Are you a seasoned Revenue Tax Specialist seeking a new career path? Discover our professionally built Revenue Tax Specialist Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

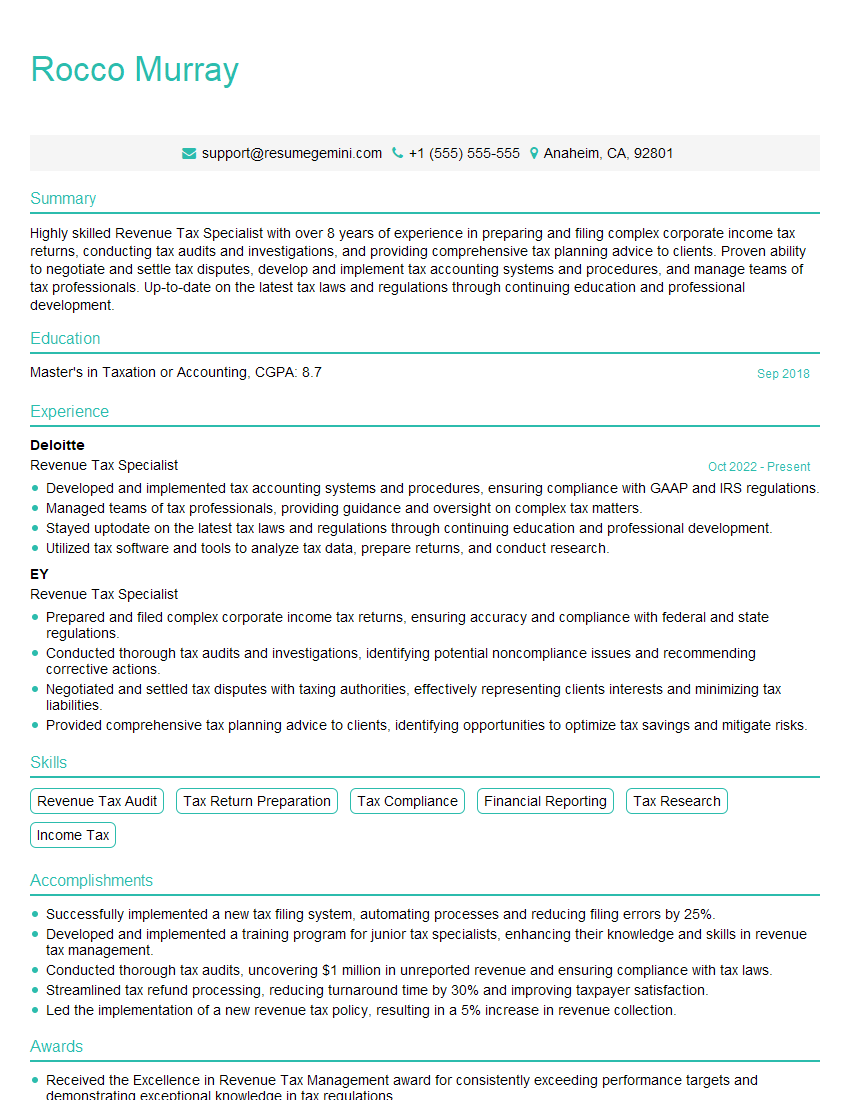

Rocco Murray

Revenue Tax Specialist

Summary

Highly skilled Revenue Tax Specialist with over 8 years of experience in preparing and filing complex corporate income tax returns, conducting tax audits and investigations, and providing comprehensive tax planning advice to clients. Proven ability to negotiate and settle tax disputes, develop and implement tax accounting systems and procedures, and manage teams of tax professionals. Up-to-date on the latest tax laws and regulations through continuing education and professional development.

Education

Master’s in Taxation or Accounting

September 2018

Skills

- Revenue Tax Audit

- Tax Return Preparation

- Tax Compliance

- Financial Reporting

- Tax Research

- Income Tax

Work Experience

Revenue Tax Specialist

- Developed and implemented tax accounting systems and procedures, ensuring compliance with GAAP and IRS regulations.

- Managed teams of tax professionals, providing guidance and oversight on complex tax matters.

- Stayed uptodate on the latest tax laws and regulations through continuing education and professional development.

