Are you gearing up for an interview for a Chief Data Officer, Finance position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Chief Data Officer, Finance and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

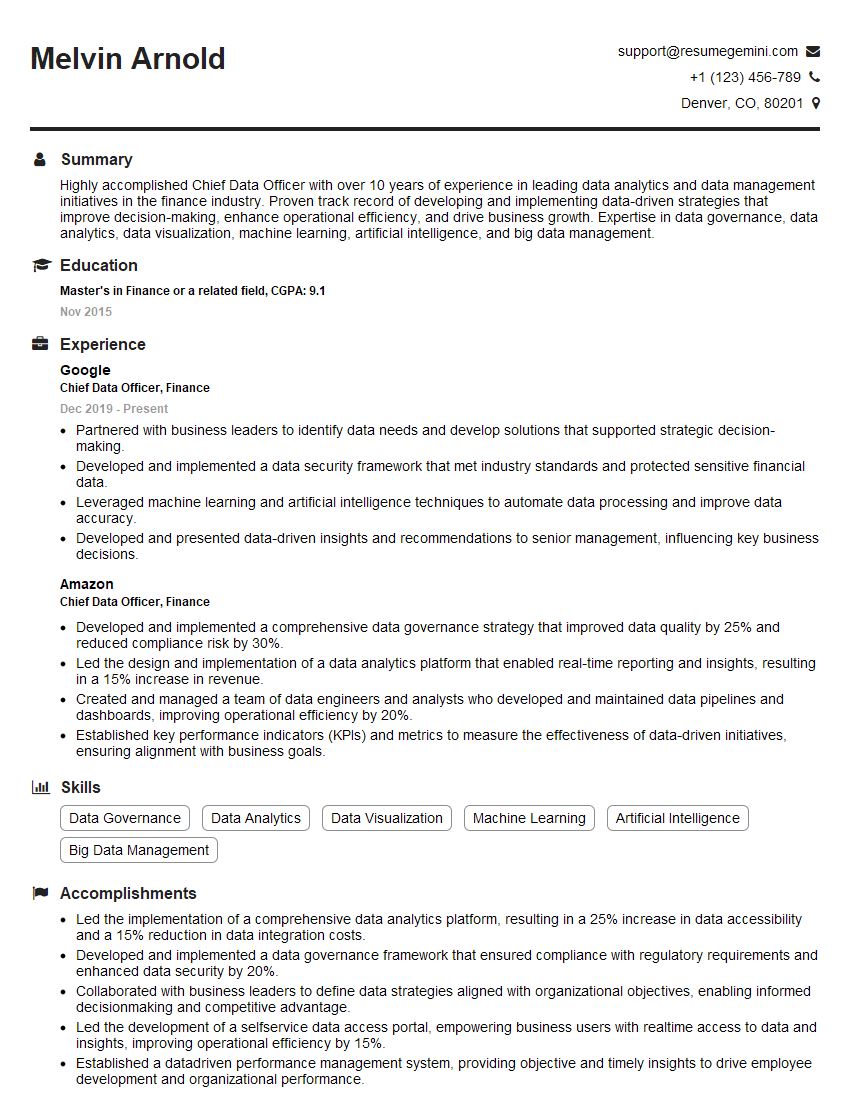

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Chief Data Officer, Finance

1. What is your understanding of the role of a Chief Data Officer in finance?

As the Chief Data Officer, my primary responsibility will be to lead and manage the organization’s data strategy and operations.

- I will be accountable for developing and implementing a comprehensive data governance framework and ensuring compliance with regulatory requirements.

- I will oversee the collection, storage, and analysis of data from various sources to drive decision-making and improve financial performance.

2. How do you plan to develop and implement a data strategy for the finance function?

Data Governance

- Establish clear data ownership, roles, and responsibilities.

- Define data quality standards and implement data validation processes.

Data Integration

- Consolidate data from multiple systems and sources into a centralized repository.

- Develop data integration tools and processes to ensure data consistency and accuracy.

Data Analytics

- Identify key performance indicators (KPIs) and develop dashboards for financial reporting and analysis.

- Use advanced analytics techniques to uncover insights and identify trends in financial data.

3. What are the key challenges you anticipate facing in this role?

There are several potential challenges that I anticipate facing in this role, including:

- Data quality and consistency issues due to the large volume and diverse nature of financial data.

- Evolving regulatory requirements and the need to adapt data management practices accordingly.

- Resistance to change from stakeholders who may be reluctant to adopt new data-driven approaches.

4. How will you measure the success of your data strategy?

The success of our data strategy will be measured based on the following key metrics:

- Improved data quality and consistency, as measured by reduced data errors and increased data integrity.

- Increased data usage and adoption by stakeholders, as evidenced by the number of data-driven decisions made.

