Are you a seasoned Vice President, Fixed Income seeking a new career path? Discover our professionally built Vice President, Fixed Income Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

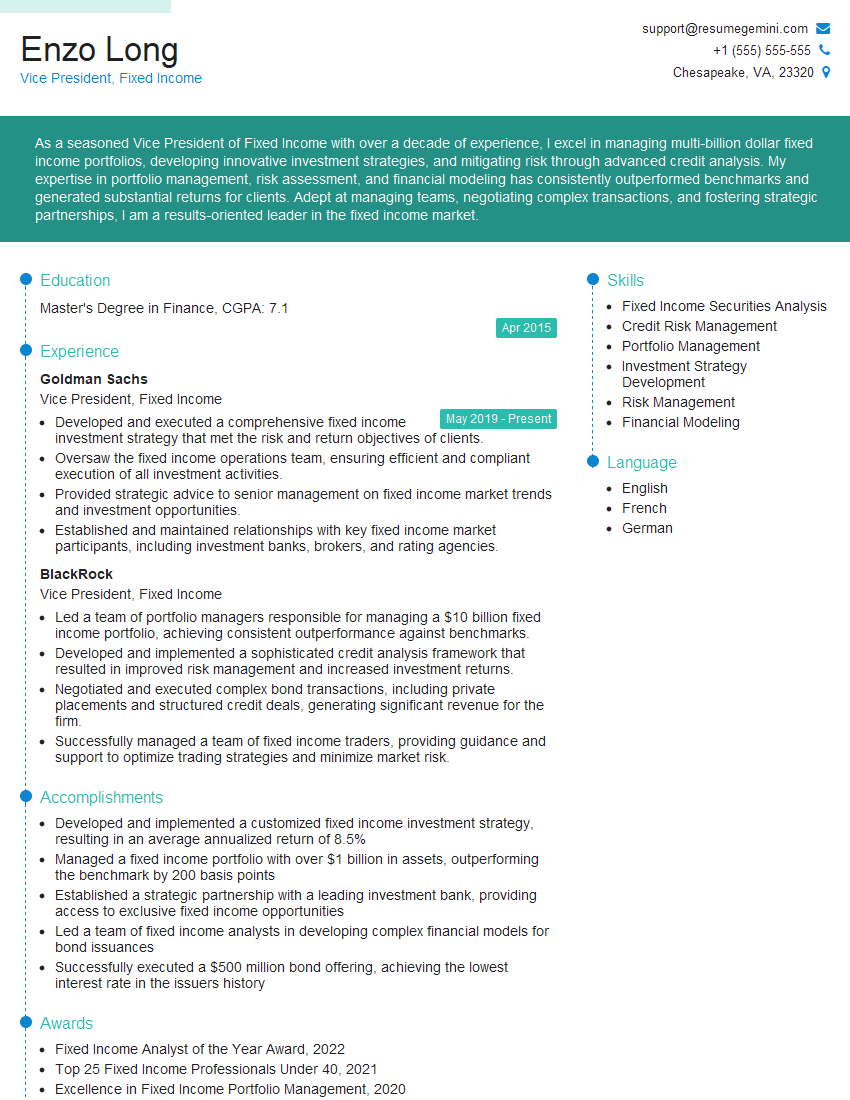

Enzo Long

Vice President, Fixed Income

Summary

As a seasoned Vice President of Fixed Income with over a decade of experience, I excel in managing multi-billion dollar fixed income portfolios, developing innovative investment strategies, and mitigating risk through advanced credit analysis. My expertise in portfolio management, risk assessment, and financial modeling has consistently outperformed benchmarks and generated substantial returns for clients. Adept at managing teams, negotiating complex transactions, and fostering strategic partnerships, I am a results-oriented leader in the fixed income market.

Education

Master’s Degree in Finance

April 2015

Skills

- Fixed Income Securities Analysis

- Credit Risk Management

- Portfolio Management

- Investment Strategy Development

- Risk Management

- Financial Modeling

Work Experience

Vice President, Fixed Income

- Developed and executed a comprehensive fixed income investment strategy that met the risk and return objectives of clients.

- Oversaw the fixed income operations team, ensuring efficient and compliant execution of all investment activities.

