Are you gearing up for an interview for a Fixed Income Director position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Fixed Income Director and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

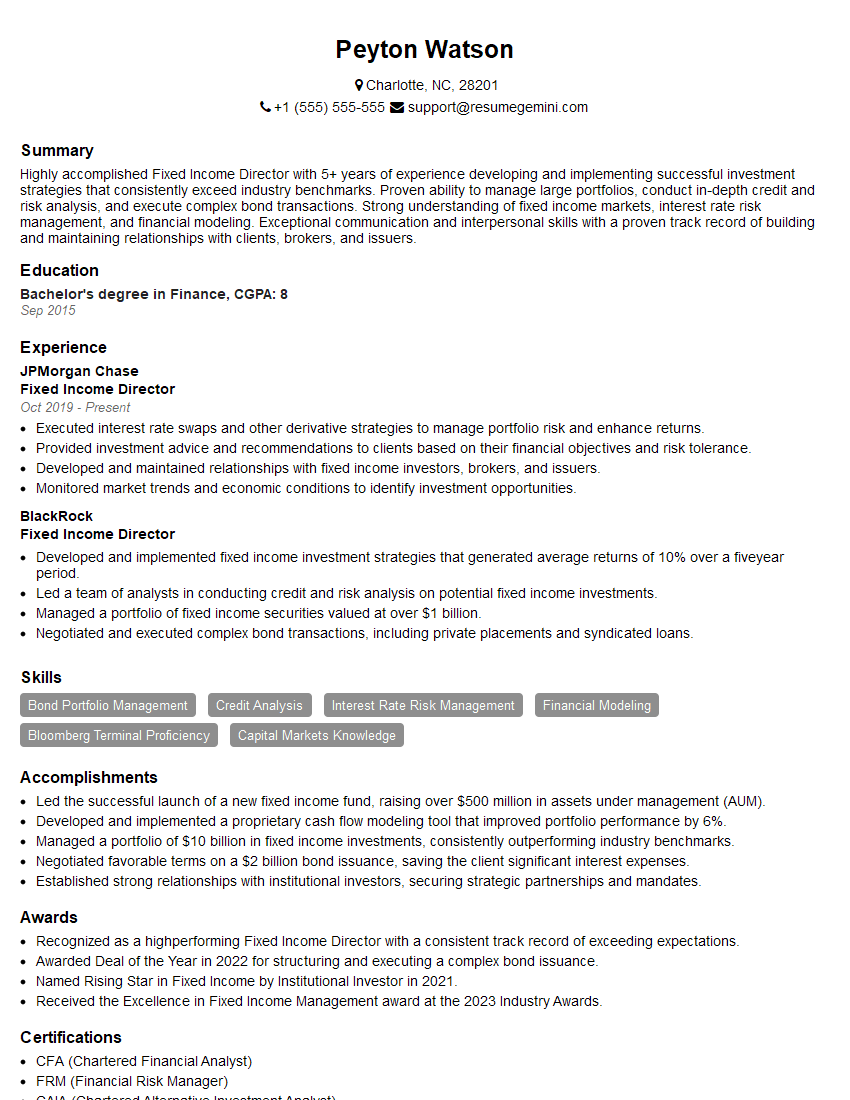

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Fixed Income Director

1. Could you talk about Fixed Income Portfolio Management?

Sure, the primary objective of Fixed Income Portfolio Management is to generate a consistent stream of income while preserving capital. It requires a deep understanding of interest rates, credit risk, and portfolio construction techniques. It involves analyzing market trends, evaluating individual bonds, and building a diversified portfolio that meets specific investment goals and risk tolerance.

2. Describe the role of a Fixed Income Director.

Responsibilities

- Lead and manage a team of fixed income analysts and portfolio managers.

- Develop and implement investment strategies for fixed income portfolios.

- Monitor market conditions and identify investment opportunities.

- Manage risk and ensure compliance with investment guidelines.

- Communicate investment decisions to clients and stakeholders.

Qualifications

- Advanced degree in finance or a related field.

- 10+ years of experience in fixed income investment management.

- Strong understanding of fixed income markets and instruments.

- Excellent analytical, quantitative, and communication skills.

- CFA or CAIA designation is highly desirable.

3. What quantitative and analytical techniques are used in Fixed Income Portfolio Management?

- Duration and convexity analysis.

- Yield curve analysis.

- Credit risk analysis.

- Statistical modeling and forecasting.

- Performance attribution and risk analysis.

4. How do you manage liquidity risk in fixed income portfolios?

- Investing in liquid assets with short maturities.

