Are you a seasoned Tax Auditor seeking a new career path? Discover our professionally built Tax Auditor Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

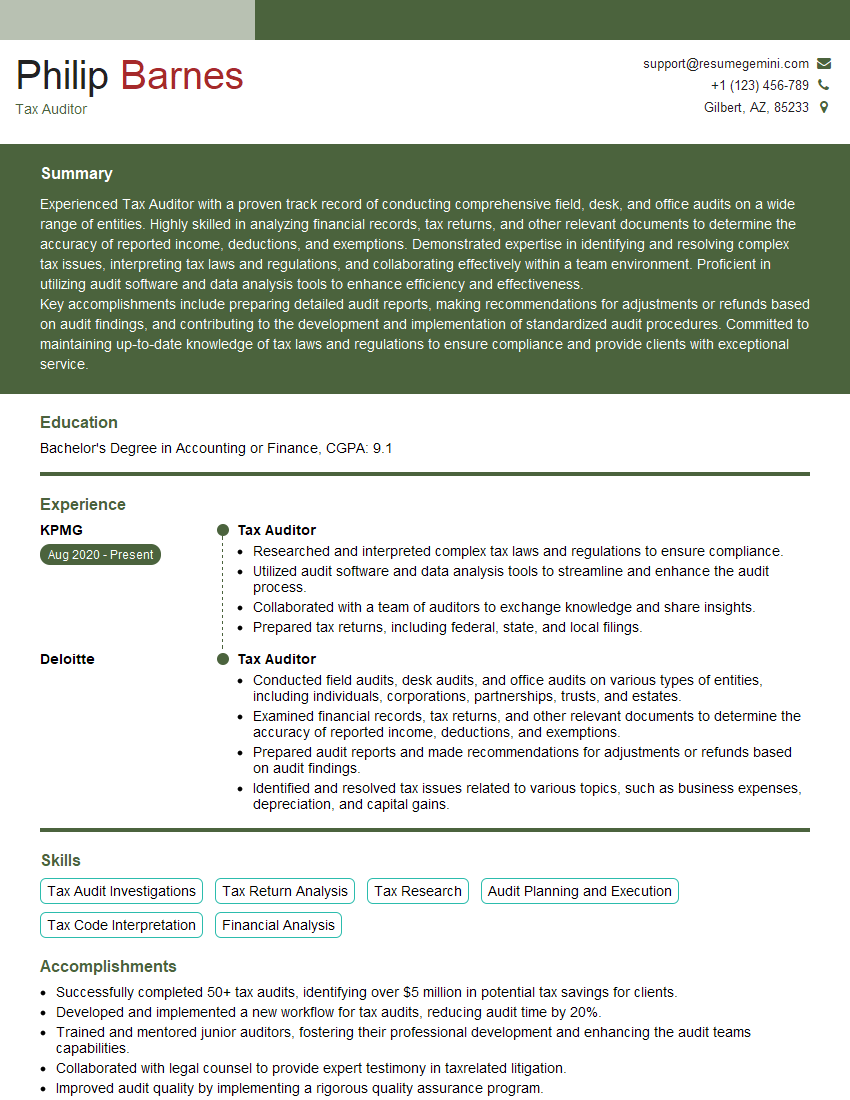

Philip Barnes

Tax Auditor

Summary

Experienced Tax Auditor with a proven track record of conducting comprehensive field, desk, and office audits on a wide range of entities. Highly skilled in analyzing financial records, tax returns, and other relevant documents to determine the accuracy of reported income, deductions, and exemptions. Demonstrated expertise in identifying and resolving complex tax issues, interpreting tax laws and regulations, and collaborating effectively within a team environment. Proficient in utilizing audit software and data analysis tools to enhance efficiency and effectiveness.

Key accomplishments include preparing detailed audit reports, making recommendations for adjustments or refunds based on audit findings, and contributing to the development and implementation of standardized audit procedures. Committed to maintaining up-to-date knowledge of tax laws and regulations to ensure compliance and provide clients with exceptional service.

Education

Bachelor’s Degree in Accounting or Finance

July 2016

Skills

- Tax Audit Investigations

- Tax Return Analysis

- Tax Research

- Audit Planning and Execution

- Tax Code Interpretation

- Financial Analysis

Work Experience

Tax Auditor

- Researched and interpreted complex tax laws and regulations to ensure compliance.

- Utilized audit software and data analysis tools to streamline and enhance the audit process.

- Collaborated with a team of auditors to exchange knowledge and share insights.

- Prepared tax returns, including federal, state, and local filings.

