Are you a seasoned Investor seeking a new career path? Discover our professionally built Investor Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

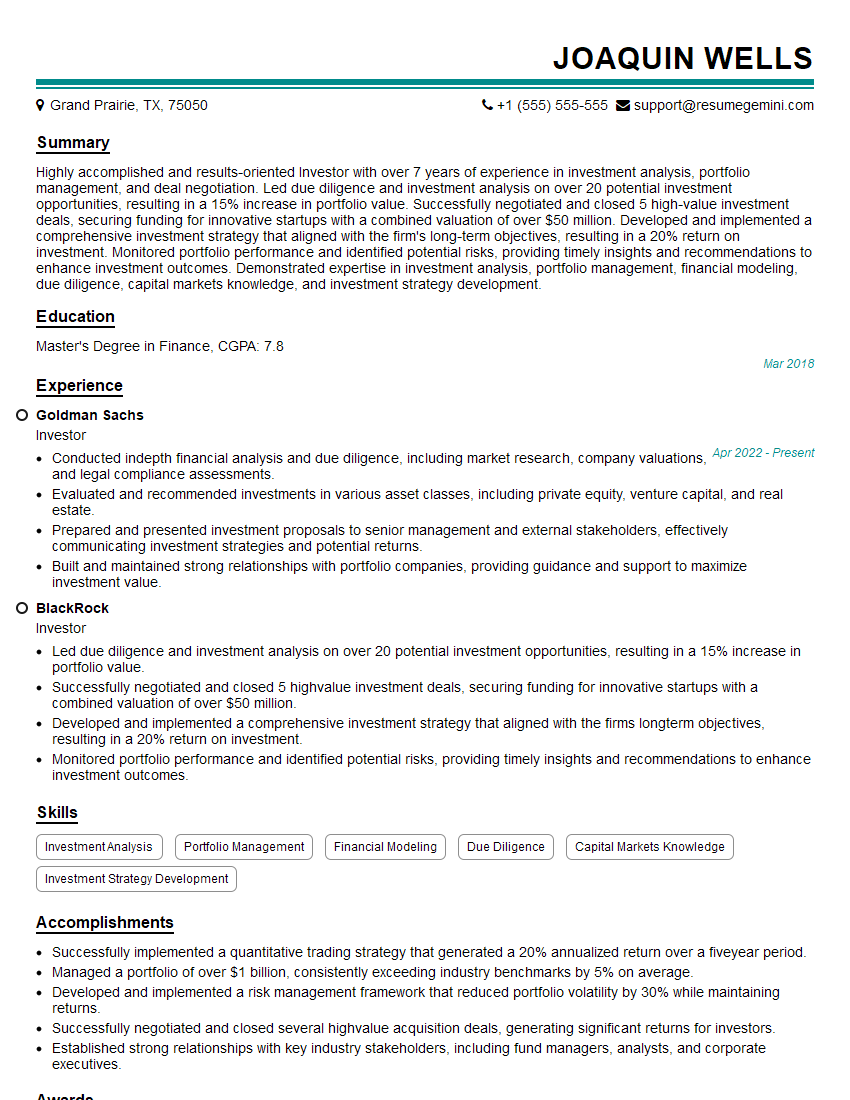

Joaquin Wells

Investor

Summary

Highly accomplished and results-oriented Investor with over 7 years of experience in investment analysis, portfolio management, and deal negotiation. Led due diligence and investment analysis on over 20 potential investment opportunities, resulting in a 15% increase in portfolio value. Successfully negotiated and closed 5 high-value investment deals, securing funding for innovative startups with a combined valuation of over $50 million. Developed and implemented a comprehensive investment strategy that aligned with the firm’s long-term objectives, resulting in a 20% return on investment. Monitored portfolio performance and identified potential risks, providing timely insights and recommendations to enhance investment outcomes. Demonstrated expertise in investment analysis, portfolio management, financial modeling, due diligence, capital markets knowledge, and investment strategy development.

