Are you a seasoned Independent Insurance Adjuster seeking a new career path? Discover our professionally built Independent Insurance Adjuster Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

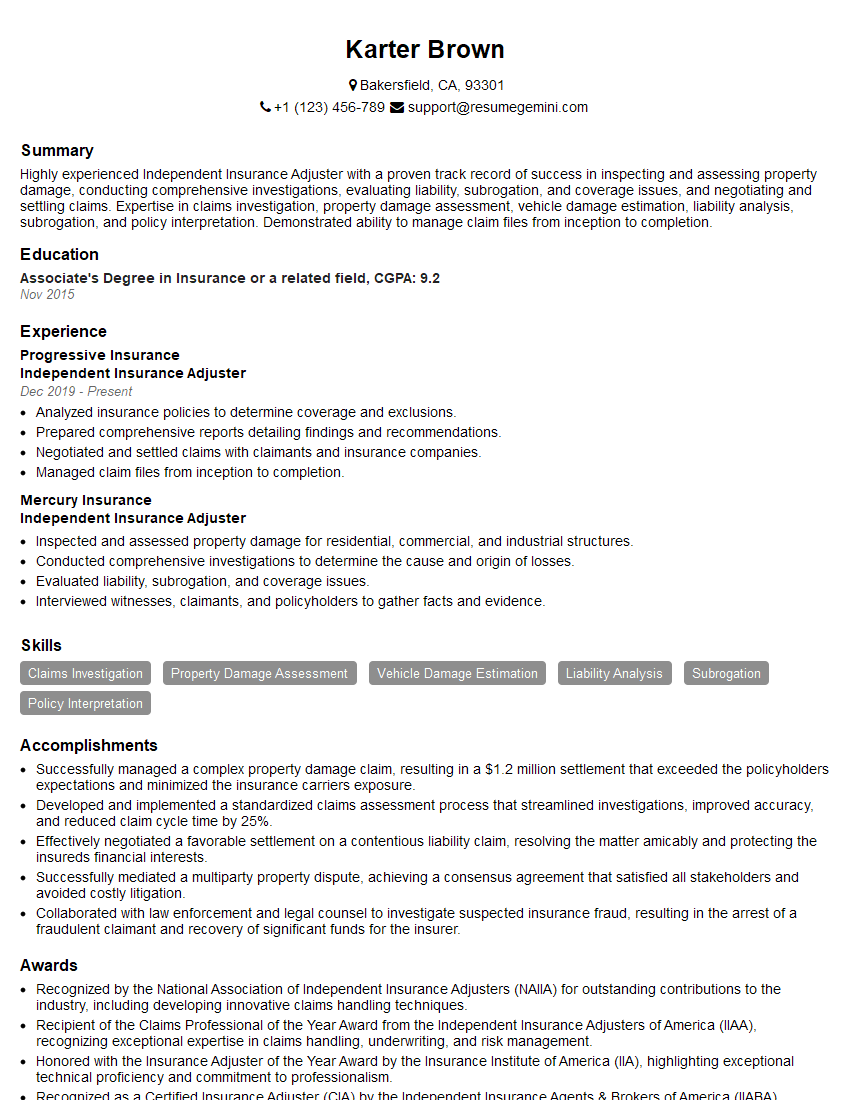

Karter Brown

Independent Insurance Adjuster

Summary

Highly experienced Independent Insurance Adjuster with a proven track record of success in inspecting and assessing property damage, conducting comprehensive investigations, evaluating liability, subrogation, and coverage issues, and negotiating and settling claims. Expertise in claims investigation, property damage assessment, vehicle damage estimation, liability analysis, subrogation, and policy interpretation. Demonstrated ability to manage claim files from inception to completion.

Education

Associate’s Degree in Insurance or a related field

November 2015

Skills

- Claims Investigation

- Property Damage Assessment

- Vehicle Damage Estimation

- Liability Analysis

- Subrogation

- Policy Interpretation

Work Experience

Independent Insurance Adjuster

- Analyzed insurance policies to determine coverage and exclusions.

- Prepared comprehensive reports detailing findings and recommendations.

- Negotiated and settled claims with claimants and insurance companies.

- Managed claim files from inception to completion.

Independent Insurance Adjuster

- Inspected and assessed property damage for residential, commercial, and industrial structures.

- Conducted comprehensive investigations to determine the cause and origin of losses.

- Evaluated liability, subrogation, and coverage issues.

