Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Financial Services Representative position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

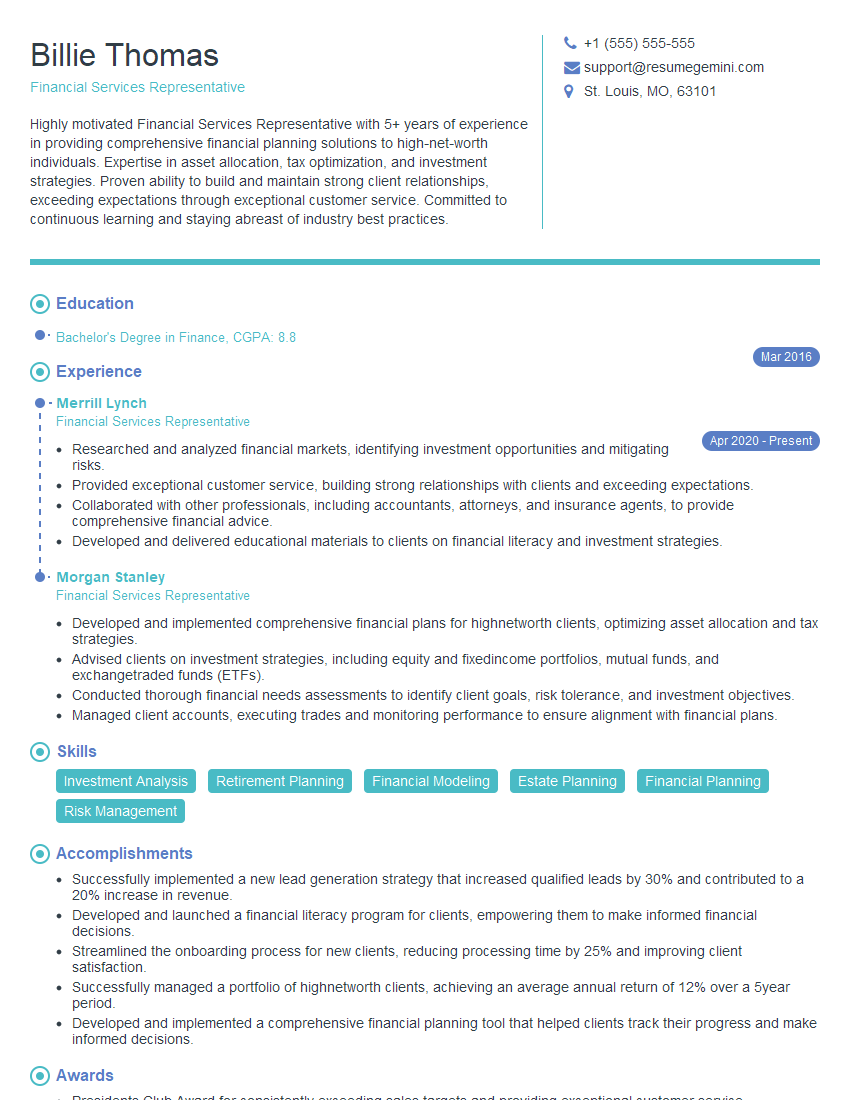

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Financial Services Representative

1. Can you explain the key differences between a Roth IRA and a traditional IRA?

Answer:

- Taxation: Roth IRAs are funded with after-tax dollars, while traditional IRAs are funded with pre-tax dollars. Roth IRA withdrawals are tax-free, while traditional IRA withdrawals are taxed as income.

- Contribution limits: Both Roth IRAs and traditional IRAs have annual contribution limits. However, Roth IRAs have higher income limits than traditional IRAs.

- Age restrictions: Traditional IRAs allow for tax-deductible contributions at any age, but Roth IRAs have age restrictions for eligibility.

- Required Minimum Distributions (RMDs): Roth IRAs have no RMDs, while traditional IRAs require RMDs after age 72.

2. What are the different types of investment products that you are familiar with and how would you recommend them to clients based on their risk tolerance and financial goals?

Asset Classes

- Stocks

- Bonds

- Mutual Funds

- ETFs

- Options

- Real Estate

Risk Tolerance and Financial Goals

- Low Risk Tolerance: Suggest conservative investments such as bonds or CDs.

- Moderate Risk Tolerance: Recommend a balanced portfolio with a mix of stocks and bonds.

- High Risk Tolerance: Advise investing in growth-oriented assets like stocks or real estate for potential higher returns.

- Short-term Financial Goals: Prioritize liquidity and stability, suggest money market accounts or short-term bonds.

- Long-term Financial Goals: Encourage investments in growth-oriented assets with higher potential returns, such as stocks or ETFs.

3. What are the key regulations that govern the financial services industry, and how do you stay up-to-date on regulatory changes?

Answer:

- Dodd-Frank Wall Street Reform and Consumer Protection Act (2010): Aims to prevent future financial crises and protect consumers.

- Investment Advisers Act of 1940: Regulates investment advisers and their activities.

- Securities Act of 1933 and Securities Exchange Act of 1934: Govern the issuance and trading of securities.

- Financial Industry Regulatory Authority (FINRA): Self-regulatory organization that oversees the securities industry.

Staying Up-to-Date on Regulatory Changes:

- Subscribe to industry publications and newsletters.

- Attend industry conferences and webinars.

- Review regulatory agency websites and guidance.

- Consult with legal or compliance professionals.

4. Walk me through the process of conducting a financial needs analysis for a client.

Answer:

- Gather client information: Collect personal, financial, and investment data.

- Identify financial goals: Determine short-term and long-term objectives, such as retirement planning or education funding.

- Assess risk tolerance: Evaluate the client’s comfort level with investment risk.

- Analyze cash flow: Review income, expenses, and assets to determine financial capacity.

