Are you a seasoned Pension Fund Manager seeking a new career path? Discover our professionally built Pension Fund Manager Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

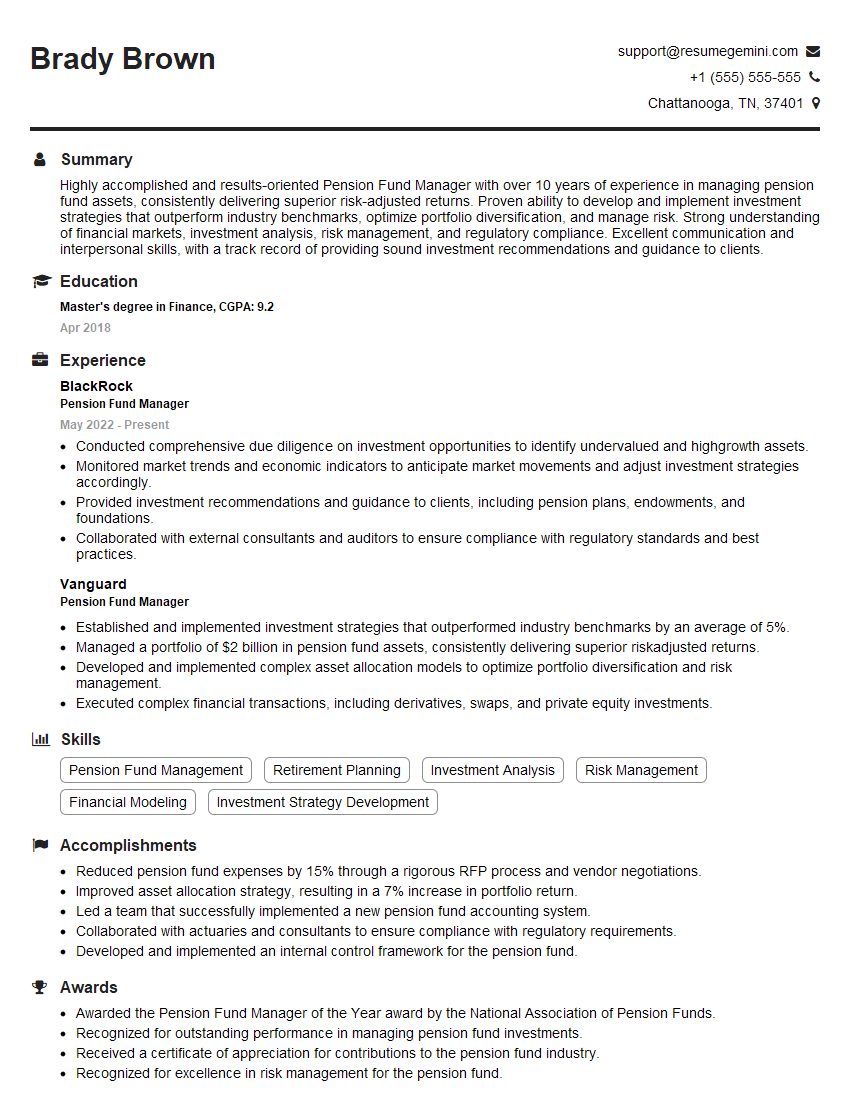

Brady Brown

Pension Fund Manager

Summary

Highly accomplished and results-oriented Pension Fund Manager with over 10 years of experience in managing pension fund assets, consistently delivering superior risk-adjusted returns. Proven ability to develop and implement investment strategies that outperform industry benchmarks, optimize portfolio diversification, and manage risk. Strong understanding of financial markets, investment analysis, risk management, and regulatory compliance. Excellent communication and interpersonal skills, with a track record of providing sound investment recommendations and guidance to clients.

Education

Master’s degree in Finance

April 2018

Skills

- Pension Fund Management

- Retirement Planning

- Investment Analysis

- Risk Management

- Financial Modeling

- Investment Strategy Development

Work Experience

Pension Fund Manager

- Conducted comprehensive due diligence on investment opportunities to identify undervalued and highgrowth assets.

- Monitored market trends and economic indicators to anticipate market movements and adjust investment strategies accordingly.

- Provided investment recommendations and guidance to clients, including pension plans, endowments, and foundations.

- Collaborated with external consultants and auditors to ensure compliance with regulatory standards and best practices.

