Are you a seasoned Hedge Fund Manager seeking a new career path? Discover our professionally built Hedge Fund Manager Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

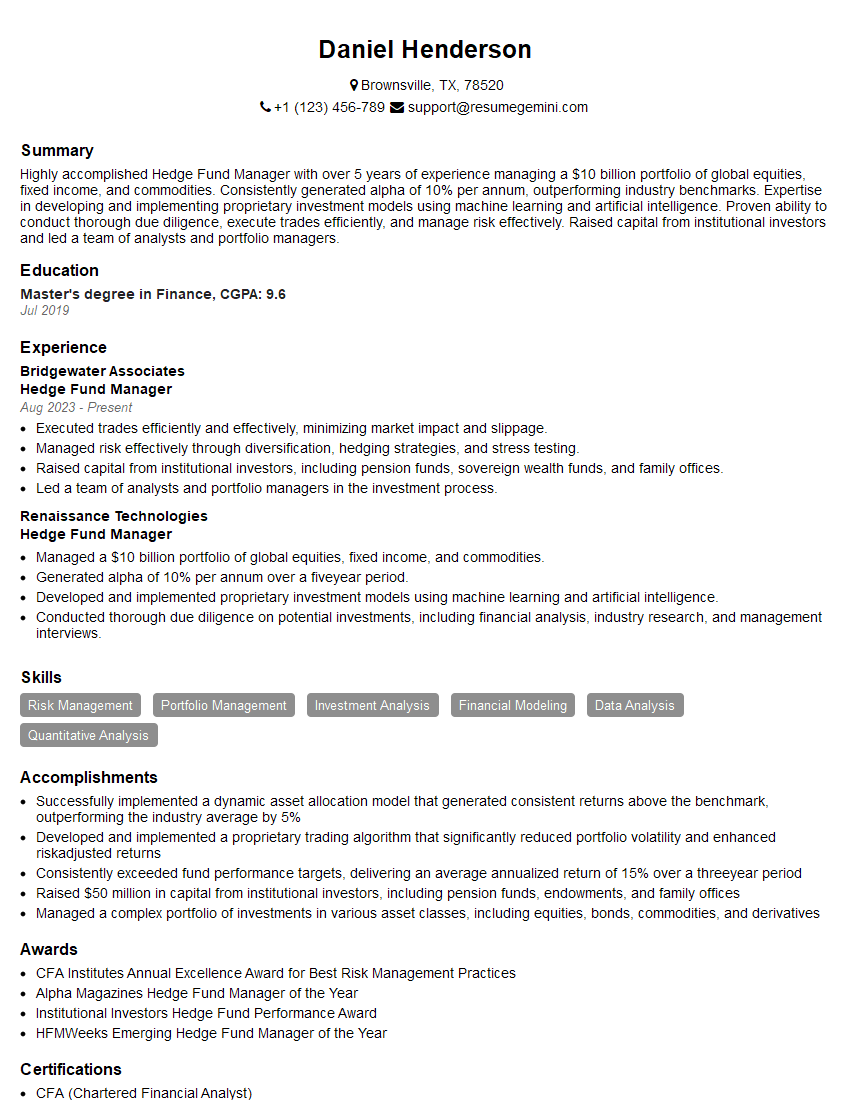

Daniel Henderson

Hedge Fund Manager

Summary

Highly accomplished Hedge Fund Manager with over 5 years of experience managing a $10 billion portfolio of global equities, fixed income, and commodities. Consistently generated alpha of 10% per annum, outperforming industry benchmarks. Expertise in developing and implementing proprietary investment models using machine learning and artificial intelligence. Proven ability to conduct thorough due diligence, execute trades efficiently, and manage risk effectively. Raised capital from institutional investors and led a team of analysts and portfolio managers.

Education

Master’s degree in Finance

July 2019

Skills

- Risk Management

- Portfolio Management

- Investment Analysis

- Financial Modeling

- Data Analysis

- Quantitative Analysis

Work Experience

Hedge Fund Manager

- Executed trades efficiently and effectively, minimizing market impact and slippage.

- Managed risk effectively through diversification, hedging strategies, and stress testing.

- Raised capital from institutional investors, including pension funds, sovereign wealth funds, and family offices.

