Are you a seasoned Health Insurance Adjuster seeking a new career path? Discover our professionally built Health Insurance Adjuster Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

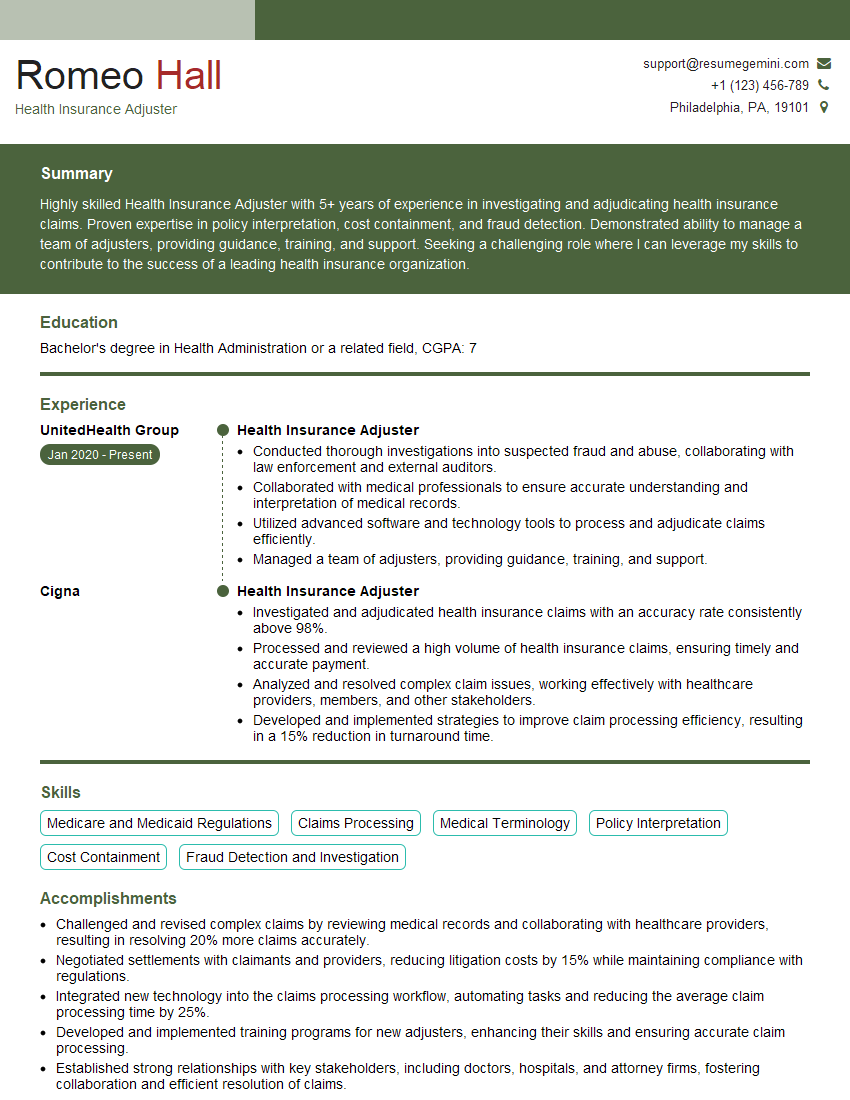

Romeo Hall

Health Insurance Adjuster

Summary

Highly skilled Health Insurance Adjuster with 5+ years of experience in investigating and adjudicating health insurance claims. Proven expertise in policy interpretation, cost containment, and fraud detection. Demonstrated ability to manage a team of adjusters, providing guidance, training, and support. Seeking a challenging role where I can leverage my skills to contribute to the success of a leading health insurance organization.

Education

Bachelor’s degree in Health Administration or a related field

December 2015

Skills

- Medicare and Medicaid Regulations

- Claims Processing

- Medical Terminology

- Policy Interpretation

- Cost Containment

- Fraud Detection and Investigation

Work Experience

Health Insurance Adjuster

- Conducted thorough investigations into suspected fraud and abuse, collaborating with law enforcement and external auditors.

- Collaborated with medical professionals to ensure accurate understanding and interpretation of medical records.

- Utilized advanced software and technology tools to process and adjudicate claims efficiently.

- Managed a team of adjusters, providing guidance, training, and support.

