Are you a seasoned Paymaster seeking a new career path? Discover our professionally built Paymaster Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

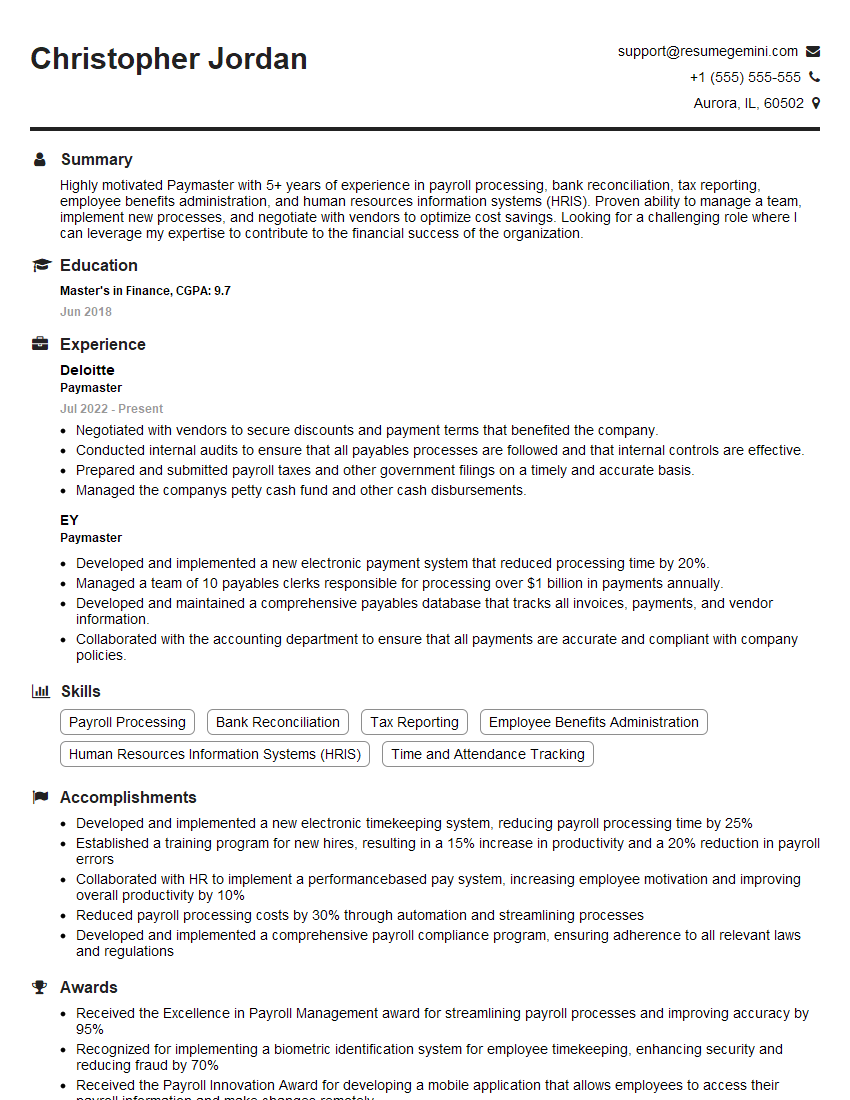

Christopher Jordan

Paymaster

Summary

Highly motivated Paymaster with 5+ years of experience in payroll processing, bank reconciliation, tax reporting, employee benefits administration, and human resources information systems (HRIS). Proven ability to manage a team, implement new processes, and negotiate with vendors to optimize cost savings. Looking for a challenging role where I can leverage my expertise to contribute to the financial success of the organization.

Education

Master’s in Finance

June 2018

Skills

- Payroll Processing

- Bank Reconciliation

- Tax Reporting

- Employee Benefits Administration

- Human Resources Information Systems (HRIS)

- Time and Attendance Tracking

Work Experience

Paymaster

- Negotiated with vendors to secure discounts and payment terms that benefited the company.