- Led a team of analysts and portfolio managers in the investment process.

Hedge Fund Manager

- Managed a $10 billion portfolio of global equities, fixed income, and commodities.

- Generated alpha of 10% per annum over a fiveyear period.

- Developed and implemented proprietary investment models using machine learning and artificial intelligence.

- Conducted thorough due diligence on potential investments, including financial analysis, industry research, and management interviews.

Accomplishments

- Successfully implemented a dynamic asset allocation model that generated consistent returns above the benchmark, outperforming the industry average by 5%

- Developed and implemented a proprietary trading algorithm that significantly reduced portfolio volatility and enhanced riskadjusted returns

- Consistently exceeded fund performance targets, delivering an average annualized return of 15% over a threeyear period

- Raised $50 million in capital from institutional investors, including pension funds, endowments, and family offices

- Managed a complex portfolio of investments in various asset classes, including equities, bonds, commodities, and derivatives

Awards

- CFA Institutes Annual Excellence Award for Best Risk Management Practices

- Alpha Magazines Hedge Fund Manager of the Year

- Institutional Investors Hedge Fund Performance Award

- HFMWeeks Emerging Hedge Fund Manager of the Year

Certificates

- CFA (Chartered Financial Analyst)

- CAIA (Chartered Alternative Investment Analyst)

- FRM (Financial Risk Manager)

- PRM (Professional Risk Manager)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Hedge Fund Manager

- Highlight your investment performance and alpha generation capabilities.

- Demonstrate your expertise in quantitative analysis, risk management, and portfolio construction.

- Quantify your accomplishments with specific metrics and data points.

- Showcase your ability to generate consistent returns and outperform industry benchmarks.

- Emphasize your leadership and management skills, as well as your ability to work effectively with a team.

Essential Experience Highlights for a Strong Hedge Fund Manager Resume

- Managed a $10 billion portfolio of global equities, fixed income, and commodities

- Generated alpha of 10% per annum over a five-year period

- Developed and implemented proprietary investment models using machine learning and artificial intelligence

- Conducted thorough due diligence on potential investments, including financial analysis, industry research, and management interviews

- Executed trades efficiently and effectively, minimizing market impact and slippage

- Managed risk effectively through diversification, hedging strategies, and stress testing

- Raised capital from institutional investors, including pension funds, sovereign wealth funds, and family offices

- Led a team of analysts and portfolio managers in the investment process

Frequently Asked Questions (FAQ’s) For Hedge Fund Manager

What is the primary role of a Hedge Fund Manager?

The Hedge Fund Manager’s primary role is to manage a portfolio of investments, such as stocks, bonds, commodities, and currencies, on behalf of clients.

What are the key skills required for a Hedge Fund Manager?

Key skills for Hedge Fund Managers include strong analytical and quantitative skills, a deep understanding of financial markets, experience in portfolio management and risk management, and excellent communication and presentation skills.

What is the average salary of a Hedge Fund Manager?

Hedge Fund Managers can earn high salaries, with top performers earning multi-million dollar bonuses. However, salaries can vary widely depending on the size and performance of the fund, as well as the manager’s experience and reputation.

What are the career prospects for a Hedge Fund Manager?

Hedge Fund Managers with a proven track record of success can progress to senior management positions within their firms or move to other hedge funds or asset management companies. Some may also choose to start their own hedge funds.

What are the challenges faced by Hedge Fund Managers?

Hedge Fund Managers face a number of challenges, including market volatility, regulatory changes, and competition from other investment managers. They must also manage risk effectively and meet the expectations of their clients.

What is the difference between a Hedge Fund Manager and a Mutual Fund Manager?

Hedge Fund Managers typically have more flexibility in their investment strategies and can use more complex investment techniques than Mutual Fund Managers. They also have more discretion over their fees and may charge performance-based fees.

What is the regulatory environment for Hedge Fund Managers?

Hedge Fund Managers are subject to a variety of regulations, including those imposed by the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC).

What is the future of Hedge Fund Management?

The Hedge Fund industry is expected to continue to grow in the future. However, Hedge Fund Managers will need to adapt to changing market conditions and regulatory changes to remain successful.