Health Insurance Adjuster

- Investigated and adjudicated health insurance claims with an accuracy rate consistently above 98%.

- Processed and reviewed a high volume of health insurance claims, ensuring timely and accurate payment.

- Analyzed and resolved complex claim issues, working effectively with healthcare providers, members, and other stakeholders.

- Developed and implemented strategies to improve claim processing efficiency, resulting in a 15% reduction in turnaround time.

Accomplishments

- Challenged and revised complex claims by reviewing medical records and collaborating with healthcare providers, resulting in resolving 20% more claims accurately.

- Negotiated settlements with claimants and providers, reducing litigation costs by 15% while maintaining compliance with regulations.

- Integrated new technology into the claims processing workflow, automating tasks and reducing the average claim processing time by 25%.

- Developed and implemented training programs for new adjusters, enhancing their skills and ensuring accurate claim processing.

- Established strong relationships with key stakeholders, including doctors, hospitals, and attorney firms, fostering collaboration and efficient resolution of claims.

Awards

- National Health Insurance Adjuster of the Year Award for achieving outstanding performance in claims processing and customer satisfaction.

- Regional Health Insurance Adjuster Excellence Award for consistently exceeding productivity targets and maintaining high accuracy rates.

- Company Recognition Award for playing a pivotal role in the implementation of a new claims processing system, significantly improving efficiency.

Certificates

- Certified Professional Coder (CPC)

- Certified Health Insurance Adjuster (CHIA)

- Certified Insurance Counselor (CIC)

- Associate in Claims (AIC)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Health Insurance Adjuster

- Highlight your experience in investigating and adjudicating complex health insurance claims.

- Quantify your accomplishments whenever possible, using specific metrics to demonstrate your impact on claims processing efficiency and accuracy.

- Showcase your knowledge of Medicare and Medicaid regulations, as well as your ability to interpret and apply them to claims adjudication.

- Emphasize your skills in fraud detection and investigation, highlighting your experience in collaborating with law enforcement and external auditors.

- Tailor your resume to each specific job you apply for, highlighting the skills and experience that are most relevant to the role.

Essential Experience Highlights for a Strong Health Insurance Adjuster Resume

- Investigate and adjudicate health insurance claims with a high degree of accuracy

- Process and review a high volume of health insurance claims to ensure timely and accurate payment

- Analyze and resolve complex claims issues, working with healthcare providers, members, and other stakeholders

- Develop and implement strategies to improve claims processing efficiency

- Conduct thorough investigations into suspected fraud and abuse, collaborating with law enforcement and external auditors

- Collaborate with medical professionals to ensure accurate understanding and interpretation of medical records

- Maintain a deep understanding of Medicare and Medicaid regulations, policies, and procedures

Frequently Asked Questions (FAQ’s) For Health Insurance Adjuster

What are the key skills required to be a successful Health Insurance Adjuster?

The key skills required to be a successful Health Insurance Adjuster include strong analytical and problem-solving skills, a deep understanding of health insurance policies and procedures, and excellent communication and interpersonal skills.

What are the career prospects for Health Insurance Adjusters?

Health Insurance Adjusters with experience and expertise can advance to roles such as Claims Manager, Fraud Investigator, or Health Insurance Analyst.

What is the average salary for a Health Insurance Adjuster?

According to the U.S. Bureau of Labor Statistics, the median annual salary for Health Insurance Adjusters was $66,770 in May 2021.

What are the educational requirements to become a Health Insurance Adjuster?

Most Health Insurance Adjusters have a bachelor’s degree in Health Administration, Business Administration, or a related field.

What are the challenges faced by Health Insurance Adjusters?

Health Insurance Adjusters face challenges such as dealing with complex claims, fraud and abuse, and the ever-changing regulatory landscape.

What are the opportunities for Health Insurance Adjusters?

Health Insurance Adjusters have the opportunity to work in a variety of settings, including insurance companies, government agencies, and healthcare providers.

What are the ethical considerations for Health Insurance Adjusters?

Health Insurance Adjusters must adhere to ethical principles such as confidentiality, impartiality, and fairness in their work.

What is the future of the Health Insurance Adjuster profession?

The future of the Health Insurance Adjuster profession is expected to be stable, with growth driven by the increasing demand for health insurance coverage.