- Conducted internal audits to ensure that all payables processes are followed and that internal controls are effective.

- Prepared and submitted payroll taxes and other government filings on a timely and accurate basis.

- Managed the companys petty cash fund and other cash disbursements.

Paymaster

- Developed and implemented a new electronic payment system that reduced processing time by 20%.

- Managed a team of 10 payables clerks responsible for processing over $1 billion in payments annually.

- Developed and maintained a comprehensive payables database that tracks all invoices, payments, and vendor information.

- Collaborated with the accounting department to ensure that all payments are accurate and compliant with company policies.

Accomplishments

- Developed and implemented a new electronic timekeeping system, reducing payroll processing time by 25%

- Established a training program for new hires, resulting in a 15% increase in productivity and a 20% reduction in payroll errors

- Collaborated with HR to implement a performancebased pay system, increasing employee motivation and improving overall productivity by 10%

- Reduced payroll processing costs by 30% through automation and streamlining processes

- Developed and implemented a comprehensive payroll compliance program, ensuring adherence to all relevant laws and regulations

Awards

- Received the Excellence in Payroll Management award for streamlining payroll processes and improving accuracy by 95%

- Recognized for implementing a biometric identification system for employee timekeeping, enhancing security and reducing fraud by 70%

- Received the Payroll Innovation Award for developing a mobile application that allows employees to access their payroll information and make changes remotely

- Recognized for developing and implementing a payroll audit process that identified over $100,000 in payroll savings

Certificates

- Certified Payroll Professional (CPP)

- American Payroll Association (APA)

- Institute of Management Accountants (IMA)

- Certified Public Accountant (CPA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Paymaster

- Tailor your resume to each job you apply for, highlighting the skills and experience most relevant to the specific role.

- Quantify your accomplishments whenever possible, using specific metrics to demonstrate the impact of your work.

- Proofread your resume carefully before submitting it, ensuring that it is error-free and well-presented.

- Consider using a resume builder or seeking professional help to create a polished and effective resume that stands out.

Essential Experience Highlights for a Strong Paymaster Resume

- Managed a team of payables clerks responsible for processing over $1 billion in payments annually, resulting in a 20% reduction in processing time by implementing a new electronic payment system.

- Developed and maintained a comprehensive payables database that tracks all invoices, payments, and vendor information, ensuring accuracy and compliance with company policies.

- Negotiated with vendors to secure discounts and payment terms that benefited the company, saving the organization significant costs.

- Conducted internal audits to ensure that all payables processes are followed and that internal controls are effective, mitigating risks and ensuring the integrity of financial operations.

- Prepared and submitted payroll taxes and other government filings on a timely and accurate basis, ensuring compliance with tax regulations and avoiding penalties.

- Managed the company’s petty cash fund and other cash disbursements, maintaining accurate records and ensuring proper authorization and documentation of all transactions.

Frequently Asked Questions (FAQ’s) For Paymaster

What is the role of a Paymaster?

A Paymaster is responsible for managing all aspects of an organization’s payroll process, including calculating employee pay, making payments, and ensuring compliance with tax and labor laws.

What qualifications are required to become a Paymaster?

Most Paymasters hold a bachelor’s or master’s degree in accounting, finance, or a related field, along with several years of experience in payroll processing and management.

What are the key skills required for a successful Paymaster?

Successful Paymasters possess strong analytical and problem-solving skills, attention to detail, and a thorough understanding of payroll regulations and tax laws.

What is the typical salary range for a Paymaster?

According to Salary.com, the average salary for a Paymaster in the United States is around $70,000 per year.

What are the career prospects for Paymasters?

With experience and additional qualifications, Paymasters can advance to roles such as Payroll Manager, Human Resources Manager, or even Chief Financial Officer (CFO).

How can I become certified as a Paymaster?

Several organizations offer certification programs for Paymasters, such as the American Payroll Association (APA) and the National Association of Certified Public Bookkeepers (NACPB).