Are you a seasoned Individual Pension Consultant seeking a new career path? Discover our professionally built Individual Pension Consultant Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

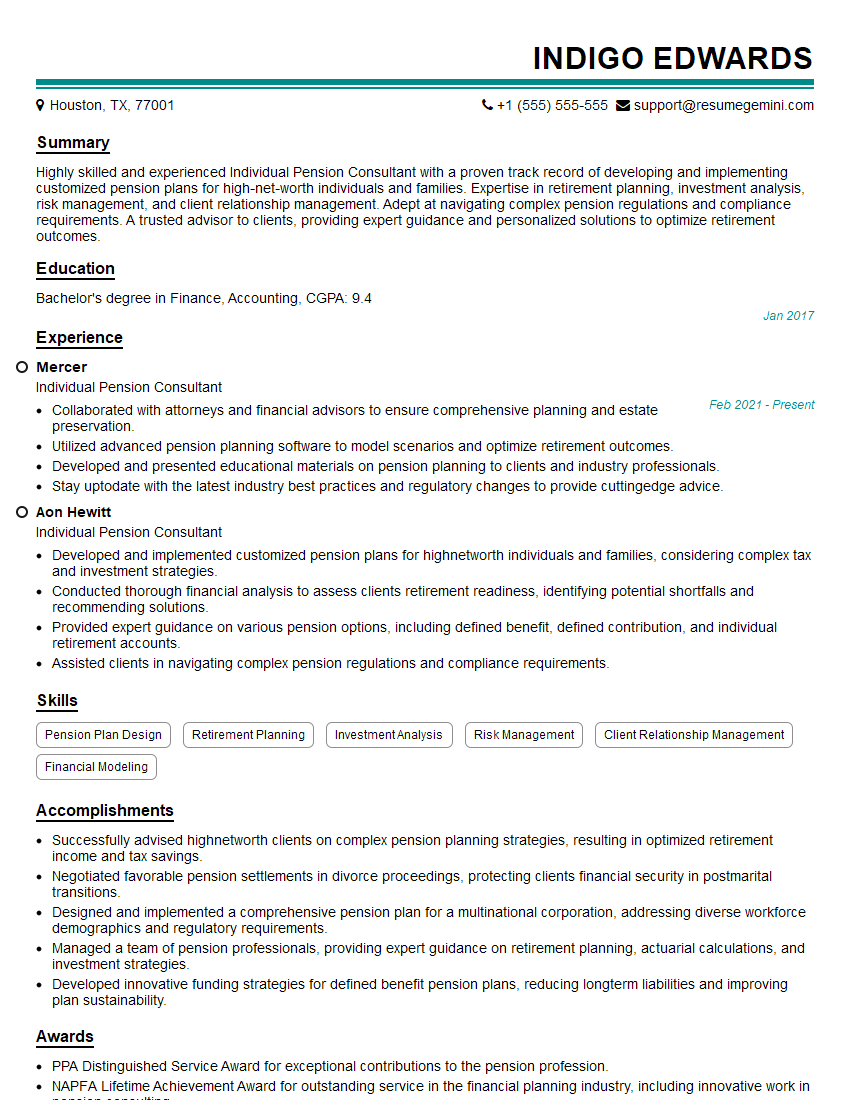

Indigo Edwards

Individual Pension Consultant

Summary

Highly skilled and experienced Individual Pension Consultant with a proven track record of developing and implementing customized pension plans for high-net-worth individuals and families. Expertise in retirement planning, investment analysis, risk management, and client relationship management. Adept at navigating complex pension regulations and compliance requirements. A trusted advisor to clients, providing expert guidance and personalized solutions to optimize retirement outcomes.

Education

Bachelor’s degree in Finance, Accounting

January 2017

Skills

- Pension Plan Design

- Retirement Planning

- Investment Analysis

- Risk Management

- Client Relationship Management

- Financial Modeling

Work Experience

Individual Pension Consultant

- Collaborated with attorneys and financial advisors to ensure comprehensive planning and estate preservation.

- Utilized advanced pension planning software to model scenarios and optimize retirement outcomes.

- Developed and presented educational materials on pension planning to clients and industry professionals.

- Stay uptodate with the latest industry best practices and regulatory changes to provide cuttingedge advice.

Individual Pension Consultant

- Developed and implemented customized pension plans for highnetworth individuals and families, considering complex tax and investment strategies.

- Conducted thorough financial analysis to assess clients retirement readiness, identifying potential shortfalls and recommending solutions.

- Provided expert guidance on various pension options, including defined benefit, defined contribution, and individual retirement accounts.

- Assisted clients in navigating complex pension regulations and compliance requirements.

Accomplishments

- Successfully advised highnetworth clients on complex pension planning strategies, resulting in optimized retirement income and tax savings.

- Negotiated favorable pension settlements in divorce proceedings, protecting clients financial security in postmarital transitions.

- Designed and implemented a comprehensive pension plan for a multinational corporation, addressing diverse workforce demographics and regulatory requirements.

- Managed a team of pension professionals, providing expert guidance on retirement planning, actuarial calculations, and investment strategies.

- Developed innovative funding strategies for defined benefit pension plans, reducing longterm liabilities and improving plan sustainability.

Awards

- PPA Distinguished Service Award for exceptional contributions to the pension profession.

- NAPFA Lifetime Achievement Award for outstanding service in the financial planning industry, including innovative work in pension consulting.

- Employee Benefits National Association (EBNA) Hall of Fame for significant contributions to the pension consulting field.

- International Foundation of Employee Benefit Plans (IFEBP) Pension Consultant of the Year Award for exceptional expertise and leadership in the profession.

Certificates

- Certified Pension Consultant (CPC)

- Certified Financial Planner (CFP)

- Enrolled Actuary (EA)

- Accredited Investment Fiduciary (AIF)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Individual Pension Consultant

- Quantify your accomplishments and results whenever possible. Use specific numbers and metrics to demonstrate the impact of your work.

- Highlight your ability to build and maintain strong relationships with clients. Provide examples of how you have exceeded client expectations and gone the extra mile.

- Showcase your technical proficiency in pension planning and retirement strategies. Mention any certifications or professional development activities that demonstrate your commitment to staying up-to-date.

- Emphasize your communication and presentation skills. As an Individual Pension Consultant, you will need to effectively convey complex financial concepts to clients and other stakeholders.

- Tailor your resume to each specific job opportunity. Highlight the skills and experience that are most relevant to the role and company you are applying to.

Essential Experience Highlights for a Strong Individual Pension Consultant Resume

- Develop and implement customized pension plans tailored to the unique needs and objectives of high-net-worth individuals and families.

- Conduct thorough financial analysis to assess clients’ retirement readiness, identify potential shortfalls, and recommend appropriate solutions.

- Provide expert guidance on various pension options, including defined benefit, defined contribution, and individual retirement accounts.

- Assist clients in navigating complex pension regulations and compliance requirements to ensure adherence to legal and fiduciary responsibilities.

- Collaborate with attorneys and financial advisors to ensure comprehensive planning and estate preservation, integrating pension strategies with other financial instruments.

- Utilize advanced pension planning software to model scenarios, optimize retirement outcomes, and provide clients with comprehensive projections and illustrations.

- Develop and present educational materials on pension planning to clients and industry professionals, sharing expertise and promoting financial literacy.

Frequently Asked Questions (FAQ’s) For Individual Pension Consultant

What are the key responsibilities of an Individual Pension Consultant?

Individual Pension Consultants are responsible for developing and implementing customized pension plans for high-net-worth individuals and families. They conduct financial analysis, provide expert guidance on pension options, assist clients in navigating regulations, collaborate with other professionals, utilize advanced planning software, and educate clients and industry professionals.

What qualifications and experience are required to become an Individual Pension Consultant?

Individual Pension Consultants typically hold a bachelor’s degree in Finance, Accounting, or a related field. They have experience in retirement planning, investment analysis, risk management, and client relationship management. Certifications and professional development activities in pension planning are also beneficial.

What is the job outlook for Individual Pension Consultants?

The job outlook for Individual Pension Consultants is expected to be positive in the coming years. The aging population and increasing complexity of retirement planning are driving demand for qualified professionals who can provide personalized guidance.

What are the earning potential and career advancement opportunities for Individual Pension Consultants?

Individual Pension Consultants can earn competitive salaries and bonuses. Career advancement opportunities include moving into management roles, specializing in specific areas of pension planning, or starting their own consulting practice.

What are the benefits of working as an Individual Pension Consultant?

Working as an Individual Pension Consultant offers several benefits, including the opportunity to make a meaningful impact on clients’ lives, intellectual challenges, professional growth opportunities, and competitive compensation.

What are the challenges of working as an Individual Pension Consultant?

Individual Pension Consultants may face challenges such as keeping up with regulatory changes, managing complex client needs, and dealing with market volatility. However, these challenges can also be seen as opportunities for professional development and growth.

What is the difference between an Individual Pension Consultant and a Financial Advisor?

While both Individual Pension Consultants and Financial Advisors provide financial advice, Individual Pension Consultants specialize in pension planning for high-net-worth individuals and families. They have a deep understanding of pension regulations and strategies and focus on optimizing retirement outcomes.

How can I find a job as an Individual Pension Consultant?

To find a job as an Individual Pension Consultant, you can network with professionals in the industry, search for job openings online, and reach out to recruiting agencies specializing in financial services.