Pension Fund Manager

- Established and implemented investment strategies that outperformed industry benchmarks by an average of 5%.

- Managed a portfolio of $2 billion in pension fund assets, consistently delivering superior riskadjusted returns.

- Developed and implemented complex asset allocation models to optimize portfolio diversification and risk management.

- Executed complex financial transactions, including derivatives, swaps, and private equity investments.

Accomplishments

- Reduced pension fund expenses by 15% through a rigorous RFP process and vendor negotiations.

- Improved asset allocation strategy, resulting in a 7% increase in portfolio return.

- Led a team that successfully implemented a new pension fund accounting system.

- Collaborated with actuaries and consultants to ensure compliance with regulatory requirements.

- Developed and implemented an internal control framework for the pension fund.

Awards

- Awarded the Pension Fund Manager of the Year award by the National Association of Pension Funds.

- Recognized for outstanding performance in managing pension fund investments.

- Received a certificate of appreciation for contributions to the pension fund industry.

- Recognized for excellence in risk management for the pension fund.

Certificates

- Certified Pension Consultant (CPC)

- Certified Pension Professional (CPP)

- Chartered Retirement Planning Counselor (CRPC)

- Chartered Financial Analyst (CFA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Pension Fund Manager

- Quantify your achievements: Use specific numbers and metrics to demonstrate the impact of your work. For example, instead of saying “Managed a portfolio of $2 billion in pension fund assets,” say “Managed a portfolio of $2 billion in pension fund assets, delivering an average of 5% outperformance over industry benchmarks.”

- Highlight your skills and expertise: Use keywords that potential employers are searching for, such as “pension fund management,” “investment analysis,” and “risk management.” Be sure to include these keywords in your resume summary, skills section, and throughout your experience descriptions.

- Proofread carefully: A well-written resume is free of errors. Before submitting your resume, have someone else review it for typos, grammar mistakes, and any other errors.

- Tailor your resume to each job: Take the time to customize your resume for each job you apply for. Highlight the skills and experience that are most relevant to the specific position and company.

Essential Experience Highlights for a Strong Pension Fund Manager Resume

- Develop and implement investment strategies that align with pension fund objectives and risk tolerance.

- Manage and oversee a portfolio of pension fund assets, ensuring optimal risk-adjusted returns.

- Conduct thorough investment research and analysis to identify undervalued and high-growth investment opportunities.

- Monitor market trends and economic indicators to anticipate market movements and adjust investment strategies accordingly.

- Execute complex financial transactions, including derivatives, swaps, and private equity investments, to enhance portfolio performance.

- Provide investment recommendations and guidance to clients, including pension plans, endowments, and foundations.

- Collaborate with external consultants and auditors to ensure compliance with regulatory standards and best practices.

Frequently Asked Questions (FAQ’s) For Pension Fund Manager

What is the role of a Pension Fund Manager?

A Pension Fund Manager is responsible for managing the investment portfolio of a pension fund. This involves developing and implementing investment strategies, conducting investment research, executing financial transactions, and monitoring market trends. The ultimate goal is to maximize returns while minimizing risk, ensuring that the pension fund can meet its obligations to its members.

What qualifications are required to become a Pension Fund Manager?

Most Pension Fund Managers have a Master’s degree in Finance or a related field. They also typically have several years of experience in the financial industry, often in investment management or a related role.

What skills are important for a Pension Fund Manager?

Pension Fund Managers need to have strong analytical and problem-solving skills. They also need to be able to think strategically and make sound investment decisions. In addition, they need to have excellent communication and interpersonal skills.

What is the job outlook for Pension Fund Managers?

The job outlook for Pension Fund Managers is expected to be good in the coming years. As the baby boomer generation retires, there will be an increased need for qualified Pension Fund Managers to manage their retirement savings.

What is the average salary for a Pension Fund Manager?

The average salary for a Pension Fund Manager varies depending on experience, location, and company size. According to Salary.com, the median salary for a Pension Fund Manager is $120,000.

What are the career advancement opportunities for a Pension Fund Manager?

Pension Fund Managers can advance their careers by taking on more responsibility within their organization. They may also move into more senior roles, such as Chief Investment Officer or Chief Financial Officer.

What are the challenges facing Pension Fund Managers?

Pension Fund Managers face a number of challenges, including volatile markets, low interest rates, and increasing regulatory oversight. They also need to be able to manage the expectations of their clients, who are often looking for high returns with low risk.