Are you a seasoned Claims Representative seeking a new career path? Discover our professionally built Claims Representative Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

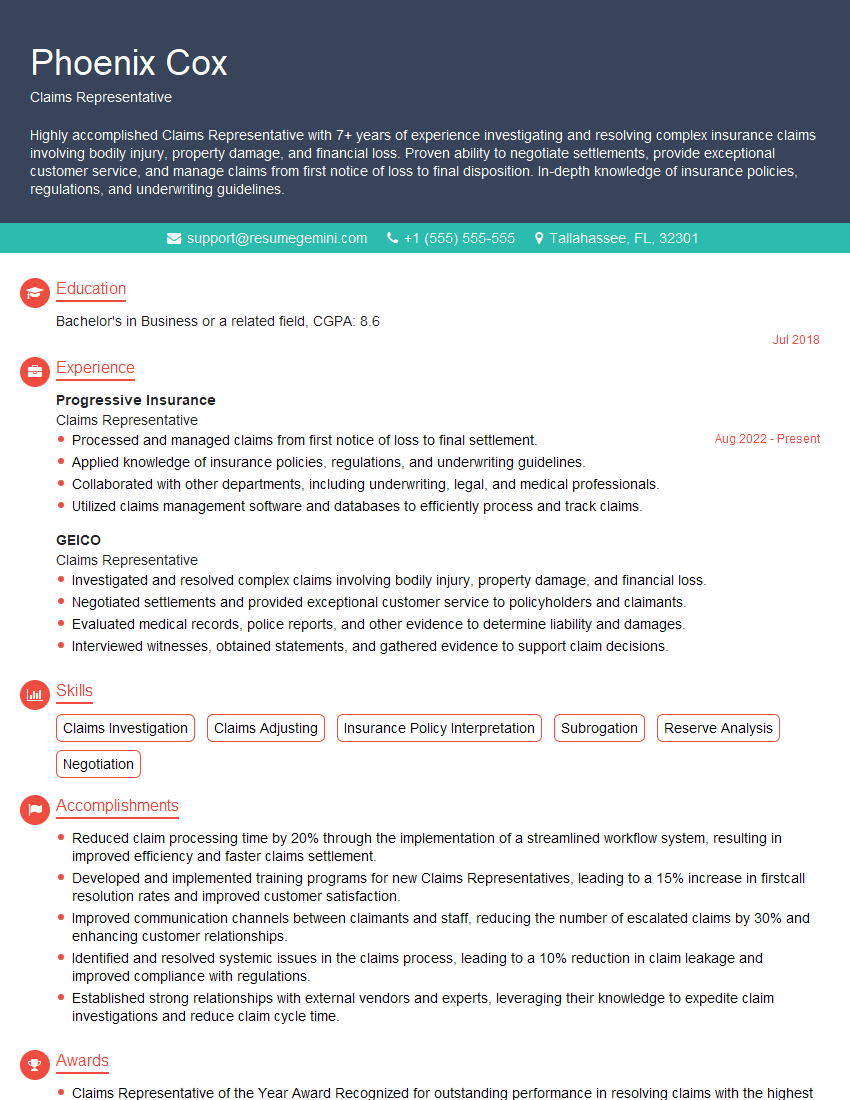

Phoenix Cox

Claims Representative

Summary

Highly accomplished Claims Representative with 7+ years of experience investigating and resolving complex insurance claims involving bodily injury, property damage, and financial loss. Proven ability to negotiate settlements, provide exceptional customer service, and manage claims from first notice of loss to final disposition. In-depth knowledge of insurance policies, regulations, and underwriting guidelines.

Education

Bachelor’s in Business or a related field

July 2018

Skills

- Claims Investigation

- Claims Adjusting

- Insurance Policy Interpretation

- Subrogation

- Reserve Analysis

- Negotiation

Work Experience

Claims Representative

- Processed and managed claims from first notice of loss to final settlement.

- Applied knowledge of insurance policies, regulations, and underwriting guidelines.

