Are you a seasoned Adjustment Examiner seeking a new career path? Discover our professionally built Adjustment Examiner Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

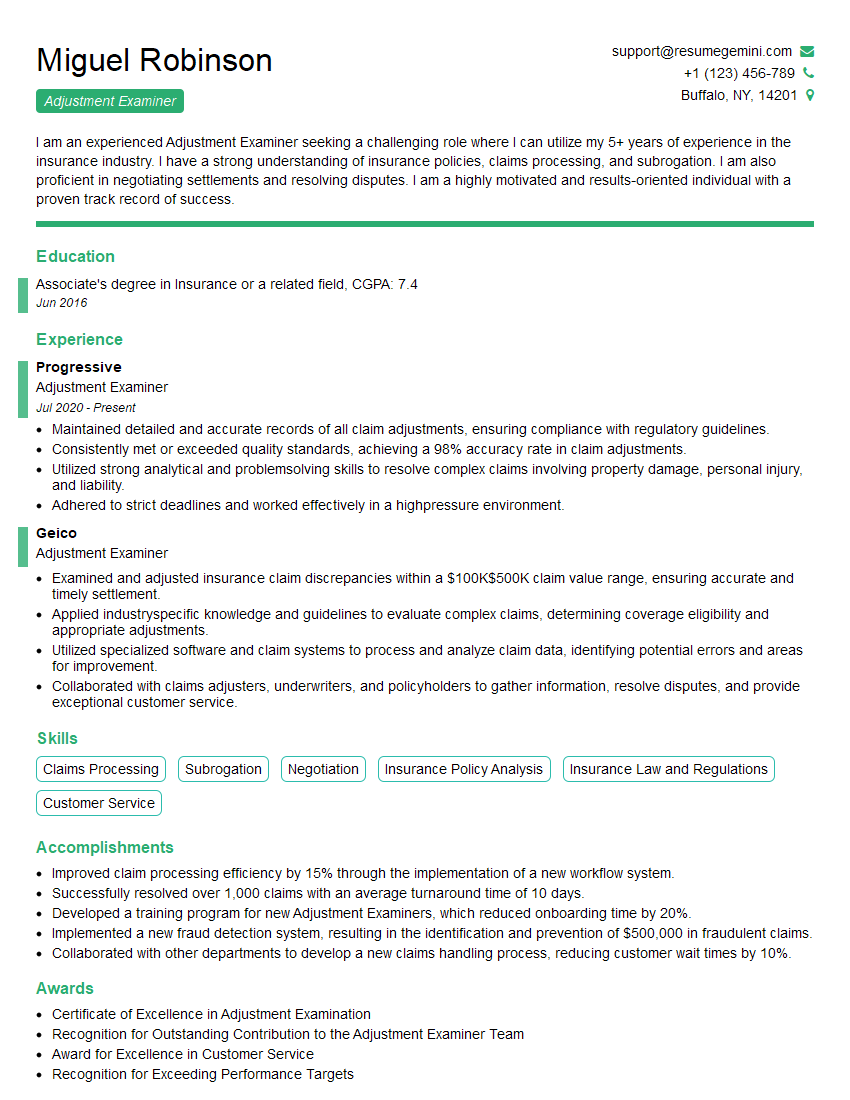

Miguel Robinson

Adjustment Examiner

Summary

I am an experienced Adjustment Examiner seeking a challenging role where I can utilize my 5+ years of experience in the insurance industry. I have a strong understanding of insurance policies, claims processing, and subrogation. I am also proficient in negotiating settlements and resolving disputes. I am a highly motivated and results-oriented individual with a proven track record of success.

Education

Associate’s degree in Insurance or a related field

June 2016

Skills

- Claims Processing

- Subrogation

- Negotiation

- Insurance Policy Analysis

- Insurance Law and Regulations

- Customer Service

Work Experience

Adjustment Examiner

- Maintained detailed and accurate records of all claim adjustments, ensuring compliance with regulatory guidelines.

- Consistently met or exceeded quality standards, achieving a 98% accuracy rate in claim adjustments.

