Are you a seasoned Risk and Insurance Manager seeking a new career path? Discover our professionally built Risk and Insurance Manager Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

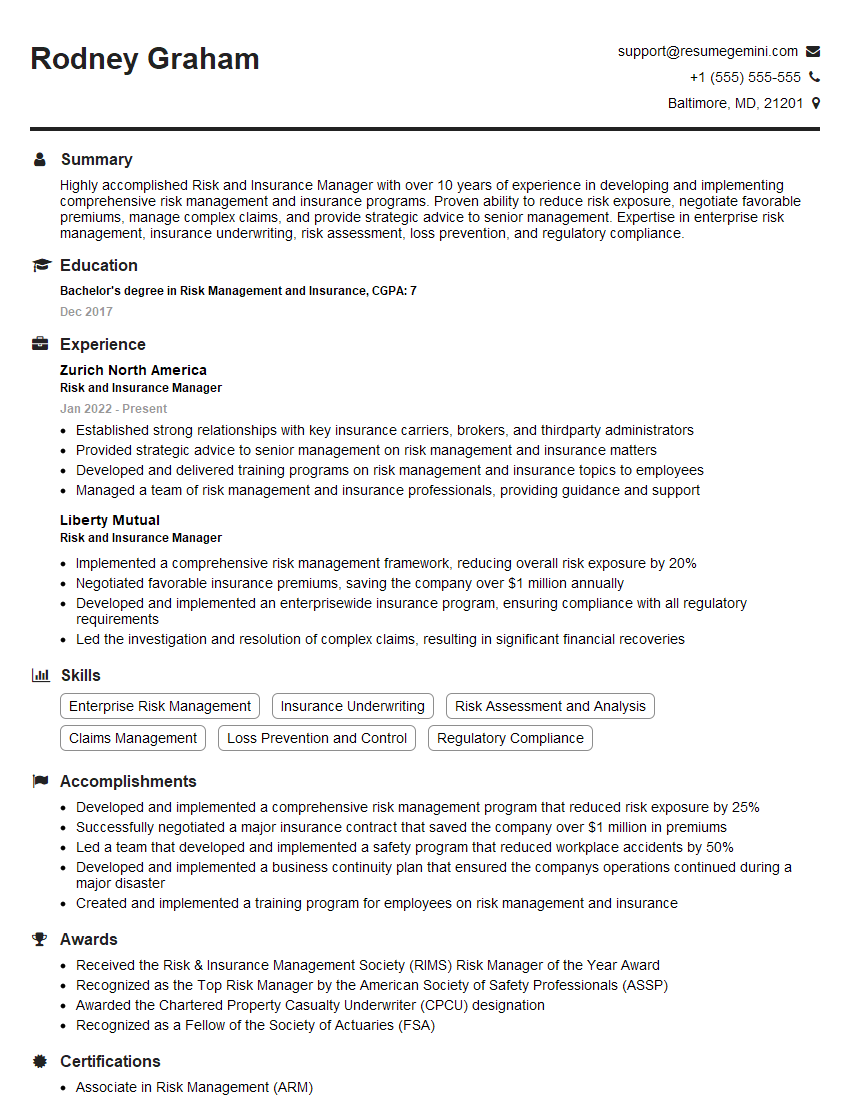

Rodney Graham

Risk and Insurance Manager

Summary

Highly accomplished Risk and Insurance Manager with over 10 years of experience in developing and implementing comprehensive risk management and insurance programs. Proven ability to reduce risk exposure, negotiate favorable premiums, manage complex claims, and provide strategic advice to senior management. Expertise in enterprise risk management, insurance underwriting, risk assessment, loss prevention, and regulatory compliance.

