Are you a seasoned Corporate Operations Compliance Manager seeking a new career path? Discover our professionally built Corporate Operations Compliance Manager Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

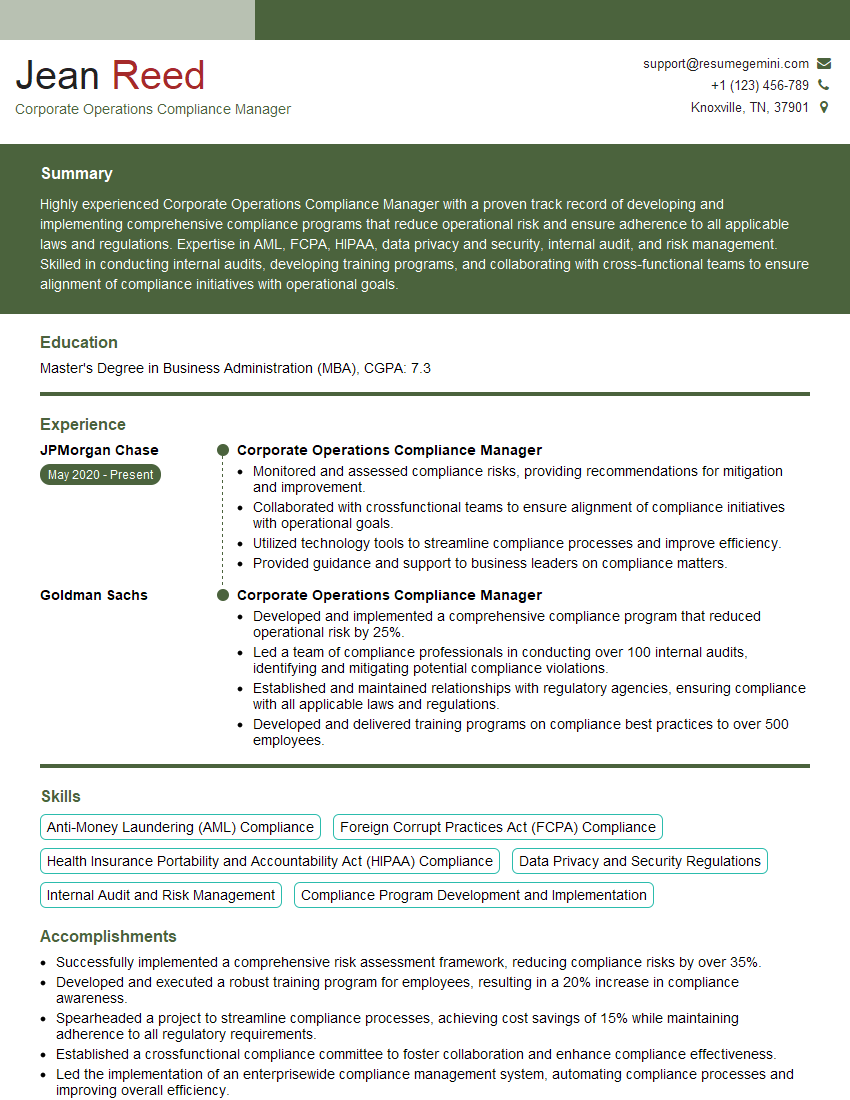

Jean Reed

Corporate Operations Compliance Manager

Summary

Highly experienced Corporate Operations Compliance Manager with a proven track record of developing and implementing comprehensive compliance programs that reduce operational risk and ensure adherence to all applicable laws and regulations. Expertise in AML, FCPA, HIPAA, data privacy and security, internal audit, and risk management. Skilled in conducting internal audits, developing training programs, and collaborating with cross-functional teams to ensure alignment of compliance initiatives with operational goals.

Education

Master’s Degree in Business Administration (MBA)

April 2016

Skills

- Anti-Money Laundering (AML) Compliance

- Foreign Corrupt Practices Act (FCPA) Compliance

- Health Insurance Portability and Accountability Act (HIPAA) Compliance

- Data Privacy and Security Regulations

- Internal Audit and Risk Management

- Compliance Program Development and Implementation

Work Experience

Corporate Operations Compliance Manager

- Monitored and assessed compliance risks, providing recommendations for mitigation and improvement.

- Collaborated with crossfunctional teams to ensure alignment of compliance initiatives with operational goals.

- Utilized technology tools to streamline compliance processes and improve efficiency.

