Are you a seasoned Underwriting Director seeking a new career path? Discover our professionally built Underwriting Director Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

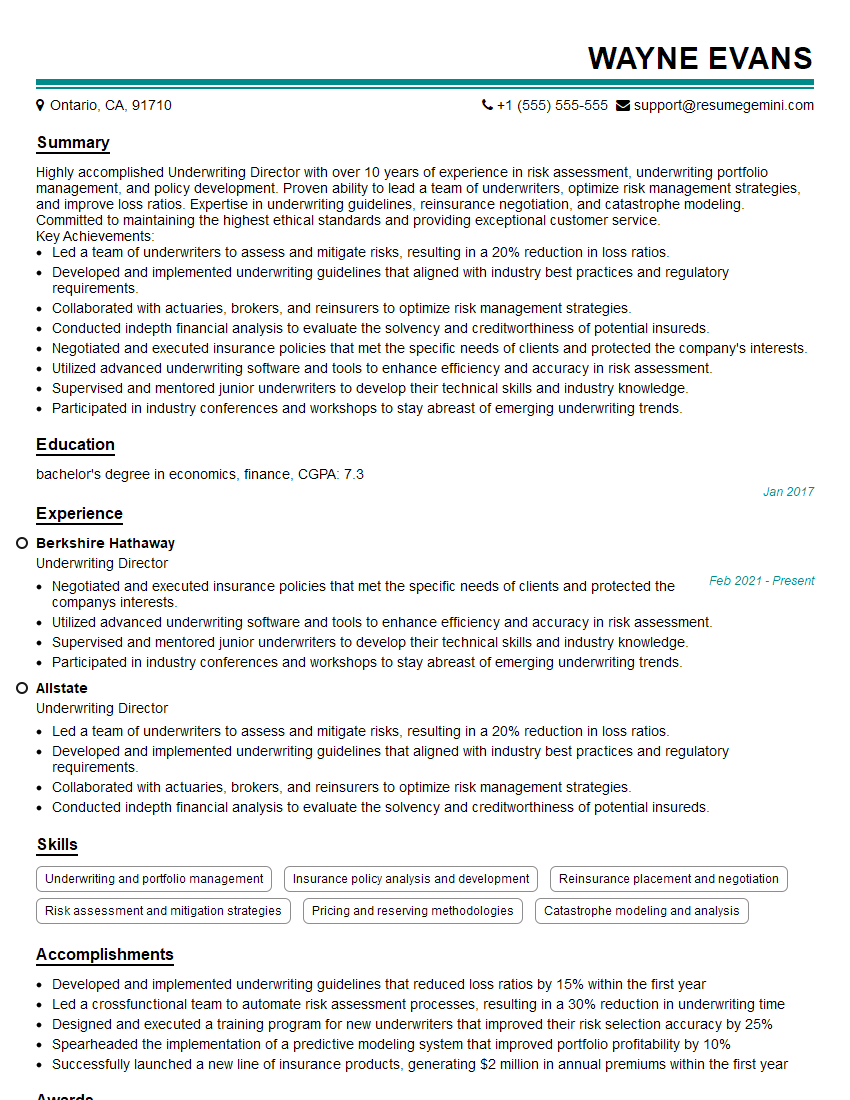

Wayne Evans

Underwriting Director

Summary

Highly accomplished Underwriting Director with over 10 years of experience in risk assessment, underwriting portfolio management, and policy development. Proven ability to lead a team of underwriters, optimize risk management strategies, and improve loss ratios. Expertise in underwriting guidelines, reinsurance negotiation, and catastrophe modeling. Committed to maintaining the highest ethical standards and providing exceptional customer service.

Key Achievements:

- Led a team of underwriters to assess and mitigate risks, resulting in a 20% reduction in loss ratios.

- Developed and implemented underwriting guidelines that aligned with industry best practices and regulatory requirements.

- Collaborated with actuaries, brokers, and reinsurers to optimize risk management strategies.

- Conducted indepth financial analysis to evaluate the solvency and creditworthiness of potential insureds.

- Negotiated and executed insurance policies that met the specific needs of clients and protected the company’s interests.

- Utilized advanced underwriting software and tools to enhance efficiency and accuracy in risk assessment.

- Supervised and mentored junior underwriters to develop their technical skills and industry knowledge.

- Participated in industry conferences and workshops to stay abreast of emerging underwriting trends.

Education

bachelor’s degree in economics, finance

January 2017

Skills

- Underwriting and portfolio management

- Insurance policy analysis and development

- Reinsurance placement and negotiation

- Risk assessment and mitigation strategies

- Pricing and reserving methodologies

- Catastrophe modeling and analysis

Work Experience

Underwriting Director

- Negotiated and executed insurance policies that met the specific needs of clients and protected the companys interests.

