Are you gearing up for a career in Energy Derivatives Trader? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Energy Derivatives Trader and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

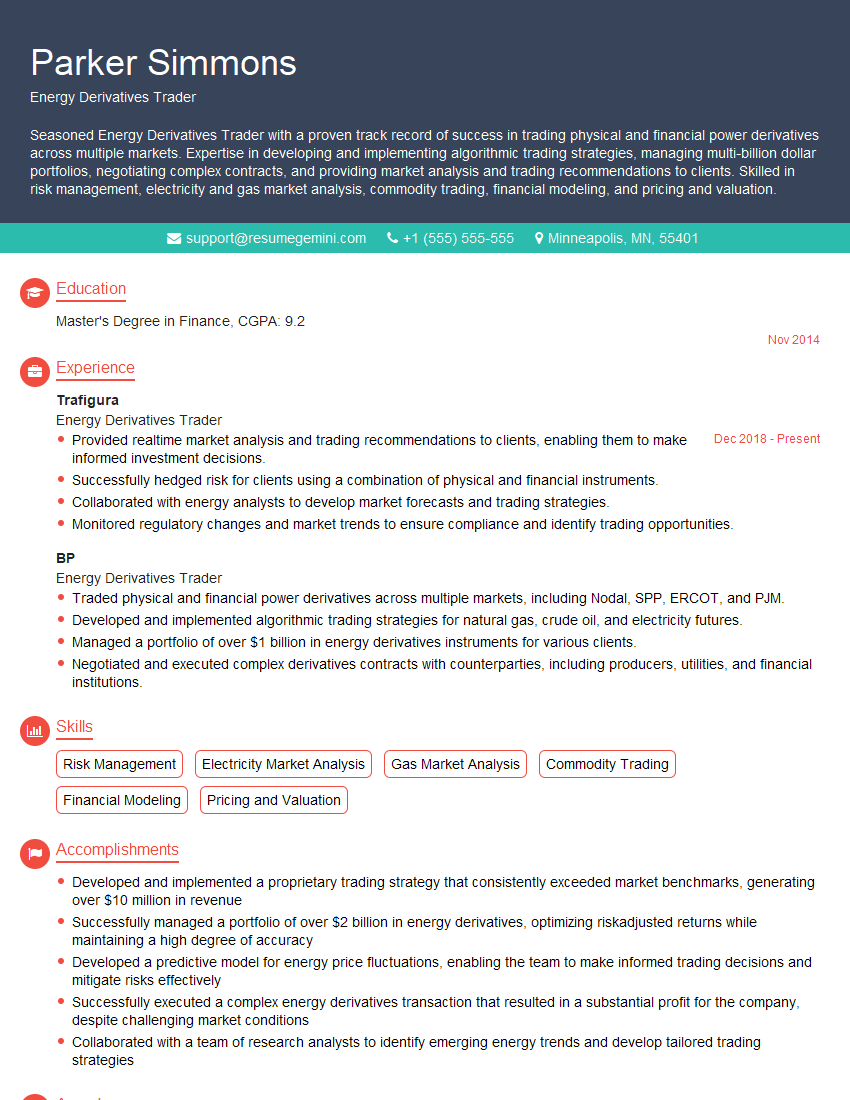

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Energy Derivatives Trader

1. Explain the concept of contango and backwardation in the oil futures market. How do these affect trading strategies?

Contango: When the futures price is higher than the spot price, indicating that the market expects a rise in prices in the future. This encourages storage, as traders can buy oil at the spot price, store it, and sell it for a profit at the higher futures price.

Backwardation: When the futures price is lower than the spot price, indicating that the market expects a decrease in prices in the future. This encourages immediate consumption, as traders can sell oil at the spot price and buy it back later at a lower futures price.

- In contango, traders employ long positions to profit from rising futures prices, while short positions are used in backwardation to benefit from falling prices.

- The shape of the futures curve influences storage decisions, hedging strategies, and inventory management.

2. Discuss the factors that influence natural gas prices.

- Supply and Demand: Production, storage levels, weather conditions, LNG imports/exports, and industrial activity.

- Seasonal Factors: Increased demand during winter for heating and decreased demand during summer for cooling.

- Geopolitical Events: Disruptions in supply or demand due to political instability or conflicts in producing or consuming regions.

- Storage Capacity: Availability and capacity of underground storage facilities for natural gas.

- Financial Factors: Speculation, currency fluctuations, and investment flows can also impact prices.

3. How do you evaluate the liquidity of a particular energy derivative contract?

- Trading Volume: The number of contracts traded per day or week indicates market activity and depth.

- Open Interest: The total number of outstanding contracts that have not been closed, reflecting market participation and commitment.

- Bid-Ask Spread: The difference between the bid and ask prices, representing the transaction costs associated with trading.

- Historical Data: Analyzing historical trading patterns can provide insights into liquidity levels during different time periods.

- Market Depth: The availability of market participants willing to trade at different prices, indicating the ease of executing trades.

4. Explain the different methods used to hedge energy price risk.

- Futures Contracts: Locking in future prices by buying or selling futures contracts at predefined prices.

- Options Contracts: Providing the option, but not the obligation, to buy or sell at a specific price, offering protection against price fluctuations.

- Swaps: Agreements to exchange cash flows based on the difference between two prices or indices, enabling customized risk management.

- Portfolio Optimization: Diversifying investments across different energy commodities, maturities, and markets to reduce overall risk.

