Are you gearing up for an interview for a Private Wealth Manager position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Private Wealth Manager and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

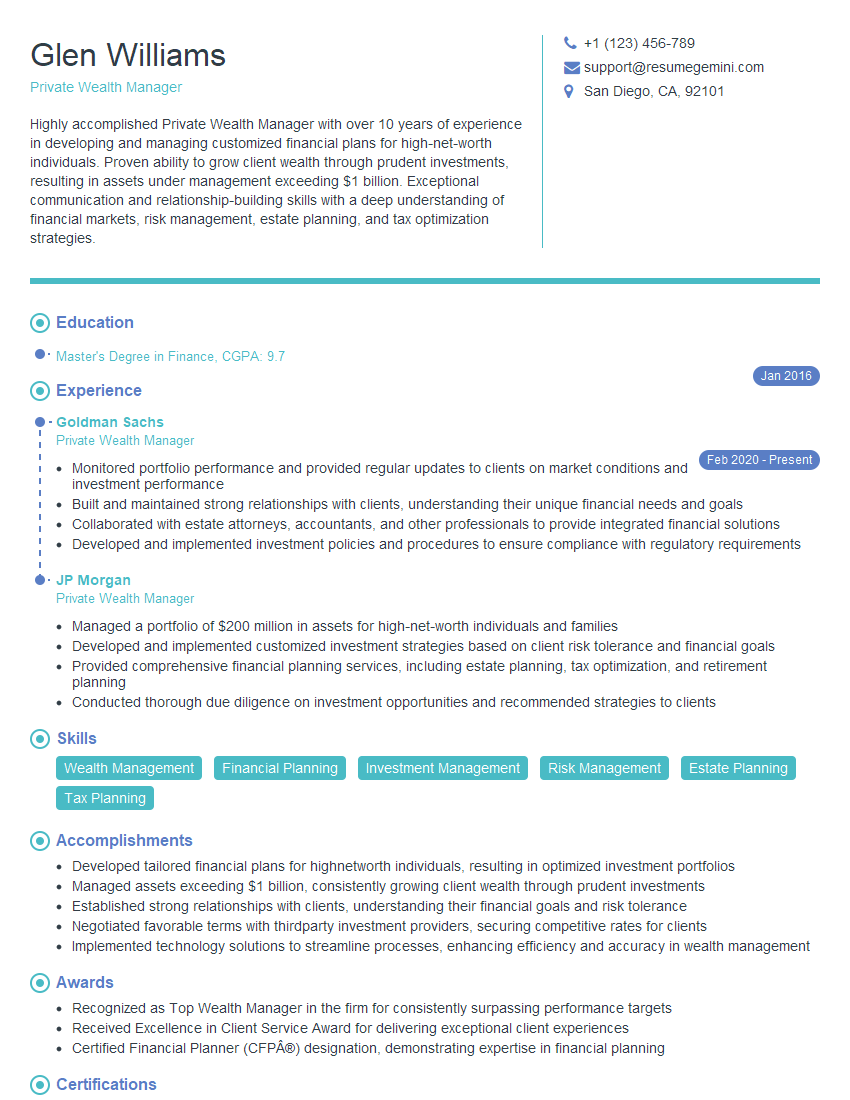

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Private Wealth Manager

1. Walk me through your investment philosophy and process for managing high-net-worth portfolios?

- Explain your overall investment philosophy, including your risk tolerance and return objectives.

- Describe the specific process you use to develop and manage investment portfolios, including your research and due diligence.

- Highlight any unique or innovative strategies you employ.

2. How do you stay up-to-date on market trends and changes in the financial landscape?

Research and Analysis

- Regularly monitor financial news, market reports, and economic data.

- Attend industry conferences and seminars.

- Utilize professional research tools and databases.

Networking and Collaboration

- Maintain relationships with other professionals in the financial industry.

- Attend industry events and collaborate on research projects.

- Participate in professional organizations and discussion forums.

3. How do you build and maintain relationships with clients, particularly those with complex and demanding needs?

- Foster open and transparent communication channels.

- Demonstrate a deep understanding of their financial goals and objectives.

- Provide tailored advice and solutions that meet their specific needs.

- Maintain regular contact and proactively address any concerns or issues.

- Build trust and confidence through consistent and exceptional service.

4. What is your approach to managing risk in client portfolios?

- Identify and assess potential risks using advanced analytical tools.

- Implement appropriate risk management strategies, such as diversification, hedging, and asset allocation.

- Monitor and adjust portfolios as market conditions change.

- Collaborate with clients to determine their risk tolerance and develop a suitable risk profile.

5. How do you handle market downturns and periods of volatility?

- Maintain a calm and objective perspective.

- Reassure clients and provide guidance based on historical data and market analysis.

- Review and adjust portfolios as necessary to minimize losses.

