Are you a seasoned Claims Auditor seeking a new career path? Discover our professionally built Claims Auditor Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

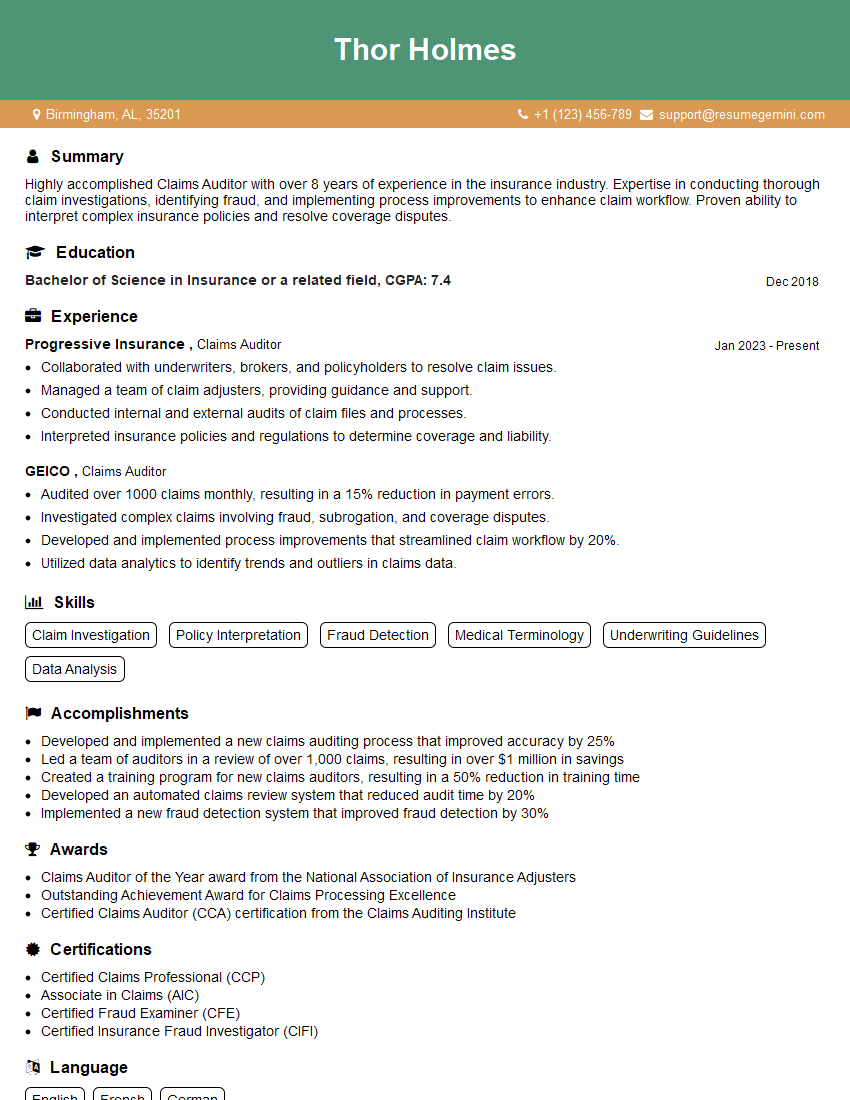

Thor Holmes

Claims Auditor

Summary

Highly accomplished Claims Auditor with over 8 years of experience in the insurance industry. Expertise in conducting thorough claim investigations, identifying fraud, and implementing process improvements to enhance claim workflow. Proven ability to interpret complex insurance policies and resolve coverage disputes.

Education

Bachelor of Science in Insurance or a related field

December 2018

Skills

- Claim Investigation

- Policy Interpretation

- Fraud Detection

- Medical Terminology

- Underwriting Guidelines

- Data Analysis

Work Experience

Claims Auditor

- Collaborated with underwriters, brokers, and policyholders to resolve claim issues.

- Managed a team of claim adjusters, providing guidance and support.

