Are you a seasoned Adjuster seeking a new career path? Discover our professionally built Adjuster Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

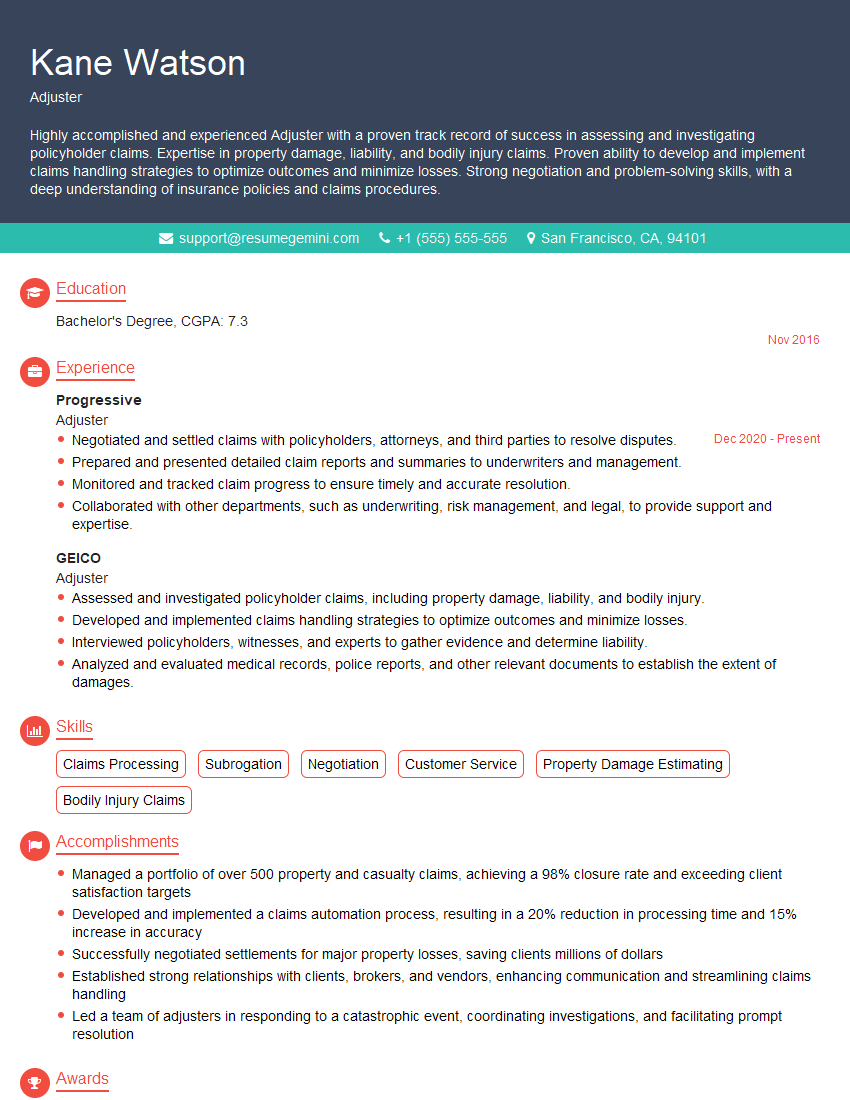

Kane Watson

Adjuster

Summary

Highly accomplished and experienced Adjuster with a proven track record of success in assessing and investigating policyholder claims. Expertise in property damage, liability, and bodily injury claims. Proven ability to develop and implement claims handling strategies to optimize outcomes and minimize losses. Strong negotiation and problem-solving skills, with a deep understanding of insurance policies and claims procedures.

Education

Bachelor’s Degree

November 2016

Skills

- Claims Processing

- Subrogation

- Negotiation

- Customer Service

- Property Damage Estimating

- Bodily Injury Claims

Work Experience

Adjuster

- Negotiated and settled claims with policyholders, attorneys, and third parties to resolve disputes.

- Prepared and presented detailed claim reports and summaries to underwriters and management.

- Monitored and tracked claim progress to ensure timely and accurate resolution.

- Collaborated with other departments, such as underwriting, risk management, and legal, to provide support and expertise.

Adjuster

- Assessed and investigated policyholder claims, including property damage, liability, and bodily injury.

- Developed and implemented claims handling strategies to optimize outcomes and minimize losses.

- Interviewed policyholders, witnesses, and experts to gather evidence and determine liability.

- Analyzed and evaluated medical records, police reports, and other relevant documents to establish the extent of damages.

Accomplishments

- Managed a portfolio of over 500 property and casualty claims, achieving a 98% closure rate and exceeding client satisfaction targets

- Developed and implemented a claims automation process, resulting in a 20% reduction in processing time and 15% increase in accuracy

- Successfully negotiated settlements for major property losses, saving clients millions of dollars

- Established strong relationships with clients, brokers, and vendors, enhancing communication and streamlining claims handling

- Led a team of adjusters in responding to a catastrophic event, coordinating investigations, and facilitating prompt resolution

Awards

- Recognized as Adjuster of the Year for exceptional performance in handling complex claims

- Received the Presidents Award for outstanding customer service and satisfaction

- Honored with the Claims Excellence Award for consistently exceeding expectations in claims resolution

Certificates

- Certified Claims Adjuster (CCA)

- Insurance Claims Adjuster License

- Certified Automotive Damage Appraiser (CADA)

- Certified General Adjuster (CGA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Adjuster

- Highlight your claims handling experience and expertise in your resume.

- Showcase your strong negotiation and problem-solving skills.

- Emphasize your knowledge of insurance policies and claims procedures.

- Provide specific examples of successful claims you have handled.

- Obtain industry certifications, such as the Associate in Claims (AIC) or Fellow, Casualty Actuarial Society (FCAS), to enhance your credibility.

Essential Experience Highlights for a Strong Adjuster Resume

- Assessed and investigated policyholder claims, including property damage, liability, and bodily injury.

- Developed and implemented claims handling strategies to optimize outcomes and minimize losses.

- Interviewed policyholders, witnesses, and experts to gather evidence and determine liability.

- Analyzed and evaluated medical records, police reports, and other relevant documents to establish the extent of damages.

- Negotiated and settled claims with policyholders, attorneys, and third parties to resolve disputes.

- Prepared and presented detailed claim reports and summaries to underwriters and management.

- Monitored and tracked claim progress to ensure timely and accurate resolution.

Frequently Asked Questions (FAQ’s) For Adjuster

What is the role of an Adjuster?

An adjuster is responsible for assessing and investigating insurance claims, determining the extent of damages, and negotiating settlements with policyholders and other parties involved.

What are the key skills required for an Adjuster?

Key skills for an adjuster include claims processing, subrogation, negotiation, customer service, property damage estimating, and bodily injury claims.

What are the career prospects for an Adjuster?

Adjusters with experience and expertise can advance to roles such as claims manager, claims supervisor, or insurance underwriter.

What is the salary range for an Adjuster?

The salary range for an adjuster varies depending on experience, location, and company. According to Salary.com, the average salary for an adjuster in the United States is around $65,000 per year.

How do I become an Adjuster?

To become an adjuster, you typically need a bachelor’s degree in a related field, such as business, finance, or insurance. Some employers may also require industry certifications, such as the Associate in Claims (AIC) or Fellow, Casualty Actuarial Society (FCAS).

What is the job outlook for Adjusters?

The job outlook for adjusters is expected to be favorable in the coming years. As the insurance industry continues to grow, there will be a need for qualified adjusters to handle claims.

What are the benefits of working as an Adjuster?

Benefits of working as an adjuster include job security, a competitive salary, and the opportunity to help people in their time of need.