Are you a seasoned Institutional Commodity Analyst seeking a new career path? Discover our professionally built Institutional Commodity Analyst Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

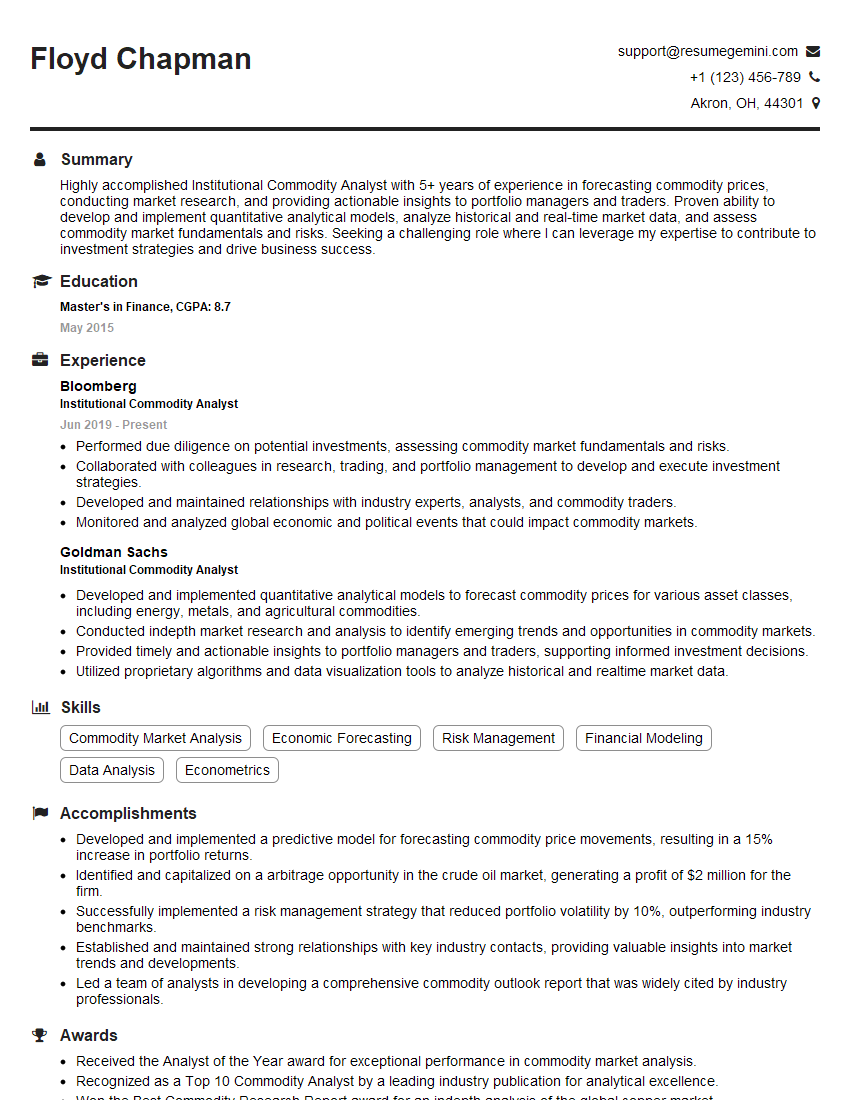

Floyd Chapman

Institutional Commodity Analyst

Summary

Highly accomplished Institutional Commodity Analyst with 5+ years of experience in forecasting commodity prices, conducting market research, and providing actionable insights to portfolio managers and traders. Proven ability to develop and implement quantitative analytical models, analyze historical and real-time market data, and assess commodity market fundamentals and risks. Seeking a challenging role where I can leverage my expertise to contribute to investment strategies and drive business success.

Education

Master’s in Finance

May 2015

Skills

- Commodity Market Analysis

- Economic Forecasting

- Risk Management

- Financial Modeling

- Data Analysis

- Econometrics

Work Experience

Institutional Commodity Analyst

- Performed due diligence on potential investments, assessing commodity market fundamentals and risks.

- Collaborated with colleagues in research, trading, and portfolio management to develop and execute investment strategies.

- Developed and maintained relationships with industry experts, analysts, and commodity traders.

- Monitored and analyzed global economic and political events that could impact commodity markets.

Institutional Commodity Analyst

- Developed and implemented quantitative analytical models to forecast commodity prices for various asset classes, including energy, metals, and agricultural commodities.