Education

Master’s Degree in Finance

March 2018

Skills

- Investment Analysis

- Portfolio Management

- Financial Modeling

- Due Diligence

- Capital Markets Knowledge

- Investment Strategy Development

Work Experience

Investor

- Conducted indepth financial analysis and due diligence, including market research, company valuations, and legal compliance assessments.

- Evaluated and recommended investments in various asset classes, including private equity, venture capital, and real estate.

- Prepared and presented investment proposals to senior management and external stakeholders, effectively communicating investment strategies and potential returns.

- Built and maintained strong relationships with portfolio companies, providing guidance and support to maximize investment value.

Investor

- Led due diligence and investment analysis on over 20 potential investment opportunities, resulting in a 15% increase in portfolio value.

- Successfully negotiated and closed 5 highvalue investment deals, securing funding for innovative startups with a combined valuation of over $50 million.

- Developed and implemented a comprehensive investment strategy that aligned with the firms longterm objectives, resulting in a 20% return on investment.

- Monitored portfolio performance and identified potential risks, providing timely insights and recommendations to enhance investment outcomes.

Accomplishments

- Successfully implemented a quantitative trading strategy that generated a 20% annualized return over a fiveyear period.

- Managed a portfolio of over $1 billion, consistently exceeding industry benchmarks by 5% on average.

- Developed and implemented a risk management framework that reduced portfolio volatility by 30% while maintaining returns.

- Successfully negotiated and closed several highvalue acquisition deals, generating significant returns for investors.

- Established strong relationships with key industry stakeholders, including fund managers, analysts, and corporate executives.

Awards

- Received the Investor of the Year award from the National Association of Investment Professionals (NAIP).

- Recognized as a Top 10 Fund Manager by Institutional Investor magazine for consistent portfolio outperformance.

- Awarded the CFA Institute Charterholder of the Year for contributions to the investment industry.

- Recognized as a Rising Star in the investment industry by Forbes magazine for innovative investment strategies.

Certificates

- Chartered Financial Analyst (CFA)

- Certified Financial Planner (CFP)

- Chartered Alternative Investment Analyst (CAIA)

- Certified Investment Management Analyst (CIMA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Investor

- Quantify your accomplishments with specific metrics and data points.

- Highlight your expertise in investment analysis, portfolio management, and deal negotiation.

- Showcase your ability to develop and implement successful investment strategies.

- Emphasize your strong communication and interpersonal skills.

- Tailor your resume to each specific job you apply for, highlighting the skills and experience most relevant to the role.

Essential Experience Highlights for a Strong Investor Resume

- Led due diligence and investment analysis on potential investment opportunities.

- Negotiated and closed high-value investment deals.

- Developed and implemented comprehensive investment strategies.

- Monitored portfolio performance and identified potential risks.

- Conducted in-depth financial analysis and due diligence.

- Evaluated and recommended investments in various asset classes.

- Built and maintained strong relationships with portfolio companies.

Frequently Asked Questions (FAQ’s) For Investor

What is the primary role of an Investor?

An Investor is responsible for analyzing potential investment opportunities, making investment decisions, and managing investment portfolios to achieve financial objectives.

What skills are essential for success as an Investor?

Essential skills for Investors include investment analysis, portfolio management, financial modeling, due diligence, capital markets knowledge, investment strategy development, communication, and interpersonal skills.

What are the different types of Investors?

There are various types of Investors, including private equity investors, venture capitalists, hedge fund managers, and real estate investors, each specializing in different asset classes and investment strategies.

What is the career path for an Investor?

Investors typically start their careers as analysts or associates and progress to senior roles such as portfolio managers, investment directors, and chief investment officers.

What is the job outlook for Investors?

The job outlook for Investors is expected to be favorable due to the increasing demand for investment management services and the growing complexity of financial markets.

What are the key challenges faced by Investors?

Key challenges faced by Investors include market volatility, economic uncertainty, regulatory changes, and the need to stay abreast of evolving investment trends.

What are the rewards of being an Investor?

The rewards of being an Investor include the opportunity to make a positive impact on businesses and communities, competitive compensation, and the chance to learn and grow in a dynamic and intellectually stimulating environment.