Are you a seasoned Cash Manager seeking a new career path? Discover our professionally built Cash Manager Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

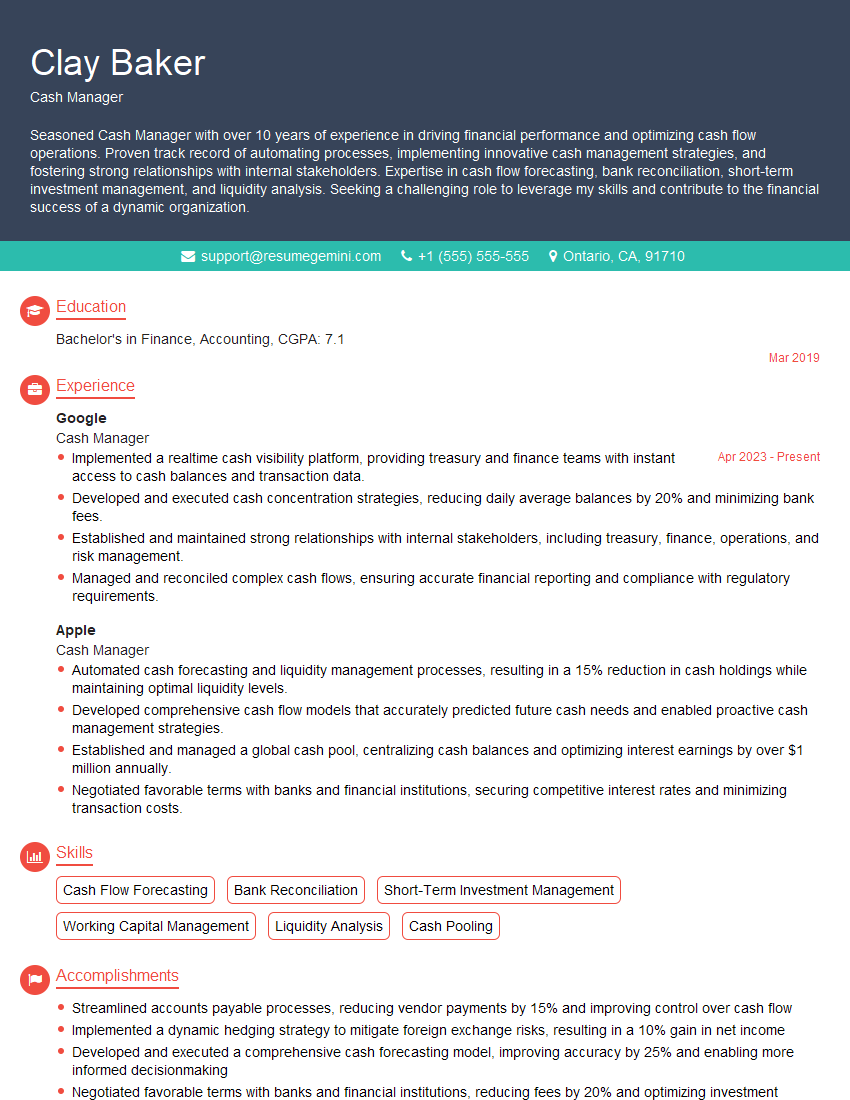

Clay Baker

Cash Manager

Summary

Seasoned Cash Manager with over 10 years of experience in driving financial performance and optimizing cash flow operations. Proven track record of automating processes, implementing innovative cash management strategies, and fostering strong relationships with internal stakeholders. Expertise in cash flow forecasting, bank reconciliation, short-term investment management, and liquidity analysis. Seeking a challenging role to leverage my skills and contribute to the financial success of a dynamic organization.

Education

Bachelor’s in Finance, Accounting

March 2019

Skills

- Cash Flow Forecasting

- Bank Reconciliation

- Short-Term Investment Management

- Working Capital Management

- Liquidity Analysis

- Cash Pooling

Work Experience

Cash Manager

- Implemented a realtime cash visibility platform, providing treasury and finance teams with instant access to cash balances and transaction data.

