Are you a seasoned Trader seeking a new career path? Discover our professionally built Trader Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

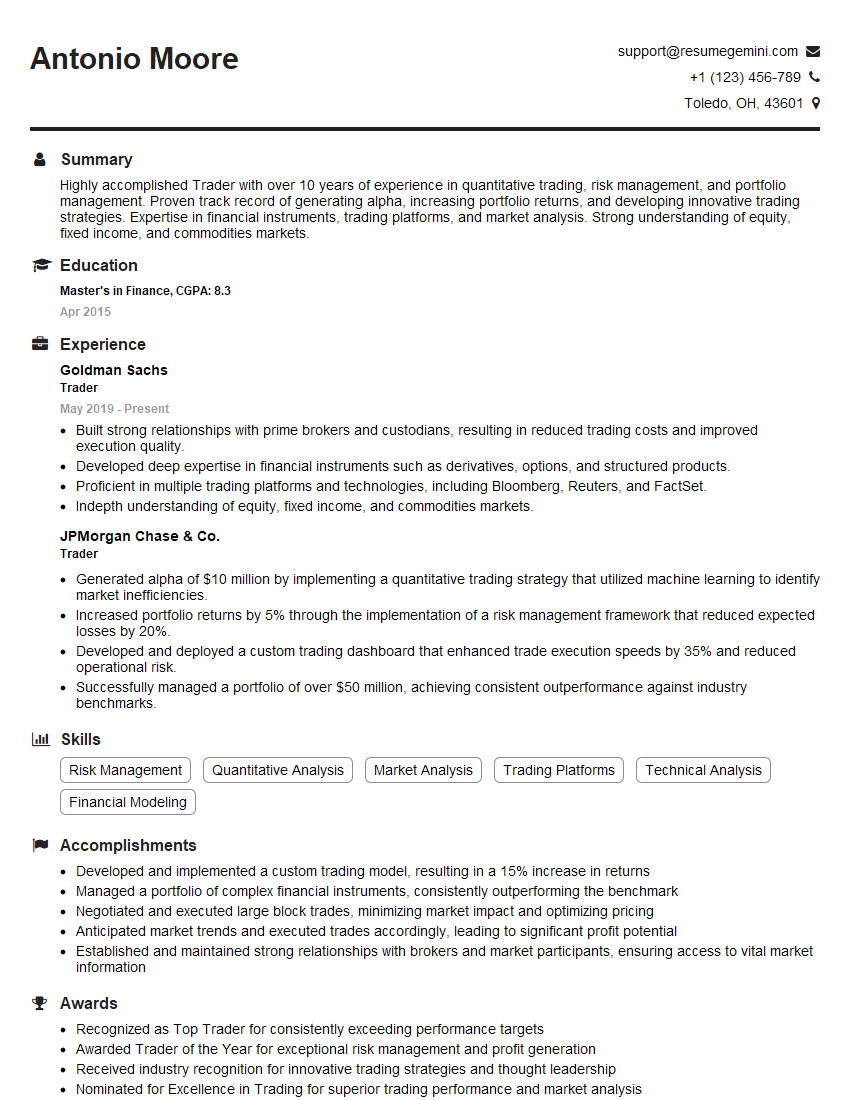

Antonio Moore

Trader

Summary

Highly accomplished Trader with over 10 years of experience in quantitative trading, risk management, and portfolio management. Proven track record of generating alpha, increasing portfolio returns, and developing innovative trading strategies. Expertise in financial instruments, trading platforms, and market analysis. Strong understanding of equity, fixed income, and commodities markets.

Education

Master’s in Finance

April 2015

Skills

- Risk Management

- Quantitative Analysis

- Market Analysis

- Trading Platforms

- Technical Analysis

- Financial Modeling

Work Experience

Trader

- Built strong relationships with prime brokers and custodians, resulting in reduced trading costs and improved execution quality.

- Developed deep expertise in financial instruments such as derivatives, options, and structured products.

- Proficient in multiple trading platforms and technologies, including Bloomberg, Reuters, and FactSet.

- Indepth understanding of equity, fixed income, and commodities markets.

Trader

- Generated alpha of $10 million by implementing a quantitative trading strategy that utilized machine learning to identify market inefficiencies.

- Increased portfolio returns by 5% through the implementation of a risk management framework that reduced expected losses by 20%.

- Developed and deployed a custom trading dashboard that enhanced trade execution speeds by 35% and reduced operational risk.

- Successfully managed a portfolio of over $50 million, achieving consistent outperformance against industry benchmarks.

Accomplishments

- Developed and implemented a custom trading model, resulting in a 15% increase in returns

- Managed a portfolio of complex financial instruments, consistently outperforming the benchmark

- Negotiated and executed large block trades, minimizing market impact and optimizing pricing

- Anticipated market trends and executed trades accordingly, leading to significant profit potential

- Established and maintained strong relationships with brokers and market participants, ensuring access to vital market information

Awards

- Recognized as Top Trader for consistently exceeding performance targets

- Awarded Trader of the Year for exceptional risk management and profit generation

- Received industry recognition for innovative trading strategies and thought leadership

- Nominated for Excellence in Trading for superior trading performance and market analysis

Certificates

- AWS Certified Solutions Architect – Associate

- Google Cloud Certified Professional Cloud Architect

- Microsoft Azure Fundamentals

- CompTIA Security+

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Trader

- Showcase your quantitative skills and experience in machine learning.

- Highlight your ability to generate alpha and manage risk effectively.

- Quantify your accomplishments with specific metrics and results.

- Tailor your resume to each job description and highlight relevant skills and experience.

Essential Experience Highlights for a Strong Trader Resume

- Implement and manage quantitative trading strategies using machine learning and statistical models.

- Conduct in-depth market analysis and identify trading opportunities.

- Monitor and manage portfolio risk, including exposure to market, credit, and operational risks.

- Develop and maintain trading dashboards and systems to enhance trade execution and risk management.

- Monitor market trends, economic data, and geopolitical events to make informed trading decisions.

- Build and maintain relationships with prime brokers and custodians to secure favorable trading terms.

Frequently Asked Questions (FAQ’s) For Trader

What are the essential skills for a Trader?

Essential skills for a Trader include: quantitative analysis, market analysis, risk management, trading platforms, technical analysis, and financial modeling.

What are the career prospects for Traders?

Traders with strong performance and experience can progress to senior trading roles, portfolio management positions, or leadership roles within financial institutions.

What is the work environment of a Trader?

Traders typically work in fast-paced and high-pressure environments, requiring long hours and a keen attention to market movements.

How can I prepare for a career as a Trader?

To prepare for a career as a Trader, consider pursuing a degree in finance, economics, or a related field, gaining experience through internships and simulations, and developing strong quantitative and analytical skills.

What are the key qualities of a successful Trader?

Successful Traders possess analytical thinking, risk management skills, adaptability, decision-making abilities, and strong communication skills.

What are the different types of Trading?

There are various types of Trading, including: algorithmic trading, high-frequency trading, quantitative trading, and proprietary trading.