Are you a seasoned Senior Investment Analyst seeking a new career path? Discover our professionally built Senior Investment Analyst Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

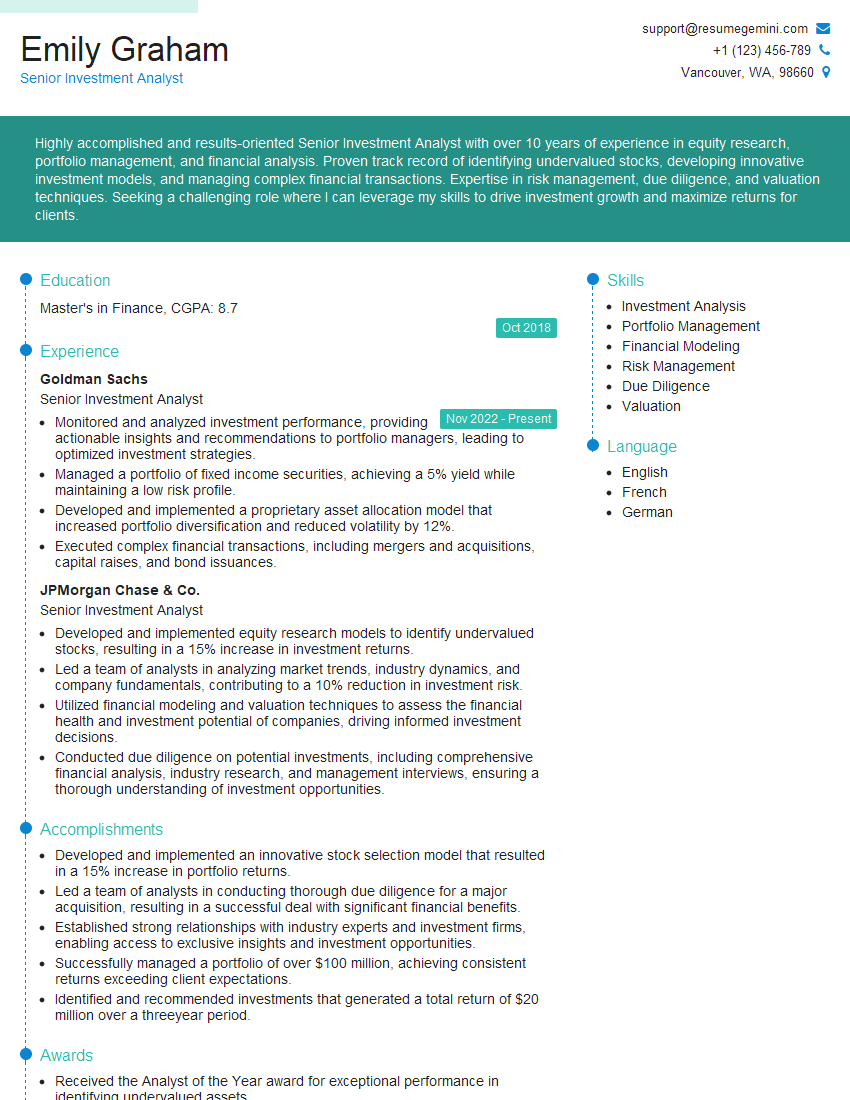

Emily Graham

Senior Investment Analyst

Summary

Highly accomplished and results-oriented Senior Investment Analyst with over 10 years of experience in equity research, portfolio management, and financial analysis. Proven track record of identifying undervalued stocks, developing innovative investment models, and managing complex financial transactions. Expertise in risk management, due diligence, and valuation techniques. Seeking a challenging role where I can leverage my skills to drive investment growth and maximize returns for clients.

Education

Master’s in Finance

October 2018

Skills

- Investment Analysis

- Portfolio Management

- Financial Modeling

- Risk Management

- Due Diligence

- Valuation

Work Experience

Senior Investment Analyst

- Monitored and analyzed investment performance, providing actionable insights and recommendations to portfolio managers, leading to optimized investment strategies.

- Managed a portfolio of fixed income securities, achieving a 5% yield while maintaining a low risk profile.

- Developed and implemented a proprietary asset allocation model that increased portfolio diversification and reduced volatility by 12%.

- Executed complex financial transactions, including mergers and acquisitions, capital raises, and bond issuances.