- Communicate regularly with clients to keep them informed and address any concerns.

6. What is your experience in managing alternative investments, such as private equity, hedge funds, and real estate?

- Explain your knowledge and understanding of alternative investment types.

- Describe your experience in selecting and evaluating alternative investment opportunities.

- Discuss how you incorporate alternative investments into client portfolios.

7. How do you measure and track the performance of your investment portfolios?

- Establish clear performance benchmarks and targets.

- Utilize advanced portfolio analysis tools and metrics.

- Conduct regular portfolio reviews and assessments.

- Provide clients with transparent and detailed performance reporting.

8. What is your understanding of tax-efficient investment strategies?

- Explain your knowledge of tax laws and regulations.

- Describe strategies to minimize taxes on investment income and gains.

- Discuss how you optimize tax efficiency in client portfolios.

9. How do you handle ethical dilemmas that may arise in your role as a Private Wealth Manager?

- Explain your understanding of ethical principles and regulations.

- Describe your approach to resolving conflicts of interest.

- Discuss your commitment to acting in the best interests of clients.

10. What sets you apart from other Private Wealth Managers?

- Highlight your unique skills, experience, or qualifications.

- Emphasize your commitment to delivering exceptional client service.

- Explain why you are the best candidate for this role.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Private Wealth Manager.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Private Wealth Manager‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A Private Wealth Manager is a financial advisor who provides comprehensive wealth management services to high-net-worth individuals, families, and institutions. Key job responsibilities include:

1. Client Relationship Management

Building and maintaining strong relationships with clients, understanding their financial goals, risk tolerance, and investment preferences.

- Conducting in-depth client consultations to gather information and develop personalized financial plans.

- Providing ongoing advice and guidance to clients on investment strategies, asset allocation, and risk management.

2. Investment Management

Managing clients’ investment portfolios, including stock, bond, and alternative investments. Conducting thorough research and analysis to identify and recommend suitable investment opportunities.

- Monitoring portfolio performance and making adjustments as needed to align with clients’ goals.

- Collaborating with investment analysts and portfolio managers to stay abreast of market trends and investment strategies.

3. Financial Planning

Developing and implementing comprehensive financial plans for clients, covering areas such as estate planning, retirement planning, and insurance.

- Analyzing clients’ financial situation and providing recommendations on tax optimization, cash flow management, and wealth preservation strategies.

- Coordinating with external professionals, such as attorneys and accountants, to ensure alignment of financial plans with clients’ overall goals.

4. Business Development

Cultivating new client relationships and expanding the firm’s client base. Identifying potential clients through networking, referrals, and marketing initiatives.

- Presenting financial planning solutions to prospective clients and building trust through open communication and personalized service.

- Developing and implementing marketing strategies to generate leads and increase brand awareness.

Interview Tips

To ace your Private Wealth Manager interview, consider preparing in the following ways:

1. Research the Firm and Industry:

Have a thorough understanding of the firm’s history, investment philosophy, and competitive landscape. Research the broader wealth management industry to demonstrate your knowledge of current trends and best practices.

- Visit the firm’s website, review their marketing materials, and read industry publications.

- Identify key industry influencers and follow their insights on social media and financial news outlets.

2. Highlight Your Expertise:

Emphasize your technical skills in investment management, financial planning, and client relationship building. Quantify your accomplishments and provide specific examples of how you have helped clients achieve their financial goals or grow their wealth.

- Discuss your experience in developing and implementing personalized financial plans, managing investment portfolios, and providing tax optimization strategies.

- Share case studies or testimonials from satisfied clients to demonstrate your ability to deliver positive results.

3. Emphasize Client-Centricity:

Private Wealth Management is a client-centric role. Highlight your passion for building strong relationships and understanding the unique needs of high-net-worth individuals. Demonstrate your ability to provide personalized service and adapt to evolving client preferences.

- Describe how you approach client consultations, build trust, and maintain ongoing communication.

- Provide examples of how you have tailored investment solutions and financial plans to meet the specific goals and risk tolerance of your clients.

4. Discuss Market Knowledge:

Demonstrate your understanding of financial markets, investment strategies, and economic trends. Show that you stay updated on industry news and have a strong grasp of the factors that influence investment performance.

- Discuss your research process for identifying and evaluating investment opportunities.

- Share your insights on current market conditions and how they may impact your clients’ portfolios.

5. Prepare for Behavioral Questions:

Behavioral interview questions assess your problem-solving skills, decision-making, and ability to handle challenging situations. Practice answering questions about how you have handled ethical dilemmas, managed client expectations, or resolved conflicts with colleagues.

- Use the STAR method (Situation, Task, Action, Result) to structure your responses.

- Focus on highlighting your ability to think critically, communicate effectively, and find innovative solutions.

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Private Wealth Manager, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Private Wealth Manager positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.