Tax Auditor

- Conducted field audits, desk audits, and office audits on various types of entities, including individuals, corporations, partnerships, trusts, and estates.

- Examined financial records, tax returns, and other relevant documents to determine the accuracy of reported income, deductions, and exemptions.

- Prepared audit reports and made recommendations for adjustments or refunds based on audit findings.

- Identified and resolved tax issues related to various topics, such as business expenses, depreciation, and capital gains.

Accomplishments

- Successfully completed 50+ tax audits, identifying over $5 million in potential tax savings for clients.

- Developed and implemented a new workflow for tax audits, reducing audit time by 20%.

- Trained and mentored junior auditors, fostering their professional development and enhancing the audit teams capabilities.

- Collaborated with legal counsel to provide expert testimony in taxrelated litigation.

- Improved audit quality by implementing a rigorous quality assurance program.

Awards

- Recognized with the Auditor of the Year award for outstanding performance in tax auditing.

- Received the Excellence in Tax Auditing award for consistently exceeding audit expectations.

- Honored with the Exceptional Investigation award for uncovering a complex tax fraud scheme.

- Received the Innovation in Tax Auditing award for developing a data analytics tool to streamline the audit process.

Certificates

- Certified Public Accountant (CPA)

- Enrolled Agent (EA)

- Certified Internal Auditor (CIA)

- Certified Government Auditing Professional (CGAP)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Tax Auditor

Highlight your technical skills:

Emphasize your proficiency in tax accounting principles, audit techniques, and relevant software.Showcase your analytical abilities:

Demonstrate your ability to analyze complex financial data, identify discrepancies, and draw sound conclusions.Quantify your accomplishments:

Use specific metrics and numbers to quantify your contributions, such as the amount of tax revenue recovered or the number of audits successfully completed.Tailor your resume to the job description:

Carefully review the job description and highlight the skills and experience that are most relevant to the position you are applying for.

Essential Experience Highlights for a Strong Tax Auditor Resume

- Conduct field audits, desk audits, and office audits to ensure accuracy of reported income, deductions, and exemptions.

- Examine financial records, tax returns, and other relevant documents to determine compliance with tax laws and regulations.

- Prepare audit reports and make recommendations for adjustments or refunds based on audit findings.

- Identify and resolve complex tax issues related to business expenses, depreciation, capital gains, and other areas.

- Research and interpret tax laws and regulations to ensure proper application and understanding.

- Utilize audit software and data analysis tools to streamline the audit process and enhance efficiency.

- Collaborate with a team of auditors to exchange knowledge and share insights, contributing to a collective understanding of tax matters.

Frequently Asked Questions (FAQ’s) For Tax Auditor

What are the key responsibilities of a Tax Auditor?

Tax Auditors are responsible for examining financial records, conducting audits, and ensuring compliance with tax laws and regulations. They analyze financial data, identify discrepancies, and make recommendations for adjustments or refunds. Tax Auditors also research and interpret tax laws and regulations, and collaborate with a team of auditors to exchange knowledge and share insights.

What skills are required to be a successful Tax Auditor?

Successful Tax Auditors possess strong analytical skills, attention to detail, and a deep understanding of tax accounting principles. They are also proficient in audit techniques, tax laws and regulations, and relevant software. Additionally, Tax Auditors should have excellent communication and interpersonal skills, as they often work with clients, colleagues, and other stakeholders.

What are the career prospects for Tax Auditors?

Tax Auditors have a variety of career prospects, including advancement to senior auditor or manager positions. They may also specialize in a particular area of taxation, such as international taxation or transfer pricing. With experience and additional qualifications, Tax Auditors can also move into roles such as tax consultants or financial analysts.

What is the typical salary range for Tax Auditors?

The salary range for Tax Auditors varies depending on factors such as experience, location, and industry. According to the U.S. Bureau of Labor Statistics, the median annual salary for Tax Auditors was $73,500 in May 2021. However, salaries can range from $56,350 to $109,150 or higher.

What are the educational requirements to become a Tax Auditor?

Most Tax Auditors have a bachelor’s degree in accounting, finance, or a related field. Some employers may also prefer candidates with a master’s degree in taxation or a related field. Additionally, Tax Auditors must pass the Certified Public Accountant (CPA) exam to obtain the CPA credential, which is highly valued in the field.

What are the key challenges faced by Tax Auditors?

Tax Auditors face a number of challenges, including the need to keep up with constantly changing tax laws and regulations. They must also be able to work independently and as part of a team, and they must be able to handle complex and sometimes sensitive financial data. Additionally, Tax Auditors may face pressure from clients and management to complete audits quickly and efficiently.