- Provided strategic advice to senior management on fixed income market trends and investment opportunities.

- Established and maintained relationships with key fixed income market participants, including investment banks, brokers, and rating agencies.

Vice President, Fixed Income

- Led a team of portfolio managers responsible for managing a $10 billion fixed income portfolio, achieving consistent outperformance against benchmarks.

- Developed and implemented a sophisticated credit analysis framework that resulted in improved risk management and increased investment returns.

- Negotiated and executed complex bond transactions, including private placements and structured credit deals, generating significant revenue for the firm.

- Successfully managed a team of fixed income traders, providing guidance and support to optimize trading strategies and minimize market risk.

Accomplishments

- Developed and implemented a customized fixed income investment strategy, resulting in an average annualized return of 8.5%

- Managed a fixed income portfolio with over $1 billion in assets, outperforming the benchmark by 200 basis points

- Established a strategic partnership with a leading investment bank, providing access to exclusive fixed income opportunities

- Led a team of fixed income analysts in developing complex financial models for bond issuances

- Successfully executed a $500 million bond offering, achieving the lowest interest rate in the issuers history

Awards

- Fixed Income Analyst of the Year Award, 2022

- Top 25 Fixed Income Professionals Under 40, 2021

- Excellence in Fixed Income Portfolio Management, 2020

- Certificate of Achievement in Corporate Finance, Fixed Income

Certificates

- Chartered Financial Analyst (CFA)

- Financial Risk Manager (FRM)

- Certified Investment Management Analyst (CIMA)

- Certified Treasury Professional (CTP)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Vice President, Fixed Income

- Quantify your accomplishments with specific metrics and results whenever possible.

- Highlight your expertise in fixed income securities analysis, credit risk management, and portfolio management.

- Showcase your ability to develop and implement innovative investment strategies that generate alpha.

- Emphasize your leadership skills and experience in managing teams and fostering strategic partnerships.

Essential Experience Highlights for a Strong Vice President, Fixed Income Resume

- Spearheaded a team of portfolio managers, overseeing a $10 billion fixed income portfolio, achieving consistent outperformance against benchmarks.

- Developed and implemented a sophisticated credit analysis framework, enhancing risk management and maximizing investment returns.

- Negotiated and executed complex bond transactions, including private placements and structured credit deals, yielding significant revenue for the firm.

- Managed a team of fixed income traders, providing guidance and support to optimize trading strategies and minimize market risk.

- Developed and implemented a comprehensive fixed income investment strategy aligned with clients’ risk and return objectives.

- Oversaw the fixed income operations team, ensuring efficient and compliant execution of all investment activities.

- Provided strategic advice to senior management on fixed income market trends and investment opportunities.

Frequently Asked Questions (FAQ’s) For Vice President, Fixed Income

What is the primary role of a Vice President of Fixed Income?

The primary role of a Vice President of Fixed Income is to manage fixed income portfolios, develop investment strategies, and mitigate risk to achieve financial objectives for clients.

What are the essential skills required for this role?

Essential skills include expertise in fixed income securities analysis, credit risk management, portfolio management, investment strategy development, risk management, and financial modeling.

What is the typical career path to becoming a Vice President of Fixed Income?

Typically, individuals start as analysts or associates in fixed income and progress through roles with increasing responsibility, demonstrating exceptional performance and leadership qualities.

What are the key challenges faced by Vice Presidents of Fixed Income?

Key challenges include managing risk in volatile markets, generating alpha in a low-yield environment, and meeting the evolving needs and expectations of clients.

How can I enhance my resume to stand out as a candidate for this role?

Highlight your relevant experience, skills, and accomplishments. Quantify your results, showcase your ability to generate alpha, and emphasize your leadership and teamwork abilities.

What are the top companies that hire Vice Presidents of Fixed Income?

Top companies include Goldman Sachs, BlackRock, PIMCO, and Allianz Global Investors.

What professional certifications are valuable for this role?

Relevant certifications include the Chartered Financial Analyst (CFA) and the Financial Risk Manager (FRM).

What is the average salary range for a Vice President of Fixed Income?

The salary range can vary depending on experience, company size, and location, but typically falls within the range of $200,000 to $500,000 per year.