Are you gearing up for a career in Trading Specialist? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Trading Specialist and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

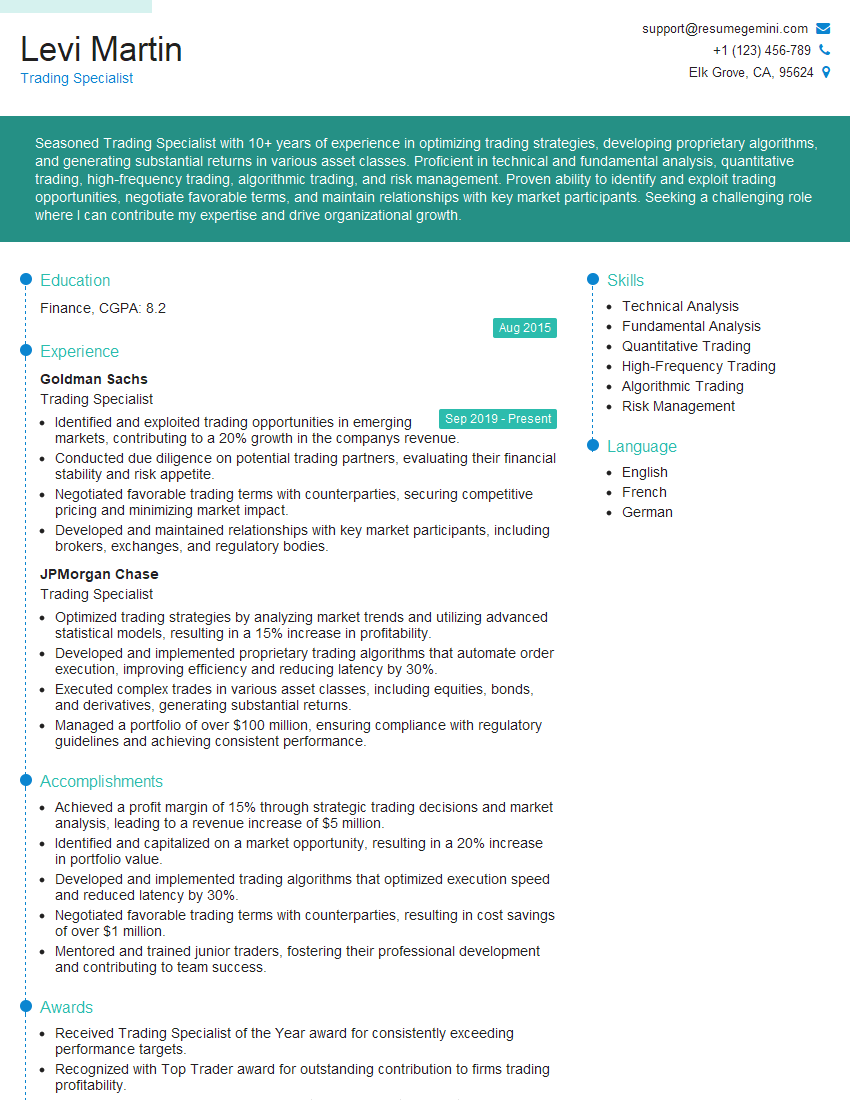

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Trading Specialist

1. What are the key components of a trading strategy?

The key components of a trading strategy are as follows:

- Entry and exit criteria: These define the conditions under which a trade will be opened and closed.

- Risk management: This involves setting limits on losses and managing risk exposure.

- Position sizing: This determines the size of each trade based on the risk tolerance and account balance.

- Trade execution: This involves the process of placing and managing orders.

- Performance evaluation: This involves tracking and analyzing the performance of the strategy to make adjustments as needed.

2. What are the different types of trading strategies?

There are numerous types of trading strategies, including:

- Trend following: These strategies aim to profit from the continuation of an established trend.

- Range trading: These strategies involve buying and selling within a defined price range.

- Momentum trading: These strategies focus on identifying and trading assets that are experiencing strong price movements.

- Scalping: These strategies involve making numerous small trades within a short time frame.

- High-frequency trading (HFT): These strategies use sophisticated algorithms to execute a large volume of trades at high speeds.

3. How do you assess the risk and reward of a trading strategy?

Assessing risk and reward involves several steps:

- Identify potential risks: Consider factors such as market volatility, liquidity, and economic conditions.

- Quantify risk exposure: Use metrics like the maximum drawdown and risk-to-reward ratio to measure potential losses.

- Determine potential rewards: Analyze historical data and market conditions to estimate the potential return on investment.

- Compare risk and reward: Evaluate the balance between the potential reward and the level of risk involved.

4. How do you optimize a trading strategy?

Optimizing a trading strategy involves:

- Backtesting: Testing the strategy on historical data to evaluate performance and identify areas for improvement.

- Parameter tuning: Adjusting the parameters of the strategy to enhance its effectiveness.

- Forward testing: Applying the optimized strategy to real-time data to assess its ongoing performance.

- Performance evaluation: Continuously monitoring the performance of the strategy and making adjustments as needed.

5. What are the common mistakes made by traders?

Some common mistakes made by traders include:

- Overtrading: Trading too frequently or taking on excessive risk.

- Chasing losses: Attempting to recoup losses by increasing trade size or deviating from the trading plan.