- Interviewed witnesses, claimants, and policyholders to gather facts and evidence.

Accomplishments

- Successfully managed a complex property damage claim, resulting in a $1.2 million settlement that exceeded the policyholders expectations and minimized the insurance carriers exposure.

- Developed and implemented a standardized claims assessment process that streamlined investigations, improved accuracy, and reduced claim cycle time by 25%.

- Effectively negotiated a favorable settlement on a contentious liability claim, resolving the matter amicably and protecting the insureds financial interests.

- Successfully mediated a multiparty property dispute, achieving a consensus agreement that satisfied all stakeholders and avoided costly litigation.

- Collaborated with law enforcement and legal counsel to investigate suspected insurance fraud, resulting in the arrest of a fraudulent claimant and recovery of significant funds for the insurer.

Awards

- Recognized by the National Association of Independent Insurance Adjusters (NAIIA) for outstanding contributions to the industry, including developing innovative claims handling techniques.

- Recipient of the Claims Professional of the Year Award from the Independent Insurance Adjusters of America (IIAA), recognizing exceptional expertise in claims handling, underwriting, and risk management.

- Honored with the Insurance Adjuster of the Year Award by the Insurance Institute of America (IIA), highlighting exceptional technical proficiency and commitment to professionalism.

- Recognized as a Certified Insurance Adjuster (CIA) by the Independent Insurance Agents & Brokers of America (IIABA), demonstrating advanced knowledge and expertise in claims handling.

Certificates

- Certified Insurance Adjuster (CIA)

- Licensed Insurance Adjuster

- Associate in Claims (AIC)

- Fellow of the Insurance Institute of America (FIIA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Independent Insurance Adjuster

- Highlight your experience and expertise in claims investigation, property damage assessment, and insurance policy interpretation

- Showcase your ability to manage multiple claims simultaneously and meet deadlines

- Emphasize your communication and interpersonal skills, including your ability to build rapport with clients and insurance professionals

- Consider obtaining certifications, such as the Associate in Claims (AIC) or Associate in Insurance Services (AIS) designation, to enhance your credibility.

Essential Experience Highlights for a Strong Independent Insurance Adjuster Resume

- Inspected and assessed property damage for residential, commercial, and industrial structures with an understanding of building codes, construction methods, and relevant safety regulations.

- Conducted comprehensive investigations to determine the cause and origin of losses involving fire, water, wind, hail, and other perils.

- Evaluated liability, subrogation, and coverage issues to determine the extent of coverage and the party responsible for the loss.

- Interviewed witnesses, claimants, and policyholders to gather facts and evidence to support the investigation and claim settlement.

- Analyzed insurance policies, coverage forms, and endorsements to determine coverage and exclusions applicable to the claim.

- Prepared comprehensive reports detailing findings, damages, and recommendations for settlement.

- Negotiated and settled claims with claimants and insurance companies to ensure fair and equitable resolutions.

Frequently Asked Questions (FAQ’s) For Independent Insurance Adjuster

What are the job duties of an Independent Insurance Adjuster?

An Independent Insurance Adjuster is responsible for inspecting and assessing property damage, conducting investigations to determine the cause and origin of losses, evaluating liability and coverage issues, interviewing witnesses and policyholders, analyzing insurance policies, preparing reports, and negotiating and settling claims.

What are the educational requirements to become an Independent Insurance Adjuster?

Most Independent Insurance Adjusters have at least an associate’s degree in insurance or a related field. Some states may require additional education or training.

What are the key skills needed to be a successful Independent Insurance Adjuster?

Key skills for an Independent Insurance Adjuster include claims investigation, property damage assessment, vehicle damage estimation, liability analysis, subrogation, policy interpretation, communication, and negotiation.

What is the average salary for an Independent Insurance Adjuster?

The average salary for an Independent Insurance Adjuster varies depending on experience, location, and company. According to the U.S. Bureau of Labor Statistics, the median annual salary for insurance adjusters, examiners, and investigators was $69,770 in May 2021.

What is the job outlook for Independent Insurance Adjusters?

The job outlook for Independent Insurance Adjusters is expected to grow faster than average over the next few years due to the increasing frequency and severity of natural disasters and the growing need for insurance coverage.

What are the advantages of being an Independent Insurance Adjuster?

Advantages of being an Independent Insurance Adjuster include flexibility, autonomy, high earning potential, and the opportunity to work with a variety of clients.