- Diversifying across issuers and sectors.

- Maintaining a cash reserve.

- Using liquidity enhancement tools such as repurchase agreements.

- Stress testing portfolios under different market scenarios.

5. What are the key considerations when investing in emerging market fixed income?

- Political and economic stability.

- Currency risk.

- Default risk.

- Liquidity risk.

- Tax implications.

6. How do you integrate ESG factors into fixed income investment strategies?

- Screening investments based on environmental, social, and governance criteria.

- Investing in companies with strong ESG track records.

- Engaging with issuers on ESG issues.

- Developing ESG-themed investment products.

- Measuring and reporting on ESG performance.

7. What are your thoughts on the current state of the fixed income market and what are the potential opportunities and risks?

The fixed income market is currently facing a number of challenges, including rising interest rates, inflation, and geopolitical uncertainty. However, there are still some potential opportunities for investors, such as:

- Investing in short-term bonds to mitigate interest rate risk.

- Investing in high-yield bonds to potentially earn higher returns.

- Investing in emerging market bonds to diversify portfolios and potentially earn higher yields.

There are also some potential risks that investors should be aware of, such as:

- The risk of rising interest rates leading to losses in bond values.

- The risk of inflation eroding the value of returns.

- The risk of geopolitical events causing market volatility.

8. How do you stay up-to-date on the latest developments in the fixed income market?

- Reading industry publications and research reports.

- Attending industry conferences and webinars.

- Networking with other fixed income professionals.

- Using data and analytics tools to monitor market trends.

9. What is your investment philosophy and how does it apply to fixed income portfolio management?

My investment philosophy is based on the principles of:

- Risk management:

- Diversification:

- Long-term perspective:

I believe that it is important to carefully manage risk in order to preserve capital and generate consistent returns. I also believe that diversification is essential to reduce the overall risk of a portfolio. Finally, I believe that it is important to take a long-term perspective on investing, as this allows for the compounding of returns over time.

10. What are your strengths and weaknesses as a Fixed Income Director?

Strengths

- Strong understanding of fixed income markets and instruments.

- Proven track record of generating consistent returns.

- Excellent analytical and quantitative skills.

- Effective leadership and communication skills.

Weaknesses

- Limited experience in managing large teams.

- Not fluent in any foreign languages.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Fixed Income Director.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Fixed Income Director‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Fixed Income Directors are responsible for overseeing fixed income operations and activities within an organization. They work closely with traders, portfolio managers, analysts, and other professionals to develop and implement investment strategies, manage risk, and maximize returns.

1. Investment Management

Plan, develop, execute, and evaluate investment strategies and objectives

- Conduct research and due diligence on fixed income investments

- Monitor market trends and economic conditions

- Make investment decisions based on analysis, research, and market conditions

- Manage portfolios with a focus on fixed income investments

2. Risk Management

Establish and implement risk management policies and procedures.

- Identify and assess potential risks

- Develop and execute risk mitigation strategies

- Monitor risk exposure and make adjustments as needed

- Report on risk exposure to senior management and stakeholders

3. Team Management

Lead, motivate, and manage a team of investment professionals.

- Set performance goals and objectives

- Provide guidance, support, and training

- Evaluate performance and provide feedback

- Foster a collaborative and productive work environment

4. Business Development

Develop and maintain relationships with clients, prospects, and industry professionals.

- Identify and target potential clients

- Develop and implement marketing strategies

- Generate referrals and build a network

- Represent the organization at industry events and functions

Interview Tips

Preparing for an interview for a Fixed Income Director position requires a combination of technical expertise, business acumen, and interpersonal skills. Here are some tips to help you ace the interview:

1. Research the Company and Position

Before the interview, thoroughly research the company, its fixed income operations, and the specific responsibilities of the Fixed Income Director role. This will demonstrate your interest and enthusiasm and provide you with a solid understanding of the organization’s goals and objectives.

2. Highlight Your Qualifications

During the interview, emphasize your technical skills and experience in fixed income investment management, risk management, and team leadership. Use specific examples to illustrate your accomplishments and quantify your results whenever possible.

3. Demonstrate Your Leadership Abilities

Fixed Income Directors are often responsible for leading and managing teams of investment professionals. Highlight your leadership experience, ability to motivate and inspire, and your commitment to creating a positive and productive work environment.

4. Ask Thoughtful Questions

Asking thoughtful questions at the end of the interview demonstrates your engagement and interest in the position and the company. Prepare questions that show you have taken the time to understand the organization and its challenges. Use these questions to clarify any aspects of the role or the company.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Fixed Income Director interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!