- Identify financial gaps: Determine any shortfalls or potential roadblocks in achieving financial goals.

- Develop a financial plan: Recommend investment strategies, insurance coverage, or other financial solutions to meet the client’s needs.

- Implement the plan: Guide the client through the implementation process, including selecting investments and obtaining necessary insurance.

5. How do you handle a difficult client who is unhappy with your recommended financial plan?

Answer:

- Listen attentively: Hear out the client’s concerns and try to understand their perspective.

- Clarify the plan: Explain the rationale behind your recommendations and how they align with the client’s goals.

- Explore alternatives: If appropriate, offer alternative solutions or modifications to the plan.

- Educate the client: Provide additional information or resources to help the client understand the risks and benefits of the plan.

- Respect the client’s decision: Ultimately, it is the client’s decision whether or not to accept the plan. Respect their choice and continue to provide support as needed.

6. What are the ethical considerations that you must adhere to as a Financial Services Representative?

Answer:

- Fiduciary Duty: Act in the best interests of the client, placing their needs before your own.

- Suitability: Only recommend investments that are appropriate for the client’s risk tolerance and financial situation.

- Confidentiality: Maintain the privacy of client information.

- Avoid Conflicts of Interest: Disclose any potential conflicts of interest and take steps to avoid them.

- Continuing Education: Maintain up-to-date knowledge of industry regulations and ethical standards.

7. How do you stay abreast of the latest financial products and industry trends?

Answer:

- Attend industry seminars and conferences: Network with peers and learn about new products and trends.

- Read industry publications and research reports: Stay informed about market conditions and investment strategies.

- Consult with product specialists: Contact financial institutions and investment firms to gather information about their offerings.

- Monitor financial news and economic data: Track market developments and economic indicators to make informed decisions.

8. What are your thoughts on the future of the financial services industry?

Answer:

- Technology advancements: Digitalization and automation will continue to reshape the industry, offering new opportunities for financial services.

- Customization: Personalized financial advice and tailored products will become increasingly important.

- Increased regulation: Regulatory oversight is likely to further increase to protect investors and maintain market stability.

- Social responsibility: Financial institutions will face pressure to adopt environmentally and socially responsible practices.

9. How do you handle a situation where a client has unrealistic expectations about investment returns?

Answer:

- Educate the client: Explain the risks and historical returns of different asset classes.

- Set realistic expectations: Emphasize the importance of long-term investing and the potential for market fluctuations.

- Stress diversification: Highlight the benefits of diversifying investments to reduce risk.

- Document discussions: Record the client’s understanding of the risks and expectations.

10. In your opinion, what are the most important qualities of a successful Financial Services Representative?

Answer:

- Strong communication skills: Ability to convey complex financial concepts clearly and effectively.

- Empathy and listening skills: Understanding and responding to client needs.

- Market knowledge and expertise: Staying informed about financial products and industry trends.

- Integrity and ethical conduct: Adhering to ethical guidelines and acting in the best interests of clients.

- Adaptability and problem-solving skills: Navigating a rapidly changing industry and finding solutions for client challenges.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Financial Services Representative.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Financial Services Representative‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Financial Services Representatives act as the interface between financial organizations and their clients, playing a vital role in financial planning, advising, and transactions.

1. Building and Maintaining Client Relationships

Establish and foster long-term relationships with clients, proactively reaching out to understand their needs and goals.

- Conduct meetings, consultations, and presentations to gather client information and provide financial advice.

- Keep clients informed about financial products and services, market trends, and changes in regulations.

2. Financial Planning and Analysis

Analyze clients’ financial situations, risk tolerance, and goals to develop customized financial plans.

- Identify and assess clients’ investment needs and recommend appropriate products and strategies.

- Develop and implement investment portfolios aligned with clients’ objectives and risk appetites.

3. Investment Management and Execution

Manage clients’ investment portfolios, executing trades and monitoring performance.

- Monitor market conditions and make investment recommendations based on research and analysis.

- Conduct thorough due diligence on investment products and make appropriate recommendations.

4. Account Management and Administration

Oversee and manage clients’ investment accounts, ensuring accurate record-keeping and timely execution of transactions.

- Maintain client records, including account statements, trade confirmations, and performance reports.

- Respond to client inquiries, handle account queries, and resolve any issues promptly.

Interview Tips

To ace an interview for a Financial Services Representative position, it’s crucial to prepare thoroughly and demonstrate your knowledge, skills, and commitment to the industry.

1. Research the Company and Role

Familiarize yourself with the financial organization, its business model, and the specific responsibilities of the Financial Services Representative role.

- Visit the company website, read news articles, and gather insights from industry sources.

- Review the job description thoroughly and identify the key qualifications and skills required.

2. Highlight Your Financial Knowledge and Skills

Emphasize your understanding of financial markets, investment products, and financial planning principles.

- Provide specific examples of how you have applied your knowledge to develop financial plans, manage investments, and provide financial advice.

- Demonstrate your proficiency in financial analysis, portfolio management, and risk assessment.

3. Showcase Your Client Management Abilities

Highlight your interpersonal and communication skills, emphasizing your ability to build and maintain strong client relationships.

- Share examples of how you have proactively engaged with clients, understood their needs, and provided personalized financial solutions.

- Discuss your experience in addressing client concerns, resolving issues, and exceeding expectations.

4. Demonstrate Your Commitment to Ethics and Compliance

Emphasize your understanding of the ethical and regulatory standards governing the financial services industry.

- Explain how you ensure compliance with industry regulations, such as KYC (Know Your Customer) and AML (Anti-Money Laundering).

- Highlight your commitment to acting in the best interests of clients and adhering to ethical practices.

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Financial Services Representative, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Financial Services Representative positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.