Feeling lost in a sea of interview questions? Landed that dream interview for Corporate Finance Analyst but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Corporate Finance Analyst interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

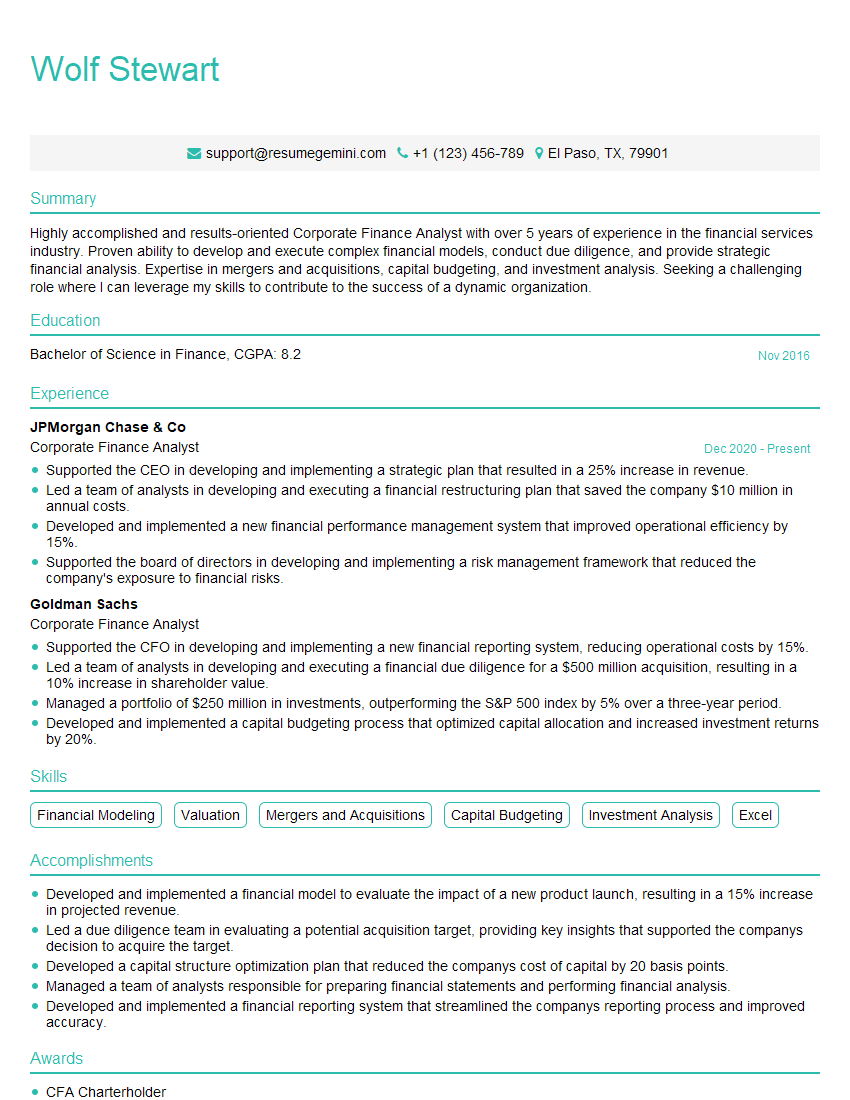

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Corporate Finance Analyst

1. Explain the process of developing a financial model for a capital budgeting project.

- Define the project scope and objectives.

- Gather data and assumptions.

- Build the financial model, including cash flow projections, depreciation schedules, and sensitivity analysis.

- Validate the model and get feedback from stakeholders.

- Use the model to make financing decisions.

2. How do you assess the cost of capital for a project?

Weighted Average Cost of Capital (WACC)

- Debt: Before-tax cost of debt multiplied by the debt ratio.

- Equity: Required return on equity multiplied by the equity ratio.

Other Considerations

- Project risk

- Market conditions

- Company-specific factors

3. What are the key metrics used to evaluate a project’s financial feasibility?

- Net Present Value (NPV)

- Internal Rate of Return (IRR)

- Payback Period

- Discounted Payback Period

- Profitability Index

4. How do you perform scenario analysis in financial modeling?

- Identify key uncertainties.

