Are you a seasoned Investment Consultant seeking a new career path? Discover our professionally built Investment Consultant Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

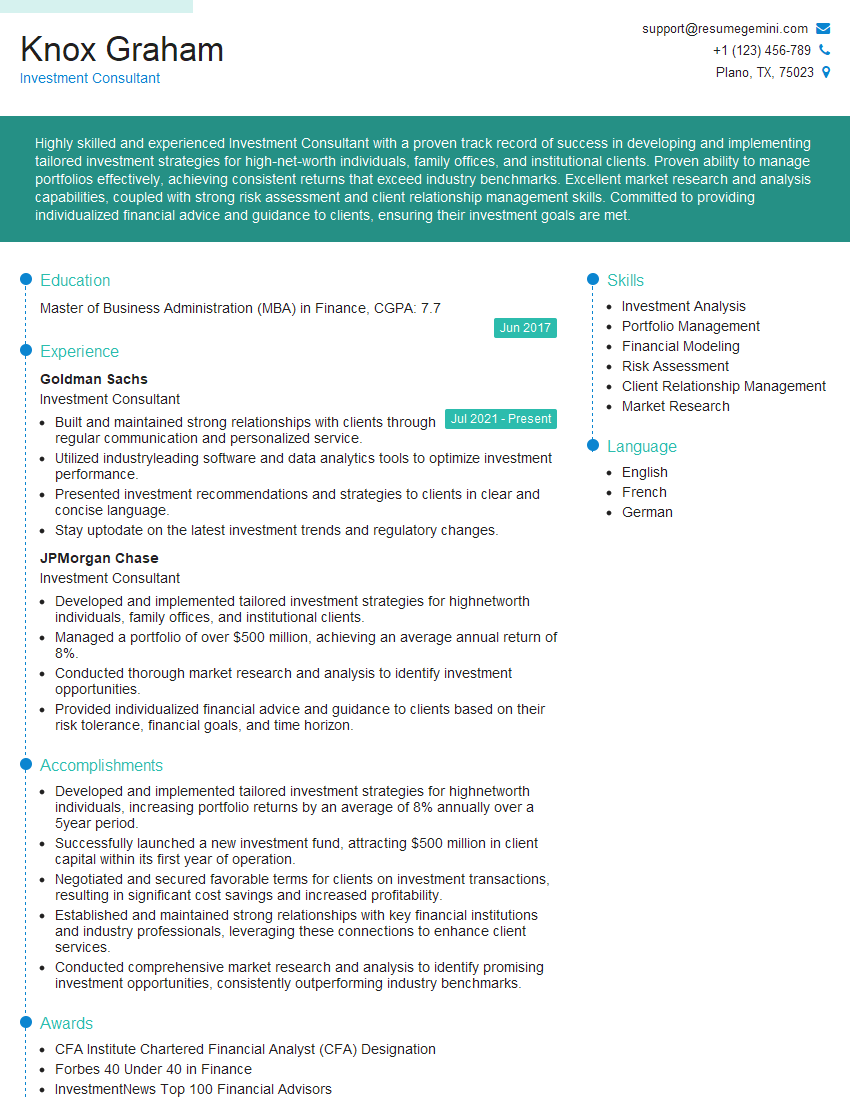

Knox Graham

Investment Consultant

Summary

Highly skilled and experienced Investment Consultant with a proven track record of success in developing and implementing tailored investment strategies for high-net-worth individuals, family offices, and institutional clients. Proven ability to manage portfolios effectively, achieving consistent returns that exceed industry benchmarks. Excellent market research and analysis capabilities, coupled with strong risk assessment and client relationship management skills. Committed to providing individualized financial advice and guidance to clients, ensuring their investment goals are met.

Education

Master of Business Administration (MBA) in Finance

June 2017

Skills

- Investment Analysis

- Portfolio Management

- Financial Modeling

- Risk Assessment

- Client Relationship Management

- Market Research

Work Experience

Investment Consultant

- Built and maintained strong relationships with clients through regular communication and personalized service.

