Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Preparer interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Preparer so you can tailor your answers to impress potential employers.

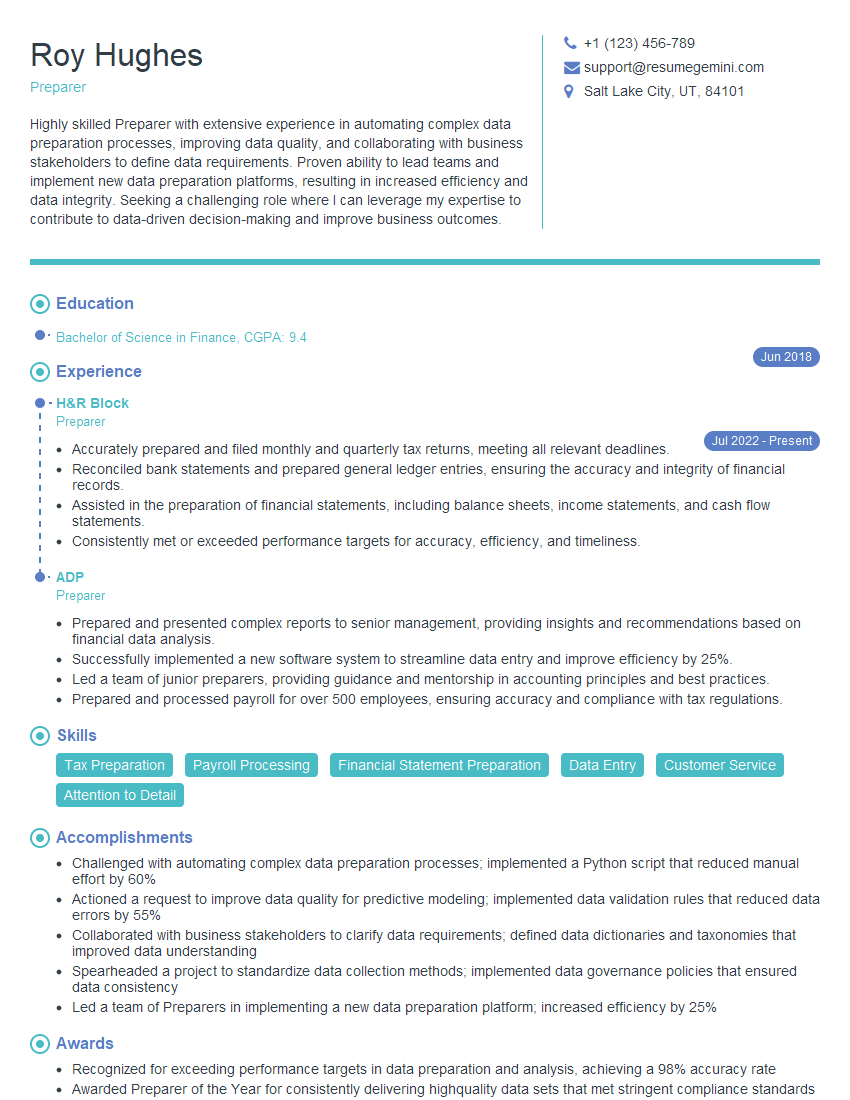

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Preparer

1. What are the key responsibilities of a Preparer?

The key responsibilities of a Preparer typically include, preparing income tax returns, ensuring client confidentiality, gathering client information, analyzing financial data, calculating taxes, filing tax returns, and staying up-to-date on tax laws and regulations.

2. What are the steps involved in preparing an income tax return?

Gathering Client Information

- Schedule a meeting with the client

- Obtain all necessary financial documents (W-2s, 1099s, etc.)