5. Discuss the key characteristics of a successful energy derivatives trader.

- Technical Expertise: Deep understanding of derivative products, pricing models, and market dynamics.

- Risk Management: Ability to assess, manage, and mitigate risk, ensuring prudent trading practices.

- Market Awareness: Continuously monitoring and analyzing market trends, news events, and economic data.

- Analytical Skills: Strong analytical abilities to interpret data, identify patterns, and make informed decisions.

- Communication and Negotiation: Excellent communication and negotiation skills for interacting with counterparties and executing trades.

6. Explain the Black-Scholes model and how it is used to price energy options.

The Black-Scholes model is a mathematical formula that calculates the theoretical value of an option based on its underlying asset’s price, strike price, time to expiration, risk-free rate, and volatility.

- In energy options pricing, the underlying asset is typically a futures contract or an index representing the price of an energy commodity.

- The volatility input is derived from historical data or implied volatility derived from market prices.

- Traders use the model to determine fair prices for options, assess risk, and make trading decisions.

7. How do you incorporate fundamental analysis into your energy derivatives trading?

- Economic Factors: Analyzing economic data, such as GDP growth, inflation, interest rates, and unemployment, to assess their impact on energy demand.

- Industry Trends: Monitoring industry news, reports, and events to stay abreast of developments and potential disruptions in the energy sector.

- Geopolitical Events: Considering geopolitical events and their potential impact on energy production, consumption, and trade flows.

- Supply and Demand Dynamics: Analyzing supply and demand data, storage levels, and weather conditions to gauge market fundamentals.

8. Explain the concept of correlation in energy derivatives and how it affects trading strategies.

- Correlation: Measuring the relationship between the price movements of two or more energy commodities or derivatives.

- Positive Correlation: When prices of two assets tend to move in the same direction, allowing for spread trading and risk diversification.

- Negative Correlation: When prices of two assets tend to move in opposite directions, enabling delta-neutral trading and hedging strategies.

- **Traders use correlation analysis to optimize portfolio risk, identify trading opportunities, and adjust hedging strategies.

9. Describe the process of margining energy derivatives trades.

- Initial Margin: Posting a deposit as collateral to cover potential losses, ensuring counterparty risk management.

- Variation Margin: Daily adjustments to margin requirements based on market price fluctuations, maintaining sufficient coverage.

- Margin Call: A demand from the clearinghouse to increase margin deposits if losses exceed initial margin, protecting against excessive risk.

- Collateral: Types of collateral accepted for margining include cash, bonds, and letters of credit.

10. Discuss the ethical and regulatory considerations involved in energy derivatives trading.

- Transparency and Disclosure: Ensuring fair and transparent trading practices and disclosing conflicts of interest.

- Compliance with Regulations: Adhering to industry regulations, such as those set by exchanges and government agencies, to maintain market integrity.

- Market Manipulation: Avoiding illegal or unethical trading practices that distort or manipulate market prices.

- Reputation Management: Protecting personal and organizational reputation by adhering to ethical and professional standards.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Energy Derivatives Trader.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Energy Derivatives Trader‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

An Energy Derivatives Trader is responsible for trading energy-related financial instruments, such as futures, options, and swaps, to manage risk and generate profit for their firm. Key responsibilities include:

1. Market Analysis and Research

Conduct in-depth market research and analysis to identify trading opportunities and assess market risks.

- Monitor energy market trends and economic indicators.

- Analyze historical data and market forecasts to predict price movements.

2. Trading Execution and Management

Execute trades based on market analysis and risk parameters.

- Negotiate and execute trades with counterparties.

- Monitor and manage existing trading positions to optimize profitability and minimize losses.

3. Risk Management

Identify, assess, and manage risks associated with energy trading.

- Develop and implement risk mitigation strategies.

- Monitor market volatility and adjust trading strategies accordingly.

4. Client Relationship Management

Build and maintain relationships with clients to understand their needs and execute trades that align with their investment objectives.

- Provide market insights and trading recommendations to clients.

- Negotiate trading terms and prices.

5. Performance Measurement and Reporting

Track and evaluate trading performance to identify areas of improvement.

- Prepare and present trading performance reports.

- Identify and implement strategies to enhance trading profitability.

Interview Preparation Tips

To ace an interview for an Energy Derivatives Trader role, candidates should follow these tips:

1. Research the Company and Industry

Familiarize yourself with the company’s business model, trading strategies, and market position. Research the energy industry, including current trends and challenges.

- Visit the company’s website and review their financial reports.

- Read industry publications and attend industry events.

2. Prepare for Technical Questions

Be prepared to answer technical questions about energy derivatives and trading strategies. Demonstrate your understanding of:

- Types of energy derivatives and their uses.

- Pricing and valuation of energy derivatives.

- Market risk and volatility management.

3. Showcase Your Trading Skills

Use examples from your previous experience to demonstrate your trading skills. Highlight:

- Successful trades you have executed.

- Your ability to identify and manage risk.

- Your technical analysis and trading tools.

4. Quantify Your Results

Use data and metrics to quantify your trading performance whenever possible. This could include:

- Return on investment (ROI).

- Risk-adjusted return.

- Sharpe ratio.

5. Practice Your Communication Skills

Energy Derivatives Trading is a communication-heavy role. Be prepared to articulate your trading strategies and market insights clearly and persuasively.

- Practice presenting your ideas to a mock interview panel.

- Use clear and concise language in your answers.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Energy Derivatives Trader interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!