Are you a seasoned Marine Underwriter seeking a new career path? Discover our professionally built Marine Underwriter Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

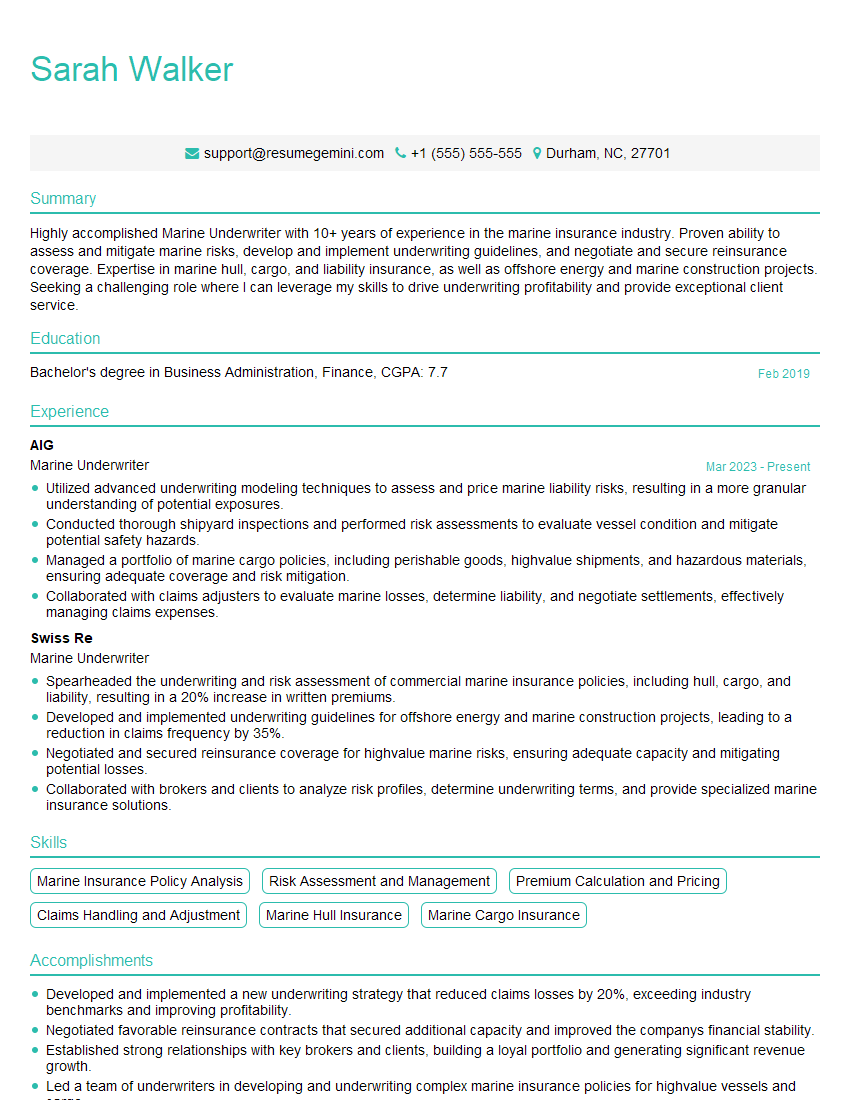

Sarah Walker

Marine Underwriter

Summary

Highly accomplished Marine Underwriter with 10+ years of experience in the marine insurance industry. Proven ability to assess and mitigate marine risks, develop and implement underwriting guidelines, and negotiate and secure reinsurance coverage. Expertise in marine hull, cargo, and liability insurance, as well as offshore energy and marine construction projects. Seeking a challenging role where I can leverage my skills to drive underwriting profitability and provide exceptional client service.

Education

Bachelor’s degree in Business Administration, Finance

February 2019

Skills

- Marine Insurance Policy Analysis

- Risk Assessment and Management

- Premium Calculation and Pricing

- Claims Handling and Adjustment

- Marine Hull Insurance

- Marine Cargo Insurance

Work Experience

Marine Underwriter

- Utilized advanced underwriting modeling techniques to assess and price marine liability risks, resulting in a more granular understanding of potential exposures.

- Conducted thorough shipyard inspections and performed risk assessments to evaluate vessel condition and mitigate potential safety hazards.

- Managed a portfolio of marine cargo policies, including perishable goods, highvalue shipments, and hazardous materials, ensuring adequate coverage and risk mitigation.

- Collaborated with claims adjusters to evaluate marine losses, determine liability, and negotiate settlements, effectively managing claims expenses.

Marine Underwriter

- Spearheaded the underwriting and risk assessment of commercial marine insurance policies, including hull, cargo, and liability, resulting in a 20% increase in written premiums.