- Emotional trading: Making decisions based on fear, greed, or other emotions.

- Ignoring risk management: Not adhering to predefined risk limits and strategies.

- Lack of discipline: Failing to follow the trading plan or execute trades consistently.

6. What tools and resources do you use for trading?

The tools and resources used for trading may include:

- Trading platforms: Software that provides access to markets and execution capabilities.

- Charting software: Tools used for analyzing price charts and identifying trading opportunities.

- Data feeds: Real-time or historical market data that provides insights into market movements.

- News and analysis: Sources of information and commentary that offer perspectives on market events and trends.

- Risk management tools: Applications that assist in calculating risk exposure and managing positions.

7. How do you stay up-to-date on market trends and developments?

I stay up-to-date on market trends and developments through various channels:

- News and media: Following financial news outlets, industry publications, and social media.

- Market analysis: Reading reports and articles from analysts and research firms.

- Technical analysis: Studying price charts and historical data to identify patterns and trends.

- Networking: Attending industry events and connecting with other professionals.

- Continuing education: Participating in webinars, conferences, and courses to expand my knowledge and skills.

8. What is your approach to managing risk?

My approach to managing risk involves:

- Defining risk tolerance: Establishing a clear understanding of acceptable levels of risk.

- Diversification: Spreading investments across different asset classes and sectors to reduce overall risk.

- Position sizing: Determining appropriate trade sizes based on risk tolerance and account balance.

- Stop-loss orders: Placing orders that automatically close positions when prices reach predefined levels.

- Risk-reward ratio: Ensuring that potential rewards outweigh potential risks for each trade.

9. How do you deal with emotional challenges in trading?

Emotional challenges in trading can be managed through:

- Self-awareness: Recognizing and understanding emotional triggers that can affect trading decisions.

- Trading plan: Adhering to a well-defined trading plan that reduces impulsive behavior.

- Risk management: Implementing strategies that limit potential losses and protect against emotional decision-making.

- Trading journal: Recording trades and emotions to identify patterns and improve self-discipline.

- Seeking support: Consulting with a therapist or mentor to gain insights and cope with emotional challenges.

10. Describe a successful trade you have executed and the decision-making process behind it.

A successful trade I executed involved identifying a breakout pattern in the EUR/USD currency pair. The decision-making process included:

- Technical analysis: Identifying a clear upward trend and a break above a resistance level.

- Risk assessment: Evaluating the potential risk-to-reward ratio and ensuring it aligned with my risk tolerance.

- Position sizing: Determining an appropriate trade size based on my account balance and risk management strategy.

- Entry and exit strategy: Placing a buy order above the breakout level and setting a stop-loss order below the support level.

- Monitoring and adjustment: Continuously monitoring the trade and adjusting the stop-loss order as needed to protect profits.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Trading Specialist.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Trading Specialist‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A Trading Specialist is responsible for managing and executing trading operations within a financial institution, with the primary objective of maximizing profits and mitigating risks.

1. Trading Execution

Executing buy and sell orders for various financial instruments, such as stocks, bonds, currencies, and derivatives.

- Understanding market dynamics and using trading strategies to optimize execution prices.

- Leveraging electronic trading platforms and negotiating with market makers to secure favorable execution outcomes.

2. Risk Management

Identifying, assessing, and managing risks associated with trading activities.

- Monitoring market conditions, analyzing potential threats, and implementing strategies to mitigate risk exposure.

- Developing and executing risk management policies and procedures, including position limits, stop-loss orders, and stress testing.

3. Market Analysis

Conducting comprehensive market research and analysis to inform trading decisions.

- Monitoring economic data, industry trends, and geopolitical events that may impact market movements.

- Utilizing technical analysis, fundamental analysis, and other tools to identify trading opportunities and develop market forecasts.

4. Portfolio Management

Managing investment portfolios, ensuring alignment with client objectives and risk tolerance.

- Allocating assets, selecting securities, and adjusting portfolio composition based on market conditions and investor needs.

- Monitoring portfolio performance, conducting performance reviews, and recommending strategic adjustments as required.

Interview Tips

Preparing thoroughly for a Trading Specialist interview is crucial to showcase your skills and knowledge. Here are some tips to help you ace the interview:

1. Research the Company and Role

Familiarize yourself with the company’s business, values, and financial performance. Understand the specific responsibilities and requirements of the Trading Specialist role.

2. Highlight Your Skills and Experience

Emphasize your proficiency in trading operations, risk management, and market analysis. Quantify your accomplishments and provide specific examples to demonstrate your expertise.

3. Practice Behavioral Interview Questions

Prepare answers to common behavioral interview questions, such as “Tell me about a time you successfully managed a high-pressure situation” or “Describe your approach to risk-taking.” Use the STAR method to answer these questions effectively.

4. Demonstrate Your Passion for Trading

Express your genuine interest and knowledge of the financial markets. Share insights on recent market trends or discuss your trading strategies. This will demonstrate your enthusiasm and commitment to the industry.

5. Be Prepared to Discuss Your Investment Philosophy

Trading Specialists often have their own investment philosophy or approach to the markets. Be prepared to explain your investment philosophy and how it aligns with the company’s objectives.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Trading Specialist interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!