Providing comprehensive financial planning services, including risk assessment, portfolio analysis, and cash flow management.

• Recommending suitable mutual fund investment strategies based on client objectives, risk tolerance, and time horizon.

• Explaining investment products, fees, and risks involved in mutual fund investments.

3. Market Research and Fund Selection

• Conducting thorough market research to identify top-performing mutual funds and stay abreast of industry trends.

• Evaluating fund managers, past performance, and investment methodologies to make informed fund recommendations.

• Monitoring fund performance and recommending adjustments as needed.

4. Administrative and Compliance

• Processing and executing mutual fund transactions, including purchases, redemptions, and account maintenance.

• Adhering to regulatory guidelines and ethical standards in all client interactions and transactions.

• Maintaining accurate records and documentation of client accounts and transactions.

Interview Tips

To ace your Mutual Funds Agent interview, thorough preparation is key. Here are some tips:

1. Research the Company and Role

• Thoroughly review the company’s website, annual reports, and any relevant news articles.

• Understand the specific responsibilities of the Mutual Funds Agent role within the organization.

• Be prepared to articulate why you are interested in joining this particular company and how your skills align with the role.

2. Highlight Your Financial Expertise

• Emphasize your knowledge of financial products, markets, and investment strategies.

• Discuss your experience in providing financial advisory services and recommending mutual funds.

• Provide concrete examples of how your advice has helped clients achieve their financial goals.

3. Showcase Your Sales and Client Service Skills

• Demonstrate your ability to build and maintain strong client relationships.

• Highlight your communication, negotiation, and persuasion skills.

• Emphasize how you have successfully converted prospects into long-term clients.

4. Prepare for Common Interview Questions

• Practice answering questions about your motivations for pursuing this career, your experience in the financial industry, and your understanding of mutual funds.

• Be prepared to discuss your approach to financial planning, risk assessment, and client relationship management.

5. Seek Feedback and Practice

• Ask a friend or family member to conduct a mock interview and provide constructive feedback.

• Practice your answers to common interview questions out loud to build confidence and improve delivery.

• Stay up-to-date on industry trends and regulatory changes by attending seminars, reading articles, and networking with other professionals.

Next Step:

Now that you’re armed with the knowledge of Mutual Funds Agent interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Mutual Funds Agent positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini