Are you a seasoned Insurance Consultant seeking a new career path? Discover our professionally built Insurance Consultant Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

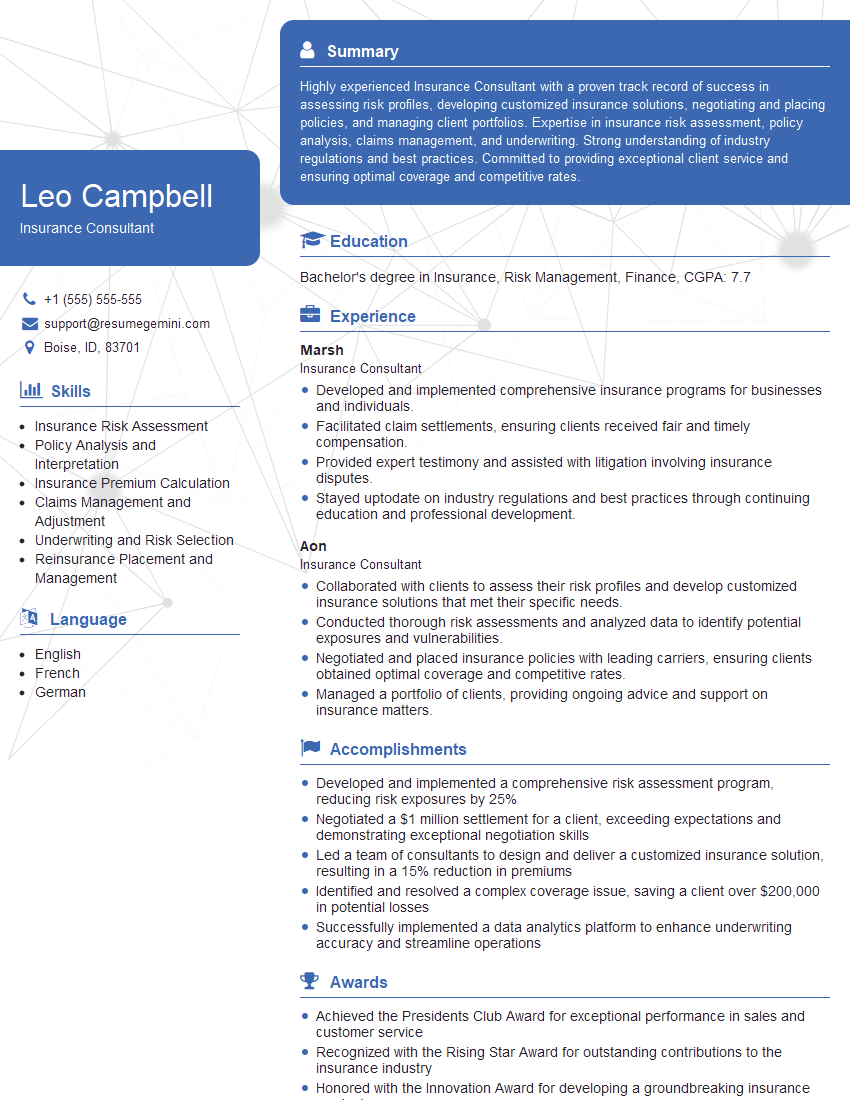

Leo Campbell

Insurance Consultant

Summary

Highly experienced Insurance Consultant with a proven track record of success in assessing risk profiles, developing customized insurance solutions, negotiating and placing policies, and managing client portfolios. Expertise in insurance risk assessment, policy analysis, claims management, and underwriting. Strong understanding of industry regulations and best practices. Committed to providing exceptional client service and ensuring optimal coverage and competitive rates.

Education

Bachelor’s degree in Insurance, Risk Management, Finance

August 2015

Skills

- Insurance Risk Assessment

- Policy Analysis and Interpretation

- Insurance Premium Calculation

- Claims Management and Adjustment

- Underwriting and Risk Selection

- Reinsurance Placement and Management

Work Experience

Insurance Consultant

- Developed and implemented comprehensive insurance programs for businesses and individuals.

- Facilitated claim settlements, ensuring clients received fair and timely compensation.

- Provided expert testimony and assisted with litigation involving insurance disputes.

- Stayed uptodate on industry regulations and best practices through continuing education and professional development.

Insurance Consultant

- Collaborated with clients to assess their risk profiles and develop customized insurance solutions that met their specific needs.

- Conducted thorough risk assessments and analyzed data to identify potential exposures and vulnerabilities.

- Negotiated and placed insurance policies with leading carriers, ensuring clients obtained optimal coverage and competitive rates.

- Managed a portfolio of clients, providing ongoing advice and support on insurance matters.

Accomplishments

- Developed and implemented a comprehensive risk assessment program, reducing risk exposures by 25%

- Negotiated a $1 million settlement for a client, exceeding expectations and demonstrating exceptional negotiation skills

- Led a team of consultants to design and deliver a customized insurance solution, resulting in a 15% reduction in premiums

- Identified and resolved a complex coverage issue, saving a client over $200,000 in potential losses

- Successfully implemented a data analytics platform to enhance underwriting accuracy and streamline operations

Awards

- Achieved the Presidents Club Award for exceptional performance in sales and customer service

- Recognized with the Rising Star Award for outstanding contributions to the insurance industry

- Honored with the Innovation Award for developing a groundbreaking insurance product

Certificates

- Chartered Property Casualty Underwriter (CPCU)

- Associate in Risk Management (ARM)

- Certified Insurance Counselor (CIC)

- Chartered Life Underwriter (CLU)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Insurance Consultant

- Highlight your expertise in insurance risk assessment and policy analysis.

- Quantify your accomplishments whenever possible, using specific numbers and metrics.

- Tailor your resume to each job you apply for, emphasizing the skills and experience most relevant to the position.

- Proofread your resume carefully for any errors before submitting it.

Essential Experience Highlights for a Strong Insurance Consultant Resume

- Collaborate with clients to assess their risk profiles and develop comprehensive insurance programs that meet their unique needs.

- Conduct thorough risk assessments and analyze data to identify potential exposures and vulnerabilities.

- Negotiate and place insurance policies with leading carriers, ensuring clients obtain optimal coverage and competitive rates.

- Manage a portfolio of clients, providing ongoing advice and support on insurance matters.

- Represent clients in insurance disputes, providing expert testimony and assisting with litigation.

- Stay up-to-date on industry regulations and best practices through continuing education and professional development.

- Facilitate claim settlements, ensuring clients receive fair and timely compensation.

Frequently Asked Questions (FAQ’s) For Insurance Consultant

What are the key skills required to be a successful Insurance Consultant?

Key skills include insurance risk assessment, policy analysis, claims management, underwriting, and reinsurance placement.

What is the career path for an Insurance Consultant?

Insurance Consultants can advance to positions such as Senior Consultant, Manager, or Principal.

What is the salary range for an Insurance Consultant?

The salary range for Insurance Consultants can vary depending on experience, location, and company size, but typically ranges from $60,000 to $120,000 per year.

What are the benefits of working as an Insurance Consultant?

Benefits include competitive salary and benefits, opportunities for career advancement, and the chance to make a difference in the lives of clients.

What are the challenges of working as an Insurance Consultant?

Challenges include the need to stay up-to-date on industry regulations, the potential for long hours, and the need to manage multiple client relationships.