- Provided guidance and support to business leaders on compliance matters.

Corporate Operations Compliance Manager

- Developed and implemented a comprehensive compliance program that reduced operational risk by 25%.

- Led a team of compliance professionals in conducting over 100 internal audits, identifying and mitigating potential compliance violations.

- Established and maintained relationships with regulatory agencies, ensuring compliance with all applicable laws and regulations.

- Developed and delivered training programs on compliance best practices to over 500 employees.

Accomplishments

- Successfully implemented a comprehensive risk assessment framework, reducing compliance risks by over 35%.

- Developed and executed a robust training program for employees, resulting in a 20% increase in compliance awareness.

- Spearheaded a project to streamline compliance processes, achieving cost savings of 15% while maintaining adherence to all regulatory requirements.

- Established a crossfunctional compliance committee to foster collaboration and enhance compliance effectiveness.

- Led the implementation of an enterprisewide compliance management system, automating compliance processes and improving overall efficiency.

Awards

- Recognition for exceptional leadership and contributions to the advancement of corporate compliance within the organization.

- Honored with the Compliance Champion award for fostering a culture of ethical behavior and compliance throughout the company.

- Received industrywide recognition for innovative approaches in implementing regulatory compliance policies.

- Awarded the Excellence in Governance prize for promoting best practices in corporate governance and compliance.

Certificates

- Certified Anti-Money Laundering Specialist (CAMS)

- Certified Fraud Examiner (CFE)

- Certified Information Systems Auditor (CISA)

- Certified Information Privacy Manager (CIPM)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Corporate Operations Compliance Manager

- Quantify your accomplishments with specific metrics to demonstrate the impact of your work.

- Highlight your knowledge of industry-specific regulations and best practices.

- Showcase your ability to collaborate with cross-functional teams and build strong relationships.

- Emphasize your commitment to continuous learning and professional development.

Essential Experience Highlights for a Strong Corporate Operations Compliance Manager Resume

- Developed and implemented a comprehensive compliance program that reduced operational risk by 25%.

- Led a team of compliance professionals in conducting over 100 internal audits, identifying and mitigating potential compliance violations.

- Established and maintained relationships with regulatory agencies, ensuring compliance with all applicable laws and regulations.

- Developed and delivered training programs on compliance best practices to over 500 employees.

- Monitored and assessed compliance risks, providing recommendations for mitigation and improvement.

- Collaborated with cross-functional teams to ensure alignment of compliance initiatives with operational goals.

- Utilized technology tools to streamline compliance processes and improve efficiency.

Frequently Asked Questions (FAQ’s) For Corporate Operations Compliance Manager

What are the key skills and qualifications required for a Corporate Operations Compliance Manager?

A Corporate Operations Compliance Manager should have a strong understanding of AML, FCPA, HIPAA, data privacy and security, internal audit, and risk management. They should also be proficient in conducting internal audits, developing training programs, and collaborating with cross-functional teams.

What are the primary responsibilities of a Corporate Operations Compliance Manager?

The primary responsibilities of a Corporate Operations Compliance Manager include developing and implementing compliance programs, conducting internal audits, establishing and maintaining relationships with regulatory agencies, developing and delivering training programs, monitoring and assessing compliance risks, and collaborating with cross-functional teams.

What are the career prospects for a Corporate Operations Compliance Manager?

Corporate Operations Compliance Managers are in high demand due to the increasing regulatory landscape. They can advance to senior-level positions within compliance, risk management, or internal audit.

What is the average salary for a Corporate Operations Compliance Manager?

The average salary for a Corporate Operations Compliance Manager varies depending on experience, location, and company size. According to Glassdoor, the average salary in the United States is around $120,000.

What are the educational requirements for a Corporate Operations Compliance Manager?

Most Corporate Operations Compliance Managers have a bachelor’s or master’s degree in business administration, finance, or a related field. Some may also have a law degree.

What are the top companies that hire Corporate Operations Compliance Managers?

Top companies that hire Corporate Operations Compliance Managers include JPMorgan Chase, Goldman Sachs, Citigroup, Bank of America, and Wells Fargo.

How can I prepare for an interview for a Corporate Operations Compliance Manager position?

To prepare for an interview for a Corporate Operations Compliance Manager position, you should research the company and the specific role. You should also be prepared to discuss your experience in compliance, risk management, and internal audit. You should also be able to demonstrate your knowledge of industry-specific regulations and best practices.