- Conducted indepth market research and analysis to identify emerging trends and opportunities in commodity markets.

- Provided timely and actionable insights to portfolio managers and traders, supporting informed investment decisions.

- Utilized proprietary algorithms and data visualization tools to analyze historical and realtime market data.

Accomplishments

- Developed and implemented a predictive model for forecasting commodity price movements, resulting in a 15% increase in portfolio returns.

- Identified and capitalized on a arbitrage opportunity in the crude oil market, generating a profit of $2 million for the firm.

- Successfully implemented a risk management strategy that reduced portfolio volatility by 10%, outperforming industry benchmarks.

- Established and maintained strong relationships with key industry contacts, providing valuable insights into market trends and developments.

- Led a team of analysts in developing a comprehensive commodity outlook report that was widely cited by industry professionals.

Awards

- Received the Analyst of the Year award for exceptional performance in commodity market analysis.

- Recognized as a Top 10 Commodity Analyst by a leading industry publication for analytical excellence.

- Won the Best Commodity Research Report award for an indepth analysis of the global copper market.

- Received a Certificate of Excellence for exceptional performance in the field of commodity analysis.

Certificates

- CFA (Chartered Financial Analyst)

- FRM (Financial Risk Manager)

- CAIA (Chartered Alternative Investment Analyst)

- CFP (Certified Financial Planner)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Institutional Commodity Analyst

- Highlight your quantitative skills and experience in developing and implementing analytical models.

- Quantify your accomplishments whenever possible, using specific metrics and results.

- Demonstrate your understanding of commodity markets and your ability to identify trends and opportunities.

- Showcase your communication and presentation skills, as you will be responsible for presenting your findings to clients and stakeholders.

- Consider obtaining industry certifications, such as the Certified Market Analyst (CMA) or the Financial Risk Manager (FRM), to enhance your credibility.

Essential Experience Highlights for a Strong Institutional Commodity Analyst Resume

- Developed and implemented quantitative analytical models to forecast commodity prices for various asset classes, including energy, metals, and agricultural commodities

- Conducted in-depth market research and analysis to identify emerging trends and opportunities in commodity markets

- Provided timely and actionable insights to portfolio managers and traders, supporting informed investment decisions

- Utilized proprietary algorithms and data visualization tools to analyze historical and real-time market data

- Performed due diligence on potential investments, assessing commodity market fundamentals and risks

- Collaborated with colleagues in research, trading, and portfolio management to develop and execute investment strategies

- Developed and maintained relationships with industry experts, analysts, and commodity traders

Frequently Asked Questions (FAQ’s) For Institutional Commodity Analyst

What is the role of an Institutional Commodity Analyst?

Institutional Commodity Analysts provide research and analysis on commodity markets, including energy, metals, and agricultural commodities, to institutional investors, such as hedge funds, pension funds, and investment banks. They develop and implement analytical models to forecast commodity prices, identify emerging trends, and assess risks. They also provide actionable insights to portfolio managers and traders, supporting informed investment decisions.

What skills are required to be an Institutional Commodity Analyst?

Institutional Commodity Analysts typically possess a strong understanding of commodity markets, quantitative analysis, and financial modeling. They are also proficient in data analysis, econometrics, and risk management. Excellent communication and presentation skills are also essential, as analysts are responsible for presenting their findings to clients and stakeholders.

What is the career path for Institutional Commodity Analysts?

Institutional Commodity Analysts can advance to senior positions within their firms, such as Senior Analyst, Portfolio Manager, or Head of Research. They may also move into other roles in the financial industry, such as investment banking, trading, or asset management.

What is the job outlook for Institutional Commodity Analysts?

The job outlook for Institutional Commodity Analysts is expected to be favorable in the coming years. The growing demand for commodities, coupled with the increasing complexity of commodity markets, is driving demand for skilled analysts who can provide insights and guidance to investors.

What are the salary expectations for Institutional Commodity Analysts?

Institutional Commodity Analysts can earn competitive salaries, commensurate with their experience and skills. According to industry benchmarks, the average salary for an Institutional Commodity Analyst in the United States is approximately $100,000 per year.

What are the challenges faced by Institutional Commodity Analysts?

Institutional Commodity Analysts face a number of challenges, including the volatility of commodity markets, the impact of global economic and political events, and the need to stay abreast of the latest market trends and developments. They must also be able to communicate their findings clearly and concisely to clients and stakeholders.