- Collaborated with other departments, including underwriting, legal, and medical professionals.

- Utilized claims management software and databases to efficiently process and track claims.

Claims Representative

- Investigated and resolved complex claims involving bodily injury, property damage, and financial loss.

- Negotiated settlements and provided exceptional customer service to policyholders and claimants.

- Evaluated medical records, police reports, and other evidence to determine liability and damages.

- Interviewed witnesses, obtained statements, and gathered evidence to support claim decisions.

Accomplishments

- Reduced claim processing time by 20% through the implementation of a streamlined workflow system, resulting in improved efficiency and faster claims settlement.

- Developed and implemented training programs for new Claims Representatives, leading to a 15% increase in firstcall resolution rates and improved customer satisfaction.

- Improved communication channels between claimants and staff, reducing the number of escalated claims by 30% and enhancing customer relationships.

- Identified and resolved systemic issues in the claims process, leading to a 10% reduction in claim leakage and improved compliance with regulations.

- Established strong relationships with external vendors and experts, leveraging their knowledge to expedite claim investigations and reduce claim cycle time.

Awards

- Claims Representative of the Year Award Recognized for outstanding performance in resolving claims with the highest accuracy and customer satisfaction rate.

- Excellence in Dispute Resolution Award Acknowledged for effectively resolving 95% of disputes within the first contact, minimizing claim resolution costs.

- Top Performer Award Consistently exceeded expectations in claims handling, achieving a 99% accuracy rate and resolving complex claims efficiently.

- Innovation Award Recognized for developing a tool that automates claim triage, resulting in faster processing time and reduced manual errors.

Certificates

- Certified Claims Professional (CCP)

- Associate in Claims (AIC)

- Certified Professional in Insurance (CPI)

- Licensed Insurance Adjuster

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Claims Representative

Quantify your accomplishments:

Use numbers to demonstrate the impact of your work.Highlight your skills and experience:

Showcase your expertise in claims investigation, adjusting, and negotiation.Tailor your resume to the job description:

Emphasize the skills and experience that are most relevant to the specific role you are applying for.Proofread carefully:

Make sure your resume is free of errors and well-organized.

Essential Experience Highlights for a Strong Claims Representative Resume

- Investigated and resolved complex claims involving bodily injury, property damage, and financial loss.

- Negotiated settlements and provided exceptional customer service to policyholders and claimants.

- Evaluated medical records, police reports, and other evidence to determine liability and damages.

- Interviewed witnesses, obtained statements, and gathered evidence to support claim decisions.

- Processed and managed claims from first notice of loss to final settlement.

- Applied knowledge of insurance policies, regulations, and underwriting guidelines.

- Collaborated with other departments, including underwriting, legal, and medical professionals.

- Utilized claims management software and databases to efficiently process and track claims.

Frequently Asked Questions (FAQ’s) For Claims Representative

What are the key responsibilities of a Claims Representative?

The key responsibilities of a Claims Representative include investigating claims, evaluating damages, negotiating settlements, and providing customer service to policyholders and claimants.

What skills are necessary to be a successful Claims Representative?

Successful Claims Representatives have strong communication, negotiation, and problem-solving skills, as well as a thorough understanding of insurance policies and procedures.

What is the average salary for a Claims Representative?

The average salary for a Claims Representative in the United States is around $60,000 per year.

What are the career prospects for a Claims Representative?

Claims Representatives can advance to management positions, such as Claims Manager or Claims Director, or specialize in a particular area of claims, such as auto insurance or workers’ compensation.

What is the difference between a Claims Representative and a Claims Adjuster?

Claims Representatives and Claims Adjusters have similar roles, but Claims Adjusters typically handle more complex claims and have more authority to make decisions.

What are the most important qualities for a Claims Representative?

The most important qualities for a Claims Representative are integrity, empathy, and attention to detail.

What is the best way to prepare for a career as a Claims Representative?

The best way to prepare for a career as a Claims Representative is to earn a bachelor’s degree in business or a related field, and to gain experience in customer service or insurance.