Are you a seasoned Auditor-In-Charge seeking a new career path? Discover our professionally built Auditor-In-Charge Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

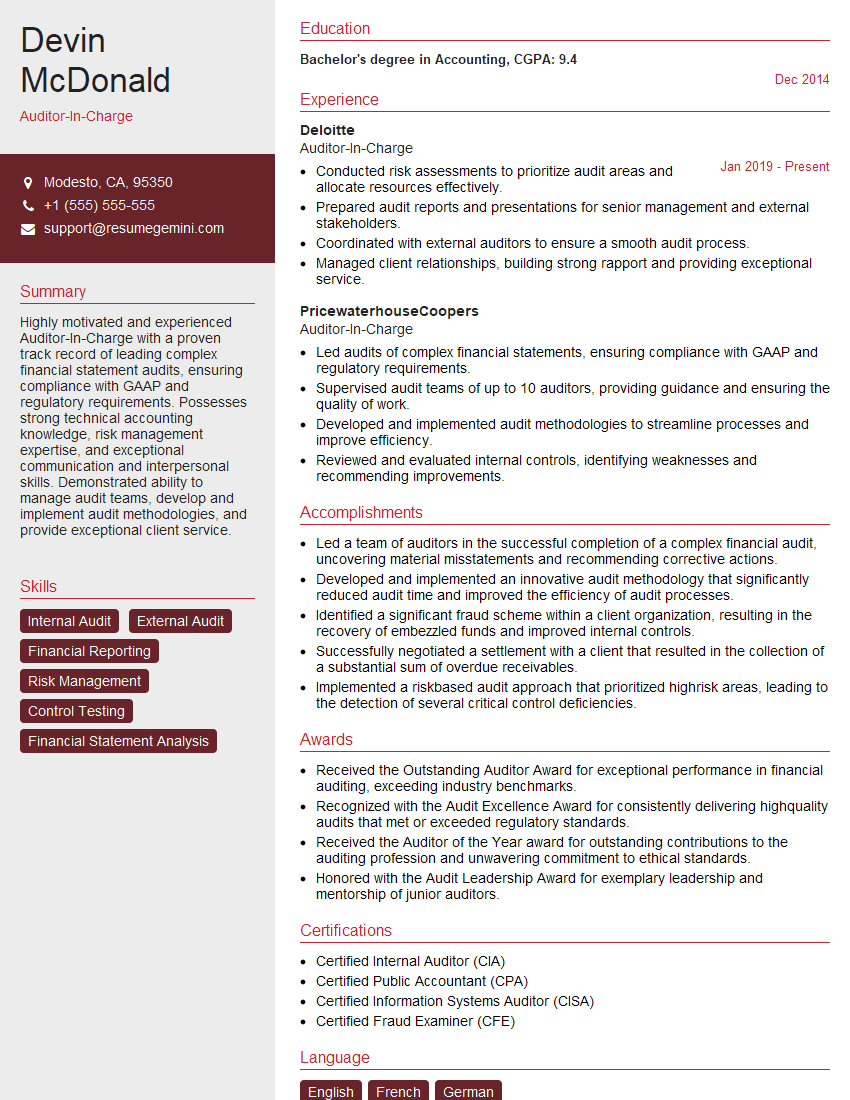

Devin McDonald

Auditor-In-Charge

Summary

Highly motivated and experienced Auditor-In-Charge with a proven track record of leading complex financial statement audits, ensuring compliance with GAAP and regulatory requirements. Possesses strong technical accounting knowledge, risk management expertise, and exceptional communication and interpersonal skills. Demonstrated ability to manage audit teams, develop and implement audit methodologies, and provide exceptional client service.

Education

Bachelor’s degree in Accounting

December 2014

Skills

- Internal Audit

- External Audit

- Financial Reporting

- Risk Management

- Control Testing

- Financial Statement Analysis

Work Experience

Auditor-In-Charge

- Conducted risk assessments to prioritize audit areas and allocate resources effectively.

- Prepared audit reports and presentations for senior management and external stakeholders.

- Coordinated with external auditors to ensure a smooth audit process.