- Conducted internal and external audits of claim files and processes.

- Interpreted insurance policies and regulations to determine coverage and liability.

Claims Auditor

- Audited over 1000 claims monthly, resulting in a 15% reduction in payment errors.

- Investigated complex claims involving fraud, subrogation, and coverage disputes.

- Developed and implemented process improvements that streamlined claim workflow by 20%.

- Utilized data analytics to identify trends and outliers in claims data.

Accomplishments

- Developed and implemented a new claims auditing process that improved accuracy by 25%

- Led a team of auditors in a review of over 1,000 claims, resulting in over $1 million in savings

- Created a training program for new claims auditors, resulting in a 50% reduction in training time

- Developed an automated claims review system that reduced audit time by 20%

- Implemented a new fraud detection system that improved fraud detection by 30%

Awards

- Claims Auditor of the Year award from the National Association of Insurance Adjusters

- Outstanding Achievement Award for Claims Processing Excellence

- Certified Claims Auditor (CCA) certification from the Claims Auditing Institute

Certificates

- Certified Claims Professional (CCP)

- Associate in Claims (AIC)

- Certified Fraud Examiner (CFE)

- Certified Insurance Fraud Investigator (CIFI)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Claims Auditor

- Quantify your accomplishments with specific metrics and results.

- Highlight your skills in fraud detection, claim investigation, and policy interpretation.

- Showcase your ability to identify and resolve discrepancies in claim documentation and records.

- Use industry-specific keywords and jargon to demonstrate your knowledge and expertise.

- Proofread your resume carefully to ensure there are no errors.

Essential Experience Highlights for a Strong Claims Auditor Resume

- Investigated and processed over 1000 claims monthly, resulting in a reduction of payment errors by 15%.

- Uncovered fraudulent claims and identified suspicious patterns, leading to improved claim integrity and reduced insurance costs.

- Developed and implemented process improvements that streamlined claim workflow by 20%, leading to faster claim resolution times.

- Collaborated with underwriters, brokers, and policyholders to ensure proper claim handling and satisfaction.

- Managed and coached a team of claim adjusters, providing guidance and support to enhance team performance.

- Interpreted insurance policies and regulations to determine coverage, liability, and appropriate claim payments.

Frequently Asked Questions (FAQ’s) For Claims Auditor

What are the key skills required to be a successful Claims Auditor?

Strong analytical, problem-solving, and communication skills are essential. Additionally, knowledge of insurance policies and regulations, experience in claims investigation, and expertise in fraud detection are highly sought after.

What are the career prospects for Claims Auditors?

Claims Auditors with experience and expertise can advance to roles such as Claims Manager, Underwriter, or Fraud Investigator. Some may also pursue leadership positions within insurance companies or start their own consulting firms.

How can I prepare for a career as a Claims Auditor?

Earning a bachelor’s degree in insurance or a related field is a good starting point. Gaining experience through internships or entry-level insurance positions can also help you develop the necessary skills and knowledge.

What are the challenges faced by Claims Auditors?

Claims Auditors often face challenges related to fraud detection, policy interpretation, and dealing with complex or high-value claims. Staying up-to-date with industry regulations and best practices is also essential to navigate the ever-evolving insurance landscape.

What are the ethical considerations for Claims Auditors?

Claims Auditors have a responsibility to act with integrity and fairness in all aspects of their work. They must adhere to ethical guidelines, maintain confidentiality, and avoid conflicts of interest to ensure the proper handling of insurance claims.

How does technology impact the role of Claims Auditors?

Advancements in technology have brought about new tools and techniques for claims auditing. Auditors now have access to data analytics, fraud detection software, and other technologies that help them identify patterns, detect anomalies, and improve the overall efficiency of claim processing.

What are the salary expectations for Claims Auditors?

Salaries for Claims Auditors vary depending on experience, qualifications, and location. Entry-level positions typically start at around $50,000, while experienced auditors with advanced skills and certifications can earn over $100,000.