- Developed and executed cash concentration strategies, reducing daily average balances by 20% and minimizing bank fees.

- Established and maintained strong relationships with internal stakeholders, including treasury, finance, operations, and risk management.

- Managed and reconciled complex cash flows, ensuring accurate financial reporting and compliance with regulatory requirements.

Cash Manager

- Automated cash forecasting and liquidity management processes, resulting in a 15% reduction in cash holdings while maintaining optimal liquidity levels.

- Developed comprehensive cash flow models that accurately predicted future cash needs and enabled proactive cash management strategies.

- Established and managed a global cash pool, centralizing cash balances and optimizing interest earnings by over $1 million annually.

- Negotiated favorable terms with banks and financial institutions, securing competitive interest rates and minimizing transaction costs.

Accomplishments

- Streamlined accounts payable processes, reducing vendor payments by 15% and improving control over cash flow

- Implemented a dynamic hedging strategy to mitigate foreign exchange risks, resulting in a 10% gain in net income

- Developed and executed a comprehensive cash forecasting model, improving accuracy by 25% and enabling more informed decisionmaking

- Negotiated favorable terms with banks and financial institutions, reducing fees by 20% and optimizing investment returns

- Established strong relationships with key stakeholders, including treasury operations, accounting, and business units

Awards

- Recognized for Outstanding Performance in Cash Management by Financial Management Association (FMA)

- Awarded Cash Manager of the Year by Treasury Today

- Received Excellence Award for Innovative Cash Forecasting and Liquidity Management

Certificates

- Certified Cash Manager (CCM)

- Certified Treasury Professional (CTP)

- Certified Public Accountant (CPA)

- Chartered Financial Analyst (CFA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Cash Manager

- Quantify your accomplishments with specific metrics whenever possible.

- Highlight your expertise in cash flow forecasting and liquidity analysis.

- Showcase your ability to manage complex cash flows and ensure accurate financial reporting.

- Emphasize your strong relationships with internal stakeholders and your ability to collaborate effectively.

Essential Experience Highlights for a Strong Cash Manager Resume

- Developed and implemented cash management strategies that reduced cash holdings by 15% while maintaining optimal liquidity levels.

- Automated cash forecasting and liquidity management processes, resulting in improved accuracy and efficiency.

- Established and managed a global cash pool, centralizing cash balances and optimizing interest earnings by over $1 million annually.

- Negotiated favorable terms with banks and financial institutions, securing competitive interest rates and minimizing transaction costs.

- Implemented a real-time cash visibility platform, providing treasury and finance teams with instant access to cash balances and transaction data.

- Developed and executed cash concentration strategies, reducing daily average balances by 20% and minimizing bank fees.

Frequently Asked Questions (FAQ’s) For Cash Manager

What is the role of a Cash Manager?

The Cash Manager is responsible for overseeing the day-to-day cash flow operations of an organization. This includes forecasting cash needs, managing bank relationships, investing excess cash, and ensuring compliance with financial regulations.

What are the key skills required for a Cash Manager?

Key skills for a Cash Manager include cash flow forecasting, bank reconciliation, short-term investment management, working capital management, liquidity analysis, and cash pooling.

What are the career prospects for a Cash Manager?

Cash Managers can advance to senior roles in treasury, finance, or operations. With experience, they can also become Chief Financial Officers (CFOs) or Controllers.

What is the average salary for a Cash Manager?

The average salary for a Cash Manager in the United States is around $120,000 per year.

What are the challenges faced by Cash Managers?

Cash Managers face challenges such as managing cash flow in volatile economic conditions, optimizing investment returns while minimizing risk, and ensuring compliance with regulatory requirements.

What are the best ways to prepare for a career as a Cash Manager?

To prepare for a career as a Cash Manager, it is recommended to pursue a degree in finance or accounting, gain experience in cash flow management or treasury operations, and obtain certifications such as the Certified Cash Manager (CCM).