- Developed and implemented underwriting guidelines for offshore energy and marine construction projects, leading to a reduction in claims frequency by 35%.

- Negotiated and secured reinsurance coverage for highvalue marine risks, ensuring adequate capacity and mitigating potential losses.

- Collaborated with brokers and clients to analyze risk profiles, determine underwriting terms, and provide specialized marine insurance solutions.

Accomplishments

- Developed and implemented a new underwriting strategy that reduced claims losses by 20%, exceeding industry benchmarks and improving profitability.

- Negotiated favorable reinsurance contracts that secured additional capacity and improved the companys financial stability.

- Established strong relationships with key brokers and clients, building a loyal portfolio and generating significant revenue growth.

- Led a team of underwriters in developing and underwriting complex marine insurance policies for highvalue vessels and cargo.

- Implemented a comprehensive underwriting model that enhanced risk assessment and pricing accuracy, resulting in improved underwriting results.

Awards

- Received the Marine Underwriter of the Year award from the American Institute of Marine Underwriters for exceptional performance and contributions to the industry.

- Recognized with the Excellence in Marine Risk Management award from the International Union of Marine Insurers for innovative approaches and successful risk mitigation strategies.

- Awarded the Outstanding Service to the Marine Insurance Community accolade by the Marine Insurance Agents and Brokers Association for dedicated contributions and mentorship.

- Received the Young Professional of the Year award from the Marine Insurance Institute for exceptional achievements and leadership potential.

Certificates

- Associate in Marine Insurance (AIM)

- Chartered Property Casualty Underwriter (CPCU)

- Marine Insurance Professional (MIP)

- Advanced Marine Insurance Analyst (AMIA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Marine Underwriter

- Highlight your expertise in marine insurance, particularly in areas such as hull, cargo, and liability.

- Quantify your accomplishments whenever possible, using specific metrics to demonstrate the impact of your work.

- Demonstrate your understanding of the marine industry and the specific risks involved in marine transportation.

- Showcase your ability to build relationships with brokers, clients, and reinsurers.

- Stay up-to-date on the latest trends and developments in the marine insurance industry.

Essential Experience Highlights for a Strong Marine Underwriter Resume

- Underwrite and assess risks for commercial marine insurance policies, including hull, cargo, and liability.

- Develop and implement underwriting guidelines to ensure consistent and profitable risk selection.

- Negotiate and secure reinsurance coverage for high-value marine risks to mitigate potential losses.

- Collaborate with brokers and clients to analyze risk profiles, determine underwriting terms, and provide tailored marine insurance solutions.

- Conduct thorough shipyard inspections and perform risk assessments to evaluate vessel condition and mitigate potential safety hazards.

- Manage a portfolio of marine cargo policies, including perishable goods, high-value shipments, and hazardous materials, ensuring adequate coverage and risk mitigation.

- Collaborate with claims adjusters to evaluate marine losses, determine liability, and negotiate settlements, effectively managing claims expenses.

Frequently Asked Questions (FAQ’s) For Marine Underwriter

What is the role of a Marine Underwriter?

Marine Underwriters assess and mitigate marine risks, develop and implement underwriting guidelines, and negotiate and secure reinsurance coverage. They work closely with brokers and clients to provide tailored marine insurance solutions for commercial marine operations.

What are the key skills required for a Marine Underwriter?

Key skills for Marine Underwriters include marine insurance policy analysis, risk assessment and management, premium calculation and pricing, claims handling and adjustment, marine hull insurance, and marine cargo insurance.

What is the career path for a Marine Underwriter?

Marine Underwriters typically start as Underwriting Assistants or Trainees and progress through various underwriting roles with increasing responsibilities. Senior-level positions include Underwriting Manager, Chief Underwriter, and Head of Marine Underwriting.

What are the challenges faced by Marine Underwriters?

Marine Underwriters face challenges such as assessing complex marine risks, navigating fluctuating market conditions, and managing claims in a timely and efficient manner.

What is the job outlook for Marine Underwriters?

The job outlook for Marine Underwriters is expected to be positive due to the growing demand for marine insurance coverage as global trade and shipping activities increase.

What professional development opportunities are available for Marine Underwriters?

Marine Underwriters can pursue professional designations such as the Chartered Property Casualty Underwriter (CPCU) and the Associate in Marine Insurance (AIM) to enhance their knowledge and credibility.

What is the salary range for Marine Underwriters?

The salary range for Marine Underwriters varies depending on factors such as experience, location, and company size. According to Indeed, the average salary for Marine Underwriters in the United States is around $100,000 per year.