Education

Bachelor’s degree in Risk Management and Insurance

December 2017

Skills

- Enterprise Risk Management

- Insurance Underwriting

- Risk Assessment and Analysis

- Claims Management

- Loss Prevention and Control

- Regulatory Compliance

Work Experience

Risk and Insurance Manager

- Established strong relationships with key insurance carriers, brokers, and thirdparty administrators

- Provided strategic advice to senior management on risk management and insurance matters

- Developed and delivered training programs on risk management and insurance topics to employees

- Managed a team of risk management and insurance professionals, providing guidance and support

Risk and Insurance Manager

- Implemented a comprehensive risk management framework, reducing overall risk exposure by 20%

- Negotiated favorable insurance premiums, saving the company over $1 million annually

- Developed and implemented an enterprisewide insurance program, ensuring compliance with all regulatory requirements

- Led the investigation and resolution of complex claims, resulting in significant financial recoveries

Accomplishments

- Developed and implemented a comprehensive risk management program that reduced risk exposure by 25%

- Successfully negotiated a major insurance contract that saved the company over $1 million in premiums

- Led a team that developed and implemented a safety program that reduced workplace accidents by 50%

- Developed and implemented a business continuity plan that ensured the companys operations continued during a major disaster

- Created and implemented a training program for employees on risk management and insurance

Awards

- Received the Risk & Insurance Management Society (RIMS) Risk Manager of the Year Award

- Recognized as the Top Risk Manager by the American Society of Safety Professionals (ASSP)

- Awarded the Chartered Property Casualty Underwriter (CPCU) designation

- Recognized as a Fellow of the Society of Actuaries (FSA)

Certificates

- Associate in Risk Management (ARM)

- Certified Insurance Risk Manager (CIRM)

- Fellow of the Society of Actuaries (FSA)

- Chartered Property Casualty Underwriter (CPCU)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Risk and Insurance Manager

- Quantify your accomplishments with specific metrics and numbers whenever possible.

- Highlight your ability to identify and mitigate risks proactively.

- Showcase your knowledge of insurance markets and regulations.

- Emphasize your communication and interpersonal skills, as you will need to work closely with various stakeholders.

- Consider obtaining professional certifications, such as the Associate in Risk Management (ARM) or Chartered Property Casualty Underwriter (CPCU), to enhance your credibility.

Essential Experience Highlights for a Strong Risk and Insurance Manager Resume

- Develop and implement comprehensive risk management frameworks to reduce risk exposure.

- Negotiate favorable insurance premiums to save the company millions of dollars annually.

- Develop and implement enterprise-wide insurance programs to ensure compliance with all regulatory requirements.

- Lead the investigation and resolution of complex claims to maximize financial recoveries.

- Establish strong relationships with key insurance carriers, brokers, and third-party administrators.

- Provide strategic advice to senior management on risk management and insurance matters.

- Develop and deliver training programs on risk management and insurance topics to employees.

Frequently Asked Questions (FAQ’s) For Risk and Insurance Manager

What are the key skills and qualifications required for a Risk and Insurance Manager?

Strong understanding of risk management principles, insurance underwriting, risk assessment, loss prevention, and regulatory compliance. Excellent communication and interpersonal skills are also essential.

What are the career prospects for Risk and Insurance Managers?

There is a growing demand for qualified Risk and Insurance Managers as businesses seek to mitigate risks and protect their assets. Career advancement opportunities include senior management positions, such as Chief Risk Officer or Chief Insurance Officer.

What are the common challenges faced by Risk and Insurance Managers?

Identifying and assessing emerging risks, managing complex insurance claims, and staying up-to-date with evolving regulations.

How can I prepare for a career as a Risk and Insurance Manager?

Earn a bachelor’s degree in Risk Management and Insurance or a related field, gain experience through internships or entry-level roles, and obtain professional certifications.

What is the typical salary range for Risk and Insurance Managers?

The salary range varies depending on experience, qualifications, and industry. According to Salary.com, the median annual salary for Risk and Insurance Managers in the United States is around $120,000.

What are the key trends in risk management and insurance?

Increasing use of technology, focus on cyber risks, and growing awareness of environmental, social, and governance (ESG) issues.