Are you a seasoned Wealth Management Advisor seeking a new career path? Discover our professionally built Wealth Management Advisor Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

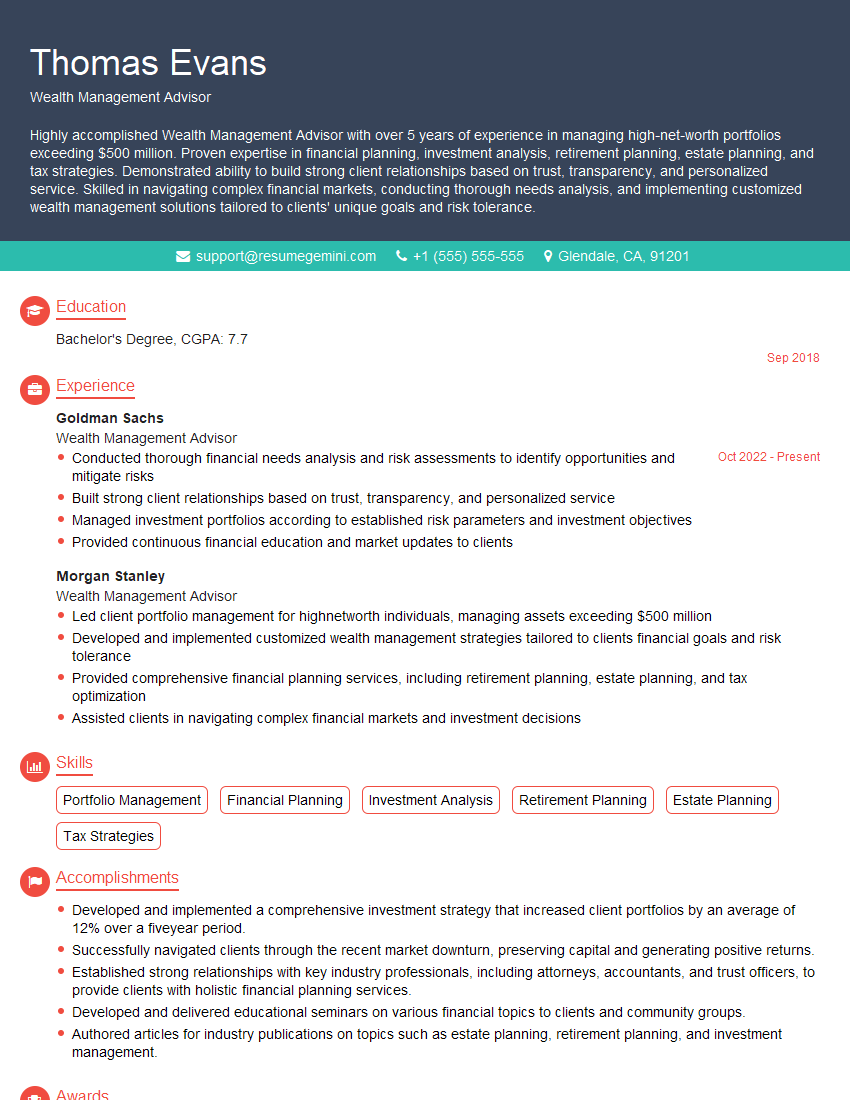

Thomas Evans

Wealth Management Advisor

Summary

Highly accomplished Wealth Management Advisor with over 5 years of experience in managing high-net-worth portfolios exceeding $500 million. Proven expertise in financial planning, investment analysis, retirement planning, estate planning, and tax strategies. Demonstrated ability to build strong client relationships based on trust, transparency, and personalized service. Skilled in navigating complex financial markets, conducting thorough needs analysis, and implementing customized wealth management solutions tailored to clients’ unique goals and risk tolerance.