- Managed client relationships, building strong rapport and providing exceptional service.

Auditor-In-Charge

- Led audits of complex financial statements, ensuring compliance with GAAP and regulatory requirements.

- Supervised audit teams of up to 10 auditors, providing guidance and ensuring the quality of work.

- Developed and implemented audit methodologies to streamline processes and improve efficiency.

- Reviewed and evaluated internal controls, identifying weaknesses and recommending improvements.

Accomplishments

- Led a team of auditors in the successful completion of a complex financial audit, uncovering material misstatements and recommending corrective actions.

- Developed and implemented an innovative audit methodology that significantly reduced audit time and improved the efficiency of audit processes.

- Identified a significant fraud scheme within a client organization, resulting in the recovery of embezzled funds and improved internal controls.

- Successfully negotiated a settlement with a client that resulted in the collection of a substantial sum of overdue receivables.

- Implemented a riskbased audit approach that prioritized highrisk areas, leading to the detection of several critical control deficiencies.

Awards

- Received the Outstanding Auditor Award for exceptional performance in financial auditing, exceeding industry benchmarks.

- Recognized with the Audit Excellence Award for consistently delivering highquality audits that met or exceeded regulatory standards.

- Received the Auditor of the Year award for outstanding contributions to the auditing profession and unwavering commitment to ethical standards.

- Honored with the Audit Leadership Award for exemplary leadership and mentorship of junior auditors.

Certificates

- Certified Internal Auditor (CIA)

- Certified Public Accountant (CPA)

- Certified Information Systems Auditor (CISA)

- Certified Fraud Examiner (CFE)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Auditor-In-Charge

Highlight your technical accounting skills and experience.

Auditors-in-charge need to have a deep understanding of accounting principles and auditing standards.Demonstrate your leadership and management abilities.

Auditors-in-charge are responsible for leading and managing audit teams.Showcase your communication and interpersonal skills.

Auditors-in-charge need to be able to communicate effectively with clients, management, and other stakeholders.Emphasize your ability to meet deadlines and manage multiple projects.

Auditors-in-charge often have to work under tight deadlines and manage multiple projects simultaneously.

Essential Experience Highlights for a Strong Auditor-In-Charge Resume

- Led audits of complex financial statements, ensuring compliance with GAAP and regulatory requirements.

- Supervised audit teams of up to 10 auditors, providing guidance and ensuring the quality of work.

- Developed and implemented audit methodologies to streamline processes and improve efficiency.

- Reviewed and evaluated internal controls, identifying weaknesses and recommending improvements.

- Conducted risk assessments to prioritize audit areas and allocate resources effectively.

- Prepared audit reports and presentations for senior management and external stakeholders.

- Coordinated with external auditors to ensure a smooth audit process.

Frequently Asked Questions (FAQ’s) For Auditor-In-Charge

What is the role of an Auditor-In-Charge?

An Auditor-In-Charge is responsible for planning, executing, and reporting on financial statement audits. They supervise audit teams, develop and implement audit methodologies, and ensure that audits are conducted in accordance with GAAP and regulatory requirements.

What are the qualifications for an Auditor-In-Charge?

Auditors-In-Charge typically have a bachelor’s degree in accounting and several years of experience in auditing. They must also have a strong understanding of GAAP and regulatory requirements.

What are the key skills for an Auditor-In-Charge?

Key skills for Auditors-In-Charge include technical accounting knowledge, risk management expertise, leadership and management skills, and communication and interpersonal skills.

What is the career path for an Auditor-In-Charge?

Auditors-In-Charge can advance to senior management positions within accounting firms or corporations. They may also choose to specialize in a particular area of auditing, such as internal auditing or forensic accounting.

What is the salary range for an Auditor-In-Charge?

The salary range for Auditors-In-Charge varies depending on their experience, location, and employer. According to Salary.com, the average salary for an Auditor-In-Charge in the United States is $95,000.

What are the benefits of being an Auditor-In-Charge?

Benefits of being an Auditor-In-Charge include a competitive salary, opportunities for career advancement, and the chance to make a positive impact on businesses and organizations.