- Develop scenarios for each uncertainty.

- Run the financial model for each scenario.

- Analyze the results and identify potential risks and opportunities.

5. What are the different methods for valuing a company?

- Discounted Cash Flow (DCF) Analysis

- Multiples Analysis

- Asset-Based Valuation

- Liquidation Value

6. How do you analyze financial statements to assess a company’s financial health?

- Income Statement: Revenue, expenses, and profitability.

- Balance Sheet: Assets, liabilities, and equity.

- Cash Flow Statement: Cash flow from operations, investing, and financing.

- Financial ratios: Liquidity, solvency, and profitability.

7. What are the different types of financial modeling software?

- Microsoft Excel

- Bloomberg

- Argus

- Capital IQ

8. How do you use Excel functions and formulas for financial modeling?

- Financial functions (NPV, IRR, PMT)

- Lookup and reference functions (VLOOKUP, INDEX, MATCH)

- Conditional formatting

- Pivot tables and charts

9. What are the ethical considerations for corporate finance analysts?

- Confidentiality

- Objectivity

- Integrity

- Professionalism

10. How do you stay up-to-date with the latest developments in corporate finance?

- Attend conferences and webinars

- Read industry publications

- Network with other professionals

- Pursue professional certifications

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Corporate Finance Analyst.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Corporate Finance Analyst‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Corporate Finance Analysts play a critical role in supporting strategic financial decisions within organizations. Their responsibilities encompass a wide range of tasks, including:

1. Financial Modeling and Analysis

Developing and maintaining financial models to forecast financial performance, evaluate investment opportunities, and assess the impact of strategic decisions.

- Creating financial projections and scenarios using complex modeling techniques.

- Analyzing financial statements and market data to identify trends and opportunities.

2. Capital Budgeting and Project Evaluation

Evaluating potential capital investments and projects to determine their financial feasibility and return on investment.

- Conducting cost-benefit analyses and sensitivity analyses to assess project risks and potential rewards.

- Preparing investment proposals and presentations to secure funding for new projects.

3. Debt and Equity Financing

Advising on debt and equity financing strategies, including the issuance of bonds and stocks.

- Evaluating the cost and benefits of different financing options.

- Negotiating with potential investors and underwriters to secure favorable terms for financing.

4. Mergers and Acquisitions

Supporting mergers and acquisitions transactions by conducting due diligence, evaluating potential targets, and advising on valuation.

- Analyzing financial data and performing valuation exercises to assess the target company’s financial health.

- Providing financial advice to management and investors throughout the transaction process.

Interview Tips

To excel in a Corporate Finance Analyst interview, consider the following tips:

1. Research the Company and Industry

Thoroughly research the company, its industry, and current financial performance. This knowledge will enable you to speak intelligently about the company’s financial situation and to ask informed questions during the interview.

- Visit the company website, read financial news, and review recent earnings reports.

- Learn about the company’s competitors, market trends, and industry outlook.

2. Practice Financial Modeling and Analysis

Corporate Finance Analysts are expected to possess strong financial modeling and analysis skills. Practice these skills by solving case studies or using online modeling tools to demonstrate your proficiency.

- Use Excel or other modeling software to create financial models and perform sensitivity analyses.

- Analyze financial statements and market data to identify key trends and drivers of performance.

3. Prepare for Technical Questions

Be prepared to answer technical questions related to financial modeling, valuation, and capital budgeting. Study financial textbooks, practice solving case studies, and review concepts such as DCF analysis, WACC, and IRR.

- Review the basics of corporate finance, including financial ratios, capital structure, and investment analysis.

- Practice answering questions about valuation methods, debt financing, and equity financing.

4. Emphasize Your Communication and Interpersonal Skills

Corporate Finance Analysts need to be able to communicate complex financial information clearly and effectively to various stakeholders. Highlight your communication and interpersonal skills during the interview.

- Explain how you have successfully presented financial data and analysis to non-financial audiences.

- Discuss your ability to build strong relationships with colleagues and clients.

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Corporate Finance Analyst, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Corporate Finance Analyst positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.