Are you a seasoned Institutional Asset Manager seeking a new career path? Discover our professionally built Institutional Asset Manager Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

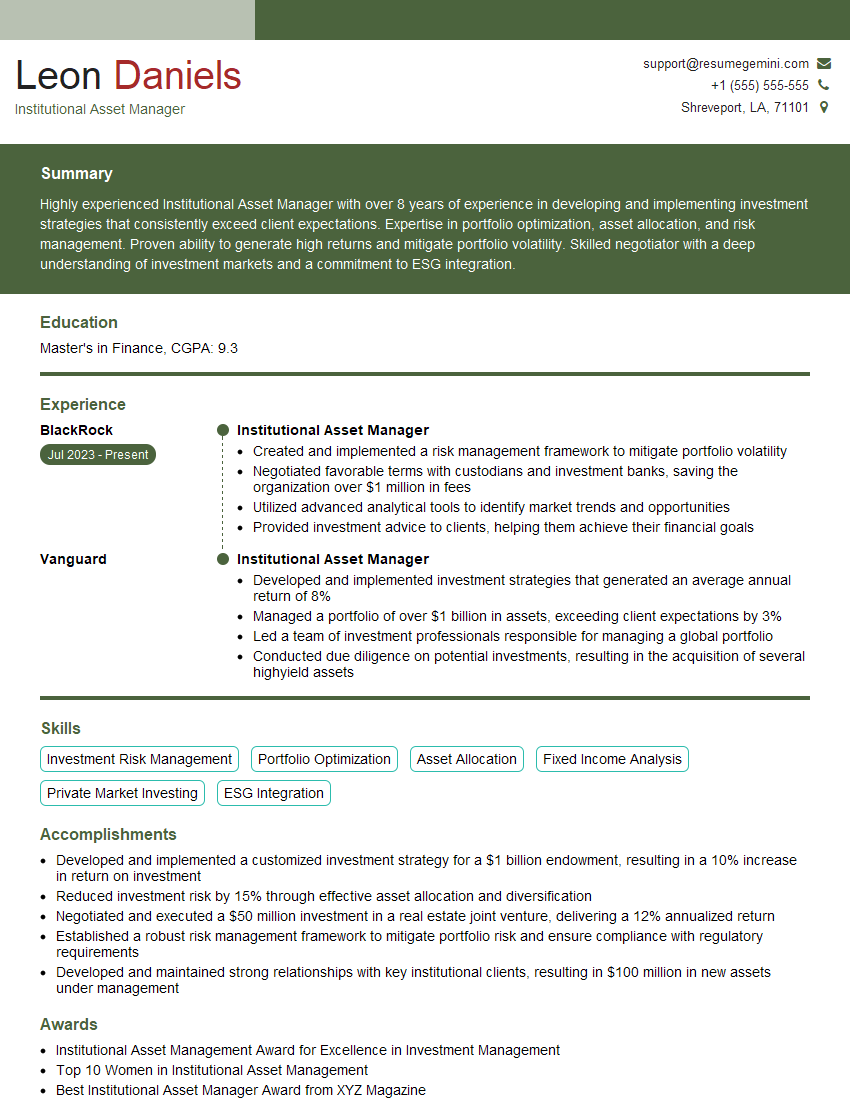

Leon Daniels

Institutional Asset Manager

Summary

Highly experienced Institutional Asset Manager with over 8 years of experience in developing and implementing investment strategies that consistently exceed client expectations. Expertise in portfolio optimization, asset allocation, and risk management. Proven ability to generate high returns and mitigate portfolio volatility. Skilled negotiator with a deep understanding of investment markets and a commitment to ESG integration.