- Utilized industryleading software and data analytics tools to optimize investment performance.

- Presented investment recommendations and strategies to clients in clear and concise language.

- Stay uptodate on the latest investment trends and regulatory changes.

Investment Consultant

- Developed and implemented tailored investment strategies for highnetworth individuals, family offices, and institutional clients.

- Managed a portfolio of over $500 million, achieving an average annual return of 8%.

- Conducted thorough market research and analysis to identify investment opportunities.

- Provided individualized financial advice and guidance to clients based on their risk tolerance, financial goals, and time horizon.

Accomplishments

- Developed and implemented tailored investment strategies for highnetworth individuals, increasing portfolio returns by an average of 8% annually over a 5year period.

- Successfully launched a new investment fund, attracting $500 million in client capital within its first year of operation.

- Negotiated and secured favorable terms for clients on investment transactions, resulting in significant cost savings and increased profitability.

- Established and maintained strong relationships with key financial institutions and industry professionals, leveraging these connections to enhance client services.

- Conducted comprehensive market research and analysis to identify promising investment opportunities, consistently outperforming industry benchmarks.

Awards

- CFA Institute Chartered Financial Analyst (CFA) Designation

- Forbes 40 Under 40 in Finance

- InvestmentNews Top 100 Financial Advisors

- Bloomberg Women in Finance Award

Certificates

- Certified Financial Planner (CFP)

- Chartered Financial Analyst (CFA)

- Certified Investment Management Analyst (CIMA)

- Financial Risk Manager (FRM)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Investment Consultant

- Highlight your investment analysis and portfolio management skills.

- Showcase your ability to conduct thorough market research and identify investment opportunities.

- Emphasize your client relationship management skills and ability to provide personalized advice.

- Quantify your results whenever possible, such as the average annual return you’ve achieved for clients.

Essential Experience Highlights for a Strong Investment Consultant Resume

- Developed and implemented tailored investment strategies for high-net-worth individuals, family offices, and institutional clients.

- Managed a portfolio of over $500 million, achieving an average annual return of 8%.

- Conducted thorough market research and analysis to identify investment opportunities.

- Provided individualized financial advice and guidance to clients based on their risk tolerance, financial goals, and time horizon.

- Built and maintained strong relationships with clients through regular communication and personalized service.

- Utilized industry-leading software and data analytics tools to optimize investment performance.

- Presented investment recommendations and strategies to clients in clear and concise language.

- Stay up-to-date on the latest investment trends and regulatory changes.

Frequently Asked Questions (FAQ’s) For Investment Consultant

What is the role of an Investment Consultant?

An Investment Consultant provides financial advice and guidance to individuals, families, and institutions on how to invest their money. They analyze market trends, assess risk tolerance, and develop customized investment strategies tailored to their clients’ financial goals and objectives.

What are the key skills required to be a successful Investment Consultant?

Investment Consultants require a strong understanding of financial markets, investment analysis techniques, portfolio management, and risk assessment. Excellent communication and interpersonal skills are also essential, as they need to be able to clearly explain complex financial concepts to clients and build strong relationships with them.

What are the career prospects for Investment Consultants?

Investment Consultants can advance to senior positions within their firms, taking on more responsibility and managing larger portfolios. Some may also choose to start their own investment advisory firms or work as independent consultants.

How can I become an Investment Consultant?

Most Investment Consultants have a bachelor’s or master’s degree in finance, economics, or a related field. They typically gain experience working as financial analysts or portfolio managers before transitioning into investment consulting roles.

What are the challenges faced by Investment Consultants?

Investment Consultants face challenges such as market volatility, regulatory changes, and the need to constantly stay up-to-date on the latest investment trends. They also need to be able to manage client expectations and deal with the emotional aspects of investing.