- Enhanced financial performance, as demonstrated by improved profitability, reduced costs, and increased shareholder value.

5. What are your thoughts on the ethical use of data in finance?

The ethical use of data is paramount in finance, and I believe in adhering to the following principles:

- Transparency: Ensuring that data collection and usage are transparent and disclosed to stakeholders.

- Data privacy: Protecting sensitive financial data and respecting the privacy rights of individuals.

- Accountability: Holding ourselves accountable for the responsible use of data and addressing any potential misuse.

6. How do you stay up-to-date with the latest trends and developments in financial data management?

To stay up-to-date with the latest trends and developments in financial data management, I regularly engage in the following activities:

- Attending industry conferences and webinars.

- Reading research papers and articles.

- Participating in professional organizations and networking with peers.

7. What are your experiences in working with cross-functional teams, particularly with IT and business stakeholders?

In my previous roles, I have consistently worked closely with cross-functional teams, including IT and business stakeholders. For instance:

- I collaborated with the IT team to develop and implement a data integration platform that streamlined data sharing across departments.

- I worked with business stakeholders to define data requirements and translate business needs into technical specifications for data management solutions.

8. What is your approach to data security and risk management?

My approach to data security and risk management is based on the following principles:

- Data encryption: Implementing encryption techniques to protect data at rest and in transit.

- Access controls: Establishing role-based access controls to limit data access to authorized personnel.

- Regular security assessments: Conducting regular security assessments to identify and mitigate vulnerabilities.

9. How do you plan to engage with the business to ensure that data initiatives align with their strategic objectives?

Engaging with the business to ensure alignment with strategic objectives is crucial. I plan to implement the following strategies:

- Regular stakeholder meetings: Conduct regular meetings to understand business needs and priorities.

- Business-centric data initiatives: Develop data initiatives that directly address business challenges and drive value.

- Data literacy programs: Offer training and workshops to enhance data literacy and promote data-driven decision-making.

10. What are your key strengths and weaknesses as a Chief Data Officer?

Strengths

- Strong technical skills in data management, analytics, and governance.

- Proven leadership experience in managing large-scale data initiatives.

- Excellent communication and interpersonal skills.

Weaknesses

- I may not have direct experience in the financial industry, but I am eager to learn and adapt to the specific challenges of this sector.

- I am sometimes overly detail-oriented, but I am working on delegating more effectively.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Chief Data Officer, Finance.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Chief Data Officer, Finance‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

As a Chief Data Officer (CDO) in Finance, your primary responsibility is to oversee the management and use of data within the Finance function. This role plays a crucial role in ensuring that the organization leverages its data assets to drive informed decision-making, improve operational efficiency, and achieve strategic objectives.

1. Data Strategy and Governance

Develop and implement a comprehensive data strategy and governance framework to ensure the effective and ethical use of data within the Finance function.

- Define data governance policies and standards.

- Establish data access and usage controls.

2. Data Analytics and Reporting

Lead the analysis and interpretation of financial data to identify trends, patterns, and insights that support decision-making.

- Develop and implement data analytics models.

- Create interactive dashboards and reports.

3. Data Management and Infrastructure

Oversee the management and maintenance of data infrastructure, including data storage, security, and quality.

- Implement data management tools and technologies.

- Monitor and ensure data integrity and security.

4. Data Collaboration and Communication

Foster collaboration among finance teams and other stakeholders to ensure that data is shared and used effectively.

- Facilitate data sharing and access across the organization.

- Communicate data insights and recommendations to stakeholders.

Interview Tips

Preparing for an interview for a Chief Data Officer (CDO) role in Finance requires a combination of technical expertise and a deep understanding of the financial industry. Here are some tips to help you ace your interview:

1. Research the Company and Industry

Thoroughly research the organization you’re interviewing with and the Finance industry as a whole. Familiarize yourself with their business model, financial performance, and key challenges.

2. Highlight Your Technical Skills

Emphasize your proficiency in data management technologies, analytics tools, and data visualization techniques. Quantify your accomplishments and provide specific examples of successful data-driven projects you’ve led.

3. Showcase Your Financial Acumen

Demonstrate your deep understanding of financial principles, accounting standards, and regulatory requirements. Explain how you have used data to solve business problems and improve financial outcomes.

4. Articulate Your Strategic Vision

Articulate your vision for how data can be leveraged to drive strategic decision-making within the Finance function. Discuss how you plan to align data initiatives with the organization’s overall business objectives.

5. Prepare for Behavioral Questions

Be prepared to answer behavioral interview questions that explore your leadership style, collaboration abilities, and problem-solving skills. Share specific examples of how you have successfully managed teams, built relationships, and overcome challenges.

Next Step:

Now that you’re armed with the knowledge of Chief Data Officer, Finance interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Chief Data Officer, Finance positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini