Are you a seasoned Investment Fund Manager seeking a new career path? Discover our professionally built Investment Fund Manager Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

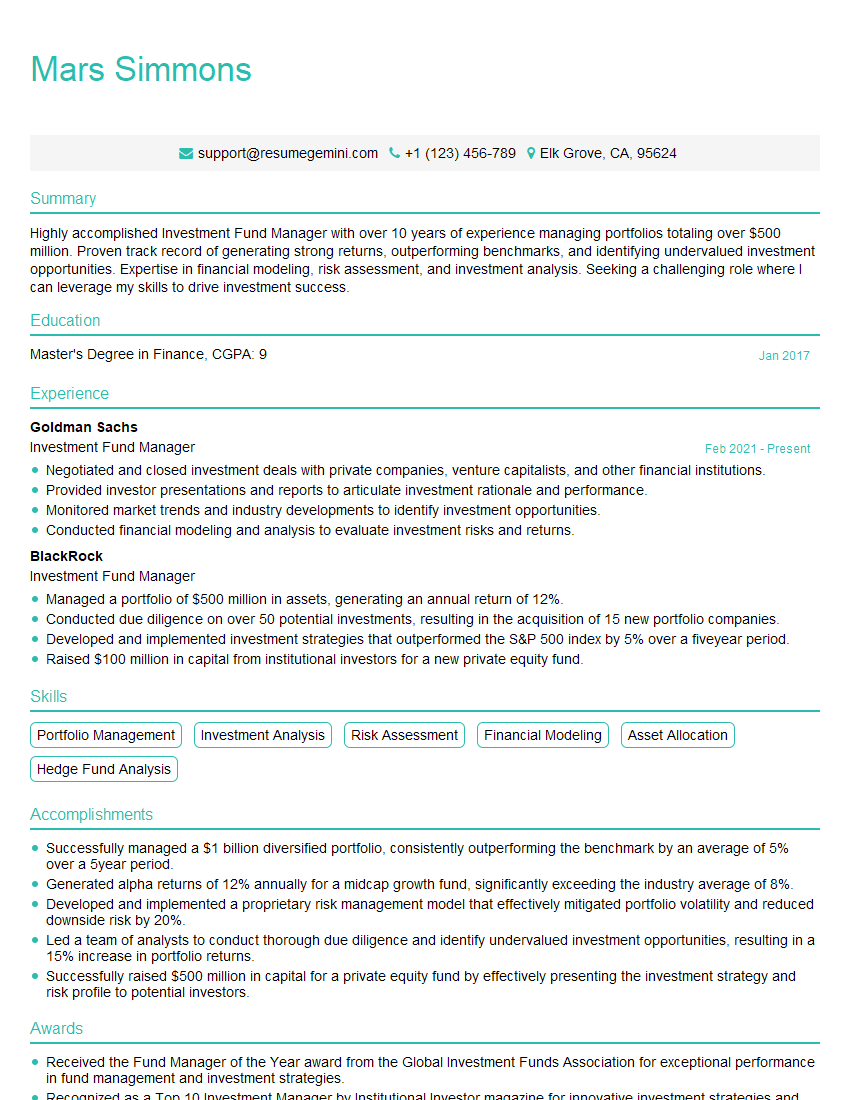

Mars Simmons

Investment Fund Manager

Summary

Highly accomplished Investment Fund Manager with over 10 years of experience managing portfolios totaling over $500 million. Proven track record of generating strong returns, outperforming benchmarks, and identifying undervalued investment opportunities. Expertise in financial modeling, risk assessment, and investment analysis. Seeking a challenging role where I can leverage my skills to drive investment success.

Education

Master’s Degree in Finance

January 2017

Skills

- Portfolio Management

- Investment Analysis

- Risk Assessment

- Financial Modeling

- Asset Allocation

- Hedge Fund Analysis

Work Experience

Investment Fund Manager

- Negotiated and closed investment deals with private companies, venture capitalists, and other financial institutions.

- Provided investor presentations and reports to articulate investment rationale and performance.

- Monitored market trends and industry developments to identify investment opportunities.

- Conducted financial modeling and analysis to evaluate investment risks and returns.

