Are you a seasoned Bank Operations Officer seeking a new career path? Discover our professionally built Bank Operations Officer Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

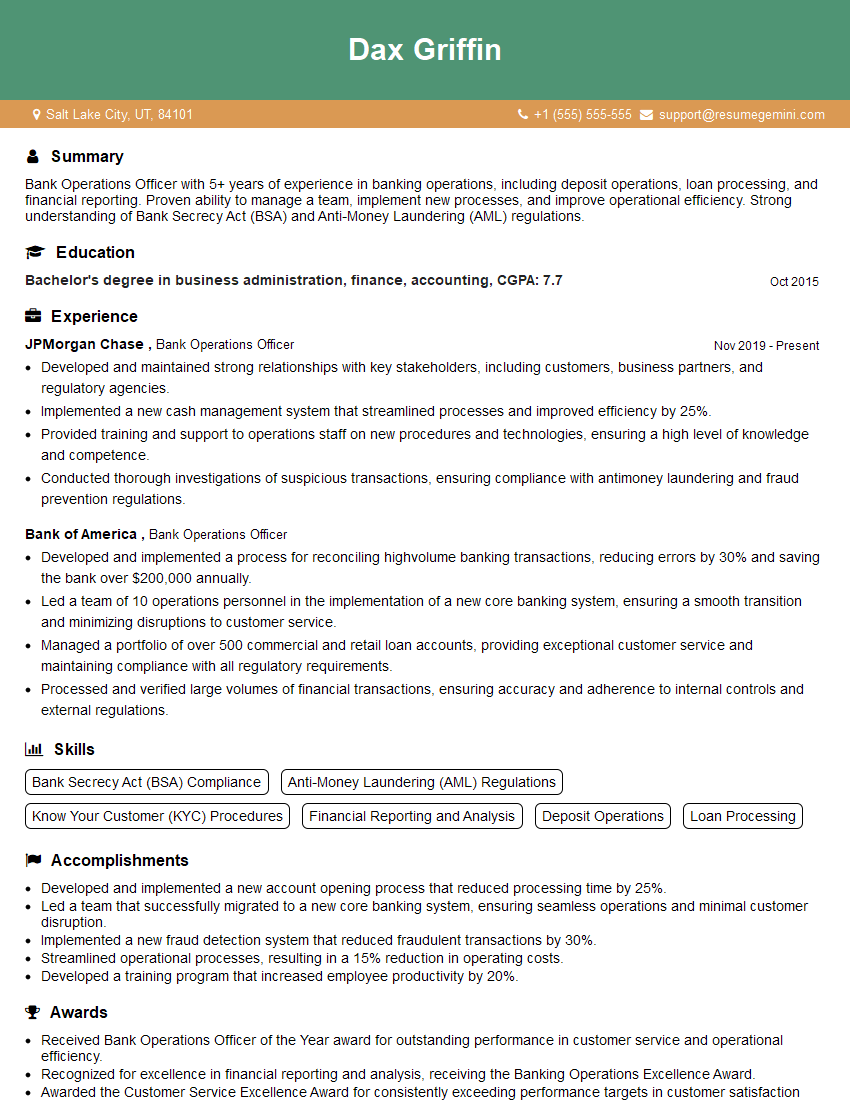

Dax Griffin

Bank Operations Officer

Summary

Bank Operations Officer with 5+ years of experience in banking operations, including deposit operations, loan processing, and financial reporting. Proven ability to manage a team, implement new processes, and improve operational efficiency. Strong understanding of Bank Secrecy Act (BSA) and Anti-Money Laundering (AML) regulations.

Education

Bachelor’s degree in business administration, finance, accounting

October 2015

Skills

- Bank Secrecy Act (BSA) Compliance

- Anti-Money Laundering (AML) Regulations

- Know Your Customer (KYC) Procedures

- Financial Reporting and Analysis

- Deposit Operations

- Loan Processing

Work Experience

Bank Operations Officer

- Developed and maintained strong relationships with key stakeholders, including customers, business partners, and regulatory agencies.

- Implemented a new cash management system that streamlined processes and improved efficiency by 25%.