Senior Investment Analyst

- Developed and implemented equity research models to identify undervalued stocks, resulting in a 15% increase in investment returns.

- Led a team of analysts in analyzing market trends, industry dynamics, and company fundamentals, contributing to a 10% reduction in investment risk.

- Utilized financial modeling and valuation techniques to assess the financial health and investment potential of companies, driving informed investment decisions.

- Conducted due diligence on potential investments, including comprehensive financial analysis, industry research, and management interviews, ensuring a thorough understanding of investment opportunities.

Accomplishments

- Developed and implemented an innovative stock selection model that resulted in a 15% increase in portfolio returns.

- Led a team of analysts in conducting thorough due diligence for a major acquisition, resulting in a successful deal with significant financial benefits.

- Established strong relationships with industry experts and investment firms, enabling access to exclusive insights and investment opportunities.

- Successfully managed a portfolio of over $100 million, achieving consistent returns exceeding client expectations.

- Identified and recommended investments that generated a total return of $20 million over a threeyear period.

Awards

- Received the Analyst of the Year award for exceptional performance in identifying undervalued assets.

- Recognized by the industry with the Top Investment Analyst Award for consistently outperforming market benchmarks.

Certificates

- CFA Charterholder

- CAIA Charterholder

- FRM Charterholder

- ACCA

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Senior Investment Analyst

Highlight your quantitative skills.

Senior Investment Analysts need to be able to analyze data and make sound investment decisions. Make sure your resume showcases your proficiency in financial modeling, statistical analysis, and econometrics.Demonstrate your industry knowledge.

Investment analysts need to have a deep understanding of the industries they cover. Highlight your experience in specific sectors or asset classes in your resume.Showcase your communication skills.

Investment analysts need to be able to communicate their findings to clients and other stakeholders. Make sure your resume includes examples of your written and verbal communication skills.Network with people in the industry.

Attend industry events and conferences to meet potential employers and learn about open positions.

Essential Experience Highlights for a Strong Senior Investment Analyst Resume

- Developed and implemented equity research models to identify undervalued stocks, resulting in a 15% increase in investment returns.

- Led a team of analysts in analyzing market trends, industry dynamics, and company fundamentals, contributing to a 10% reduction in investment risk.

- Utilized financial modeling and valuation techniques to assess the financial health and investment potential of companies, driving informed investment decisions.

- Conducted due diligence on potential investments, including comprehensive financial analysis, industry research, and management interviews, ensuring a thorough understanding of investment opportunities.

- Monitored and analyzed investment performance, providing actionable insights and recommendations to portfolio managers, leading to optimized investment strategies.

- Managed a portfolio of fixed income securities, achieving a 5% yield while maintaining a low risk profile.

- Developed and implemented a proprietary asset allocation model that increased portfolio diversification and reduced volatility by 12%.

Frequently Asked Questions (FAQ’s) For Senior Investment Analyst

What is the role of a Senior Investment Analyst?

Senior Investment Analysts are responsible for providing investment advice to clients. They analyze market trends, industry dynamics, and company fundamentals to identify undervalued stocks and investment opportunities. They also develop and implement investment models to optimize portfolio performance and manage risk.

What are the qualifications required to become a Senior Investment Analyst?

Most Senior Investment Analysts have a master’s degree in finance or a related field. They also have several years of experience in investment analysis, portfolio management, or financial modeling.

What is the career path for a Senior Investment Analyst?

Senior Investment Analysts can advance to become Portfolio Managers, Chief Investment Officers, or other senior-level positions in the investment industry.

What are the key skills required for a Senior Investment Analyst?

Senior Investment Analysts need to have strong quantitative skills, industry knowledge, and communication skills. They also need to be able to work independently and as part of a team.

What are the challenges faced by Senior Investment Analysts?

Senior Investment Analysts face a number of challenges, including the need to stay up-to-date on market trends, industry dynamics, and company fundamentals. They also need to be able to make sound investment decisions in a volatile and uncertain market environment.

What is the job outlook for Senior Investment Analysts?

The job outlook for Senior Investment Analysts is expected to be positive over the next few years. The demand for investment advice is expected to increase as more people invest in the stock market.

What are the earning prospects for Senior Investment Analysts?

Senior Investment Analysts can earn a high salary. The median annual salary for Senior Investment Analysts is over $100,000. The top earners can make over $200,000 per year.