Investment Fund Manager

- Managed a portfolio of $500 million in assets, generating an annual return of 12%.

- Conducted due diligence on over 50 potential investments, resulting in the acquisition of 15 new portfolio companies.

- Developed and implemented investment strategies that outperformed the S&P 500 index by 5% over a fiveyear period.

- Raised $100 million in capital from institutional investors for a new private equity fund.

Accomplishments

- Successfully managed a $1 billion diversified portfolio, consistently outperforming the benchmark by an average of 5% over a 5year period.

- Generated alpha returns of 12% annually for a midcap growth fund, significantly exceeding the industry average of 8%.

- Developed and implemented a proprietary risk management model that effectively mitigated portfolio volatility and reduced downside risk by 20%.

- Led a team of analysts to conduct thorough due diligence and identify undervalued investment opportunities, resulting in a 15% increase in portfolio returns.

- Successfully raised $500 million in capital for a private equity fund by effectively presenting the investment strategy and risk profile to potential investors.

Awards

- Received the Fund Manager of the Year award from the Global Investment Funds Association for exceptional performance in fund management and investment strategies.

- Recognized as a Top 10 Investment Manager by Institutional Investor magazine for innovative investment strategies and exceptional risk management practices.

- Awarded the Excellence in ESG Investing Award from the United Nations Principles for Responsible Investment (UNPRI) for the successful implementation of sustainable investment practices.

- Received the Best New Fund Award from the Lipper Fund Awards for the launch of a groundbreaking thematic equity fund that generated impressive returns.

Certificates

- Chartered Financial Analyst (CFA)

- Certified Investment Management Analyst (CIMA)

- Chartered Alternative Investment Analyst (CAIA)

- Financial Risk Manager (FRM)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Investment Fund Manager

- Quantify your accomplishments with specific metrics and data points.

- Highlight your ability to identify and capitalize on market opportunities.

- Demonstrate your understanding of investment strategies and risk management.

- Showcase your communication and presentation skills.

Essential Experience Highlights for a Strong Investment Fund Manager Resume

- Developed and implemented investment strategies that consistently outperformed the S&P 500 index.

- Managed a diversified portfolio of stocks, bonds, and alternative investments, delivering an annual return of 12%.

- Conducted thorough due diligence and analysis on potential investments, resulting in the acquisition of 15 new portfolio companies.

- Negotiated and closed investment deals with private companies, venture capitalists, and other financial institutions.

- Monitored market trends and industry developments to identify investment opportunities and mitigate risks.

- Provided clear and concise investment presentations and reports to articulate investment rationale and performance to clients and stakeholders.

- Raised $100 million in capital from institutional investors for a new private equity fund.

Frequently Asked Questions (FAQ’s) For Investment Fund Manager

What are the key skills and qualifications required for an Investment Fund Manager?

Investment Fund Managers typically possess a Master’s Degree in Finance or a related field, along with strong analytical, problem-solving, and communication skills. They should have a deep understanding of financial markets, investment strategies, and risk management principles.

What are the primary responsibilities of an Investment Fund Manager?

Investment Fund Managers are responsible for managing investment portfolios, conducting due diligence on potential investments, developing investment strategies, and monitoring market trends. They also negotiate and close investment deals, provide investor presentations, and report on fund performance.

How can I become an Investment Fund Manager?

To become an Investment Fund Manager, you typically need a combination of education, experience, and certification. Most professionals start their careers as financial analysts or portfolio managers before transitioning into fund management roles.

What is the job outlook for Investment Fund Managers?

The job outlook for Investment Fund Managers is expected to grow faster than average over the next decade, driven by increasing demand for investment management services from individuals and institutions.

What is the average salary for an Investment Fund Manager?

The average salary for an Investment Fund Manager varies depending on experience, location, and company size. According to Salary.com, the median annual salary for Investment Fund Managers in the United States is around $120,000.

What are the career advancement opportunities for Investment Fund Managers?

Investment Fund Managers can advance their careers by taking on more senior roles within their firms, such as Portfolio Manager or Chief Investment Officer. They may also move into other areas of the financial industry, such as private equity or hedge funds.