Education

Bachelor’s Degree

September 2018

Skills

- Portfolio Management

- Financial Planning

- Investment Analysis

- Retirement Planning

- Estate Planning

- Tax Strategies

Work Experience

Wealth Management Advisor

- Conducted thorough financial needs analysis and risk assessments to identify opportunities and mitigate risks

- Built strong client relationships based on trust, transparency, and personalized service

- Managed investment portfolios according to established risk parameters and investment objectives

- Provided continuous financial education and market updates to clients

Wealth Management Advisor

- Led client portfolio management for highnetworth individuals, managing assets exceeding $500 million

- Developed and implemented customized wealth management strategies tailored to clients financial goals and risk tolerance

- Provided comprehensive financial planning services, including retirement planning, estate planning, and tax optimization

- Assisted clients in navigating complex financial markets and investment decisions

Accomplishments

- Developed and implemented a comprehensive investment strategy that increased client portfolios by an average of 12% over a fiveyear period.

- Successfully navigated clients through the recent market downturn, preserving capital and generating positive returns.

- Established strong relationships with key industry professionals, including attorneys, accountants, and trust officers, to provide clients with holistic financial planning services.

- Developed and delivered educational seminars on various financial topics to clients and community groups.

- Authored articles for industry publications on topics such as estate planning, retirement planning, and investment management.

Awards

- Received the Financial Planning Associations Excellence Award for Outstanding Client Service.

- Recognized as a top performer in the WealthManagement.com annual ranking of feebased advisors.

- Awarded the CFA Institutes Certificate in Investment Performance Measurement.

- Achieved the CFP (Certified Financial Planner) designation.

Languages

- English

- French

- German

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Wealth Management Advisor

- Highlight your quantitative skills and experience in managing large portfolios.

- Showcase your knowledge of financial planning, investment analysis, and tax strategies.

- Emphasize your ability to build strong client relationships and provide personalized service.

- Include specific examples of how you have helped clients achieve their financial goals.

- Consider obtaining certifications, such as the CFP® or ChFC®, to demonstrate your expertise.

Essential Experience Highlights for a Strong Wealth Management Advisor Resume

- Led client portfolio management for high-net-worth individuals.

- Developed and implemented customized wealth management strategies tailored to clients’ financial goals and risk tolerance.

- Provided comprehensive financial planning services, including retirement planning, estate planning, and tax optimization.

- Assisted clients in navigating complex financial markets and investment decisions.

- Conducted thorough financial needs analysis and risk assessments to identify opportunities and mitigate risks.

- Managed investment portfolios according to established risk parameters and investment objectives.

- Provided continuous financial education and market updates to clients.

Frequently Asked Questions (FAQ’s) For Wealth Management Advisor

What is the role of a Wealth Management Advisor?

A Wealth Management Advisor provides comprehensive financial advice and services to affluent individuals and families. They help clients manage their wealth, achieve their financial goals, and make informed financial decisions.

What are the key skills and qualifications for a Wealth Management Advisor?

Key skills include financial planning, investment analysis, portfolio management, and strong communication and interpersonal skills. Common qualifications include a Bachelor’s degree in finance, economics, or a related field, as well as industry certifications such as the CFP® or ChFC®.

What are the earning prospects for a Wealth Management Advisor?

Earning prospects vary depending on experience, qualifications, and the size and location of the firm. According to the U.S. Bureau of Labor Statistics, the median annual salary for financial advisors was $94,880 in May 2021. Top earners can earn well over $200,000 per year.

What is the job outlook for Wealth Management Advisors?

The job outlook is expected to be positive over the next few years. As the population ages and the number of high-net-worth individuals increases, the demand for qualified Wealth Management Advisors is likely to grow.

What are the challenges of being a Wealth Management Advisor?

Challenges include the need to stay up-to-date on complex financial regulations and market trends, as well as the pressure to meet clients’ expectations and achieve their financial goals.

What are the rewards of being a Wealth Management Advisor?

Rewards include the opportunity to make a real difference in clients’ lives, the intellectual challenge of managing complex financial portfolios, and the potential for high earnings.

How can I become a Wealth Management Advisor?

To become a Wealth Management Advisor, you typically need a Bachelor’s degree in finance, economics, or a related field, as well as industry certifications such as the CFP® or ChFC®. You will also need to gain experience in financial planning and investment management.