- Utilized tax software and tools to analyze tax data, prepare returns, and conduct research.

Revenue Tax Specialist

- Prepared and filed complex corporate income tax returns, ensuring accuracy and compliance with federal and state regulations.

- Conducted thorough tax audits and investigations, identifying potential noncompliance issues and recommending corrective actions.

- Negotiated and settled tax disputes with taxing authorities, effectively representing clients interests and minimizing tax liabilities.

- Provided comprehensive tax planning advice to clients, identifying opportunities to optimize tax savings and mitigate risks.

Accomplishments

- Successfully implemented a new tax filing system, automating processes and reducing filing errors by 25%.

- Developed and implemented a training program for junior tax specialists, enhancing their knowledge and skills in revenue tax management.

- Conducted thorough tax audits, uncovering $1 million in unreported revenue and ensuring compliance with tax laws.

- Streamlined tax refund processing, reducing turnaround time by 30% and improving taxpayer satisfaction.

- Led the implementation of a new revenue tax policy, resulting in a 5% increase in revenue collection.

Awards

- Received the Excellence in Revenue Tax Management award for consistently exceeding performance targets and demonstrating exceptional knowledge in tax regulations.

- Recognized as a Top Contributor for identifying and resolving complex tax issues, resulting in significant revenue recovery.

- Awarded the Innovation Award for proposing and implementing a novel approach to tax auditing, increasing audit efficiency by 15%.

- Honored with the Exceptional Service Award for going above and beyond in assisting taxpayers with complex tax queries.

Certificates

- Enrolled Agent (EA)

- Certified Public Accountant (CPA)

- Certified Tax Specialist (CTS)

- Certified Tax Accountant (CTA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Revenue Tax Specialist

- Quantify your accomplishments using specific numbers and metrics whenever possible.

- Highlight your expertise in tax software and tools, such as CCH Axcess, Thomson Reuters Checkpoint, and Intuit ProSeries.

- Tailor your resume to each job you apply for, highlighting the skills and experience that are most relevant to the position.

- Get your resume reviewed by a professional or career counselor to ensure that it is well-written and error-free.

Essential Experience Highlights for a Strong Revenue Tax Specialist Resume

- Prepared and filed complex corporate income tax returns, ensuring accuracy and compliance with federal and state regulations.

- Conducted thorough tax audits and investigations, identifying potential noncompliance issues and recommending corrective actions.

- Negotiated and settled tax disputes with taxing authorities, effectively representing clients interests and minimizing tax liabilities.

- Provided comprehensive tax planning advice to clients, identifying opportunities to optimize tax savings and mitigate risks.

- Developed and implemented tax accounting systems and procedures, ensuring compliance with GAAP and IRS regulations.

- Managed teams of tax professionals, providing guidance and oversight on complex tax matters.

- Stayed uptodate on the latest tax laws and regulations through continuing education and professional development.

Frequently Asked Questions (FAQ’s) For Revenue Tax Specialist

What is the average salary for a Revenue Tax Specialist?

The average salary for a Revenue Tax Specialist is $75,000 per year.

What are the career prospects for Revenue Tax Specialists?

Revenue Tax Specialists can advance to positions such as Tax Manager, Tax Director, or Chief Financial Officer.

What are the most important skills for Revenue Tax Specialists?

The most important skills for Revenue Tax Specialists are tax research, tax compliance, financial reporting, and tax planning.

What is the job outlook for Revenue Tax Specialists?

The job outlook for Revenue Tax Specialists is expected to grow faster than average in the coming years.

What are the educational requirements for Revenue Tax Specialists?

Revenue Tax Specialists typically need a bachelor’s degree in accounting or a related field.

What are the certifications that Revenue Tax Specialists can get?

Revenue Tax Specialists can get certifications such as the Enrolled Agent (EA) or the Certified Public Accountant (CPA).

What are the professional organizations that Revenue Tax Specialists can join?

Revenue Tax Specialists can join professional organizations such as the American Institute of Certified Public Accountants (AICPA) or the National Association of Tax Professionals (NATP).

What are the continuing education requirements for Revenue Tax Specialists?

Revenue Tax Specialists must complete continuing education credits each year to maintain their licenses.