- Provided training and support to operations staff on new procedures and technologies, ensuring a high level of knowledge and competence.

- Conducted thorough investigations of suspicious transactions, ensuring compliance with antimoney laundering and fraud prevention regulations.

Bank Operations Officer

- Developed and implemented a process for reconciling highvolume banking transactions, reducing errors by 30% and saving the bank over $200,000 annually.

- Led a team of 10 operations personnel in the implementation of a new core banking system, ensuring a smooth transition and minimizing disruptions to customer service.

- Managed a portfolio of over 500 commercial and retail loan accounts, providing exceptional customer service and maintaining compliance with all regulatory requirements.

- Processed and verified large volumes of financial transactions, ensuring accuracy and adherence to internal controls and external regulations.

Accomplishments

- Developed and implemented a new account opening process that reduced processing time by 25%.

- Led a team that successfully migrated to a new core banking system, ensuring seamless operations and minimal customer disruption.

- Implemented a new fraud detection system that reduced fraudulent transactions by 30%.

- Streamlined operational processes, resulting in a 15% reduction in operating costs.

- Developed a training program that increased employee productivity by 20%.

Awards

- Received Bank Operations Officer of the Year award for outstanding performance in customer service and operational efficiency.

- Recognized for excellence in financial reporting and analysis, receiving the Banking Operations Excellence Award.

- Awarded the Customer Service Excellence Award for consistently exceeding performance targets in customer satisfaction and resolution.

- Received the Innovation Award for developing a new product that significantly improved customer convenience.

Certificates

- Certified Anti-Money Laundering Specialist (CAMS)

- Bank Secrecy Act Compliance Officer (BSACO)

- Certified Treasury Professional (CTP)

- Certified Financial Crime Specialist (CFCS)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Bank Operations Officer

- Highlight your relevant experience and skills in your resume, such as your ability to manage a team, implement new processes, and improve operational efficiency.

- Use keywords from the job description in your resume and cover letter to make it more relevant to the position.

- Proofread your resume carefully for any errors in grammar or spelling.

- Tailor your resume and cover letter to each specific job you apply for.

- Quantify your accomplishments whenever possible to demonstrate the impact of your work.

Essential Experience Highlights for a Strong Bank Operations Officer Resume

- Manage day-to-day operations of the banking branch, including teller transactions, cash handling, and customer service.

- Oversee the loan application process, including credit analysis, underwriting, and loan closing.

- Prepare financial reports and statements, including balance sheets, income statements, and cash flow statements.

- Implement and maintain internal controls to ensure the accuracy and security of financial transactions.

- Stay up-to-date on regulatory changes and ensure compliance with all applicable laws and regulations.

Frequently Asked Questions (FAQ’s) For Bank Operations Officer

What is the role of a Bank Operations Officer?

A Bank Operations Officer is responsible for the day-to-day operations of a bank branch, including teller transactions, cash handling, and customer service. They also oversee the loan application process, prepare financial reports, and implement internal controls to ensure the accuracy and security of financial transactions.

What are the qualifications for a Bank Operations Officer?

Bank Operations Officers typically need a bachelor’s degree in business administration, finance, accounting, or a related field. They also need to have experience in banking operations, including deposit operations, loan processing, and financial reporting.

What are the skills required for a Bank Operations Officer?

Bank Operations Officers need to have excellent communication and interpersonal skills, as well as the ability to manage a team and implement new processes. They also need to be detail-oriented and have a strong understanding of Bank Secrecy Act (BSA) and Anti-Money Laundering (AML) regulations.

What is the career path for a Bank Operations Officer?

Bank Operations Officers can advance to become Branch Managers, Operations Managers, or other senior management positions within the banking industry.

What is the salary range for a Bank Operations Officer?

The salary range for a Bank Operations Officer can vary depending on their experience, location, and employer. However, the median annual salary for Bank Operations Officers is around $60,000.

What are the benefits of working as a Bank Operations Officer?

Bank Operations Officers can enjoy a variety of benefits, including health insurance, paid time off, and retirement plans. They also have the opportunity to work in a dynamic and challenging environment and to make a difference in the lives of their customers.