Analyzing Financial Data

- Review client’s financial documents

- Identify potential deductions and credits

- Calculate the client’s tax liability

Completing the Tax Return

- Fill out the tax forms accurately and completely

- Attach all necessary supporting documents

- Review the return with the client before filing

Filing the Tax Return

- Electronically file the return

- Mail the return to the IRS

3. What are some of the challenges you have faced as a Preparer?

Some of the challenges I have faced as a Preparer include, dealing with complex tax laws and regulations, meeting filing deadlines, and handling difficult clients.

- Dealing with complex tax laws and regulations

- Meeting filing deadlines

- Handling difficult clients

4. What are some of the qualities that make a successful Preparer?

Some of the qualities that make a successful Preparer include, attention to detail, accuracy, strong communication skills, and a commitment to continuing education.

- Attention to detail

- Accuracy

- Strong communication skills

- Commitment to continuing education

5. What is your favorite part of being a Preparer?

My favorite part of being a Preparer is helping clients save money on their taxes and ensuring that they comply with all applicable tax laws.

6. Can you describe a time when you had to go above and beyond to help a client?

One time, I had a client who was facing an IRS audit. I worked closely with the client to gather all of the necessary documentation and prepare for the audit. I also represented the client at the audit and was able to successfully resolve the matter in their favor.

7. Are there any specific tax laws or regulations that you find particularly challenging?

The Affordable Care Act (ACA) is a particularly challenging area of tax law. The ACA has a number of complex provisions that can be difficult to understand and apply. However, I stay up-to-date on the latest changes to the ACA and am able to help my clients comply with the law.

8. What are your career goals for the next 5 years?

My career goal for the next 5 years is to become a full partner at the firm. I also want to continue to develop my skills as a Preparer and become an expert in a particular area of tax law.

9. What is your experience with tax software?

I have extensive experience with a variety of tax software, including ProSeries, UltraTax, and TaxSlayer. I am proficient in using these software programs to prepare both individual and business tax returns.

10. What are your strengths and weaknesses as a Preparer?

Strengths

- Attention to detail

- Accuracy

- Strong communication skills

Weaknesses

- I can be a bit of a perfectionist

- I sometimes have difficulty delegating tasks

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Preparer.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Preparer‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

As a Preparer, you will play a crucial role in ensuring the accuracy and completeness of various financial reports and documents. Your responsibilities will encompass:

1. Data Preparation

Compiling and organizing financial data from multiple sources, such as accounting systems, spreadsheets, and databases.

2. Data Entry

Manually or electronically entering data into financial systems and ensuring its accuracy and consistency.

3. Data Analysis and Review

Analyzing financial data to identify trends, anomalies, and potential errors. Summarizing and presenting data in clear and concise reports.

4. Document Preparation

Preparing various financial documents, such as reports, statements, invoices, and receipts. Ensuring compliance with accounting regulations and internal policies.

5. Account Reconciliation

Balancing accounts and verifying their accuracy by comparing data from different sources. Identifying and correcting any discrepancies.

6. Archiving and Record Keeping

Maintaining and organizing financial records in a secure and accessible manner. Retaining documents for legal and audit purposes.

Interview Tips

To ace your Preparer interview, consider the following tips:

1. Research the Company and Industry

Demonstrate your knowledge of the company’s business, financial performance, and industry trends. This shows you are genuinely interested in the position and have taken the time to understand the context of the role.

2. Practice Your Technical Skills

Be prepared to showcase your proficiency in data analysis, entry, and financial reporting tools. Consider reviewing common interview questions related to these areas.

3. Emphasize Accuracy and Attention to Detail

Highlight your meticulous nature and commitment to delivering accurate and error-free work. Provide examples of how you have ensured the integrity of financial data in previous roles.

4. Display Your Communication Skills

The ability to communicate effectively is essential for a Preparer. Practice articulating complex financial information to both technical and non-technical audiences.

5. Ask Insightful Questions

Engage the interviewer by asking thoughtful questions about the company’s financial operations, growth plans, or industry best practices. This demonstrates your curiosity and interest in the role.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Preparer role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.