- Utilized advanced underwriting software and tools to enhance efficiency and accuracy in risk assessment.

- Supervised and mentored junior underwriters to develop their technical skills and industry knowledge.

- Participated in industry conferences and workshops to stay abreast of emerging underwriting trends.

Underwriting Director

- Led a team of underwriters to assess and mitigate risks, resulting in a 20% reduction in loss ratios.

- Developed and implemented underwriting guidelines that aligned with industry best practices and regulatory requirements.

- Collaborated with actuaries, brokers, and reinsurers to optimize risk management strategies.

- Conducted indepth financial analysis to evaluate the solvency and creditworthiness of potential insureds.

Accomplishments

- Developed and implemented underwriting guidelines that reduced loss ratios by 15% within the first year

- Led a crossfunctional team to automate risk assessment processes, resulting in a 30% reduction in underwriting time

- Designed and executed a training program for new underwriters that improved their risk selection accuracy by 25%

- Spearheaded the implementation of a predictive modeling system that improved portfolio profitability by 10%

- Successfully launched a new line of insurance products, generating $2 million in annual premiums within the first year

Awards

- Recognized as Underwriter of the Year by the National Association of Underwriters for exceptional performance

- Awarded the Excellence in Underwriting Award by the International Association of Insurance Professionals

- Received the Presidents Award for Outstanding Achievement in Underwriting from the American Insurance Institute

- Honored with the Underwriting Excellence Award from the Insurance Institute of America

Certificates

- Chartered Property Casualty Underwriter (CPCU)

- Associate in Reinsurance (ARe)

- Certified Insurance Counselor (CIC)

- Fellow of the Society of Actuaries (FSA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Underwriting Director

- Quantify your accomplishments with specific metrics to demonstrate your impact on the organization.

- Highlight your expertise in underwriting software and tools, showcasing your proficiency in risk assessment and portfolio management.

- Emphasize your ability to negotiate favorable terms with reinsurers, demonstrating your understanding of the reinsurance market.

- Showcase your leadership and mentorship skills by describing your experience in developing and guiding a team of underwriters.

Essential Experience Highlights for a Strong Underwriting Director Resume

- Lead a team of underwriters to assess and mitigate risks, establishing underwriting guidelines and policies to ensure sound risk management practices.

- Conduct in-depth financial analysis of potential insureds to determine their solvency and creditworthiness, making informed decisions on policy issuance.

- Negotiate and execute insurance policies that meet the specific needs of clients, balancing risk exposure with coverage adequacy.

- Collaborate with actuaries, brokers, and reinsurers to optimize risk management strategies and ensure proper coverage for clients.

- Monitor and analyze underwriting results, identifying trends and implementing strategies to improve portfolio performance and reduce loss ratios.

- Stay abreast of industry best practices, regulatory changes, and emerging underwriting tools to maintain a competitive and compliant operation.

- Mentor and train junior underwriters, fostering their professional development and ensuring the continuation of underwriting expertise.

Frequently Asked Questions (FAQ’s) For Underwriting Director

What are the key responsibilities of an Underwriting Director?

The primary responsibilities of an Underwriting Director include leading a team of underwriters, developing underwriting guidelines, assessing risks, pricing and reserving policies, negotiating reinsurance, and monitoring underwriting performance.

What are the qualifications required to become an Underwriting Director?

Typically, an Underwriting Director requires a bachelor’s degree in economics, finance, or a related field, along with several years of experience in underwriting and risk management.

What are the career prospects for an Underwriting Director?

Underwriting Directors with strong leadership and technical skills can advance to senior management positions within insurance companies, such as Chief Underwriting Officer or Chief Risk Officer.

What are the challenges faced by Underwriting Directors?

Underwriting Directors face challenges in accurately assessing risks, managing underwriting cycles, navigating regulatory changes, and maintaining profitability while providing adequate coverage to clients.

What is the earning potential for an Underwriting Director?

The earning potential for an Underwriting Director varies depending on experience, company size, and industry. According to Salary.com, the average salary for an Underwriting Director in the United States is around $120,000 per year.

What are the essential skills for an Underwriting Director?

Essential skills for an Underwriting Director include strong analytical and problem-solving abilities, expertise in underwriting principles and practices, proficiency in financial modeling and analysis, excellent communication and negotiation skills, and a deep understanding of insurance regulations and industry trends.

How can I prepare for an interview for an Underwriting Director position?

To prepare for an interview for an Underwriting Director position, research the company and the industry, practice answering common interview questions, prepare questions to ask the interviewer, and highlight your relevant experience and skills.

What are the emerging trends in underwriting?

Emerging trends in underwriting include the use of artificial intelligence and machine learning in risk assessment, data analytics for more precise pricing, and the adoption of insurtech solutions to streamline underwriting processes.