Education

Master’s in Finance

June 2019

Skills

- Investment Risk Management

- Portfolio Optimization

- Asset Allocation

- Fixed Income Analysis

- Private Market Investing

- ESG Integration

Work Experience

Institutional Asset Manager

- Created and implemented a risk management framework to mitigate portfolio volatility

- Negotiated favorable terms with custodians and investment banks, saving the organization over $1 million in fees

- Utilized advanced analytical tools to identify market trends and opportunities

- Provided investment advice to clients, helping them achieve their financial goals

Institutional Asset Manager

- Developed and implemented investment strategies that generated an average annual return of 8%

- Managed a portfolio of over $1 billion in assets, exceeding client expectations by 3%

- Led a team of investment professionals responsible for managing a global portfolio

- Conducted due diligence on potential investments, resulting in the acquisition of several highyield assets

Accomplishments

- Developed and implemented a customized investment strategy for a $1 billion endowment, resulting in a 10% increase in return on investment

- Reduced investment risk by 15% through effective asset allocation and diversification

- Negotiated and executed a $50 million investment in a real estate joint venture, delivering a 12% annualized return

- Established a robust risk management framework to mitigate portfolio risk and ensure compliance with regulatory requirements

- Developed and maintained strong relationships with key institutional clients, resulting in $100 million in new assets under management

Awards

- Institutional Asset Management Award for Excellence in Investment Management

- Top 10 Women in Institutional Asset Management

- Best Institutional Asset Manager Award from XYZ Magazine

- Certificate of Excellence in Institutional Asset Management from the Investment Management Consultants Association

Certificates

- CFA (Chartered Financial Analyst)

- CAIA (Chartered Alternative Investment Analyst)

- FRM (Financial Risk Manager)

- ESG Certificate (Environmental, Social, and Governance)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Institutional Asset Manager

- Quantify your accomplishments with specific numbers and metrics

- Highlight your experience in ESG integration and sustainable investing

- Showcase your ability to manage a global portfolio and your international investment expertise

- Demonstrate your strong analytical skills and proficiency in using advanced investment tools

Essential Experience Highlights for a Strong Institutional Asset Manager Resume

- Develop and execute investment strategies aligned with client objectives and risk tolerance

- Manage and monitor a diversified portfolio of assets, including stocks, bonds, real estate, and private investments

- Conduct thorough due diligence on potential investments to identify high-yield opportunities

- Implement rigorous risk management frameworks to mitigate portfolio volatility

- Negotiate favorable investment terms with custodians and investment banks

- Provide investment advice and guidance to clients, helping them achieve their financial goals

- Stay abreast of market trends and economic developments to make informed investment decisions

Frequently Asked Questions (FAQ’s) For Institutional Asset Manager

What are the key responsibilities of an Institutional Asset Manager?

Institutional Asset Managers are responsible for managing large pools of assets on behalf of institutional clients, such as pension funds, endowments, and insurance companies. Their primary responsibilities include developing and implementing investment strategies, managing portfolios, conducting due diligence, and providing investment advice.

What are the educational requirements for becoming an Institutional Asset Manager?

Most Institutional Asset Managers hold a Master’s degree in Finance, Economics, or a related field, along with a strong foundation in investment principles and practices.

What are the career prospects for Institutional Asset Managers?

Institutional Asset Managers with strong track records and expertise can advance to senior roles within their organizations, such as Chief Investment Officer or Portfolio Manager. They may also move into related fields, such as investment banking or wealth management.

What are the challenges faced by Institutional Asset Managers?

Institutional Asset Managers face a number of challenges, including market volatility, regulatory changes, and increasing competition. They must also navigate the complex and evolving landscape of ESG investing.

What are the key skills and qualities of a successful Institutional Asset Manager?

Successful Institutional Asset Managers possess strong analytical skills, a deep understanding of investment markets, and a commitment to ethical and responsible investing. They are also effective communicators, team players, and have the ability to make sound decisions under pressure.

What are the top companies that hire Institutional Asset Managers?

Top companies that hire Institutional Asset Managers include BlackRock, Vanguard, State Street Global Advisors, and PIMCO.

What is the average salary for an Institutional Asset Manager?

The average salary for an Institutional Asset Manager varies depending on experience, qualifications, and location. According to Glassdoor, the average base salary for an Institutional Asset Manager in the United States is around $120,000 per year.