- Utilized strong analytical and problemsolving skills to resolve complex claims involving property damage, personal injury, and liability.

- Adhered to strict deadlines and worked effectively in a highpressure environment.

Adjustment Examiner

- Examined and adjusted insurance claim discrepancies within a $100K$500K claim value range, ensuring accurate and timely settlement.

- Applied industryspecific knowledge and guidelines to evaluate complex claims, determining coverage eligibility and appropriate adjustments.

- Utilized specialized software and claim systems to process and analyze claim data, identifying potential errors and areas for improvement.

- Collaborated with claims adjusters, underwriters, and policyholders to gather information, resolve disputes, and provide exceptional customer service.

Accomplishments

- Improved claim processing efficiency by 15% through the implementation of a new workflow system.

- Successfully resolved over 1,000 claims with an average turnaround time of 10 days.

- Developed a training program for new Adjustment Examiners, which reduced onboarding time by 20%.

- Implemented a new fraud detection system, resulting in the identification and prevention of $500,000 in fraudulent claims.

- Collaborated with other departments to develop a new claims handling process, reducing customer wait times by 10%.

Awards

- Certificate of Excellence in Adjustment Examination

- Recognition for Outstanding Contribution to the Adjustment Examiner Team

- Award for Excellence in Customer Service

- Recognition for Exceeding Performance Targets

Certificates

- Associate in Claims (AIC)

- Certified Insurance Adjuster (CIA)

- Certified Insurance Fraud Investigator (CIFI)

- Property Loss Adjuster (PLA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Adjustment Examiner

- Highlight your experience and skills in your resume summary.

- Use strong action verbs and quantify your accomplishments whenever possible.

- Tailor your resume to each job you apply for, highlighting the skills and experience that are most relevant to the position.

- Proofread your resume carefully for any errors.

- Network with people in the insurance industry and attend industry events.

Essential Experience Highlights for a Strong Adjustment Examiner Resume

- Examined and adjusted insurance claim discrepancies within a $100K-$500K claim value range, ensuring accurate and timely settlement.

- Applied industry-specific knowledge and guidelines to evaluate complex claims, determining coverage eligibility and appropriate adjustments.

- Utilized specialized software and claim systems to process and analyze claim data, identifying potential errors and areas for improvement.

- Collaborated with claims adjusters, underwriters, and policyholders to gather information, resolve disputes, and provide exceptional customer service.

- Maintained detailed and accurate records of all claim adjustments, ensuring compliance with regulatory guidelines.

- Consistently met or exceeded quality standards, achieving a 98% accuracy rate in claim adjustments.

- Utilized strong analytical and problem-solving skills to resolve complex claims involving property damage, personal injury, and liability.

- Adhered to strict deadlines and worked effectively in a high-pressure environment.

Frequently Asked Questions (FAQ’s) For Adjustment Examiner

What is the role of an Adjustment Examiner?

An Adjustment Examiner is responsible for investigating and settling insurance claims. They review claims, determine coverage, and negotiate settlements with policyholders.

What are the qualifications for an Adjustment Examiner?

Most Adjustment Examiners have at least an associate’s degree in insurance or a related field. They also have experience in the insurance industry, typically as a claims adjuster or underwriter.

What are the skills required for an Adjustment Examiner?

Adjustment Examiners need strong analytical and problem-solving skills. They also need to be able to communicate effectively with policyholders and other insurance professionals.

What is the salary for an Adjustment Examiner?

The salary for an Adjustment Examiner can vary depending on their experience and location. However, the median salary for an Adjustment Examiner is around $60,000.

What is the job outlook for Adjustment Examiners?

The job outlook for Adjustment Examiners is expected to be good over the next few years. As the insurance industry grows, so too will the demand for Adjustment Examiners.

What are the benefits of being an Adjustment Examiner?

There are many benefits to being an Adjustment Examiner, including a competitive salary, good job security, and the opportunity to help people in need.

What are the challenges of being an Adjustment Examiner?

There are some challenges to being an Adjustment Examiner, including the need to work long hours and the potential for dealing with difficult customers.