Are you a seasoned Bank Compliance Officer seeking a new career path? Discover our professionally built Bank Compliance Officer Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

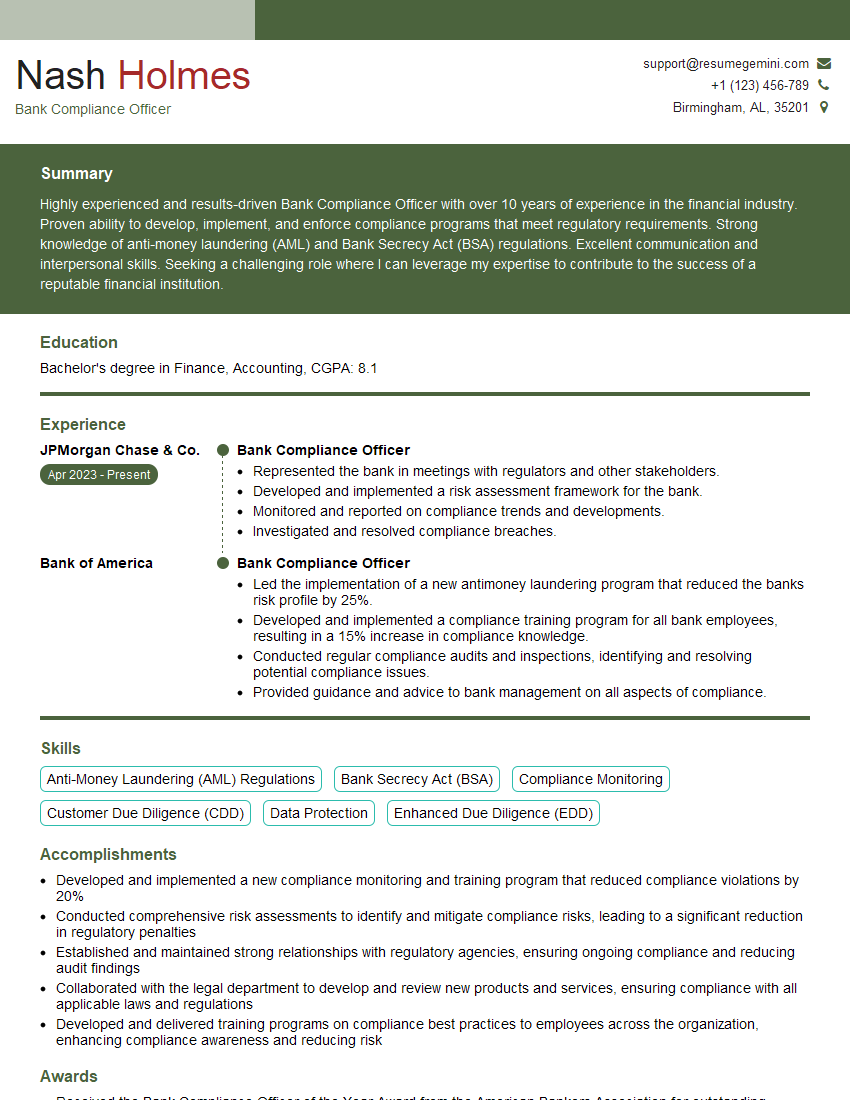

Nash Holmes

Bank Compliance Officer

Summary

Highly experienced and results-driven Bank Compliance Officer with over 10 years of experience in the financial industry. Proven ability to develop, implement, and enforce compliance programs that meet regulatory requirements. Strong knowledge of anti-money laundering (AML) and Bank Secrecy Act (BSA) regulations. Excellent communication and interpersonal skills. Seeking a challenging role where I can leverage my expertise to contribute to the success of a reputable financial institution.

Education

Bachelor’s degree in Finance, Accounting

March 2019

Skills

- Anti-Money Laundering (AML) Regulations

- Bank Secrecy Act (BSA)

- Compliance Monitoring

- Customer Due Diligence (CDD)

- Data Protection

- Enhanced Due Diligence (EDD)

Work Experience

Bank Compliance Officer

- Represented the bank in meetings with regulators and other stakeholders.

- Developed and implemented a risk assessment framework for the bank.

- Monitored and reported on compliance trends and developments.

- Investigated and resolved compliance breaches.

Bank Compliance Officer

- Led the implementation of a new antimoney laundering program that reduced the banks risk profile by 25%.

- Developed and implemented a compliance training program for all bank employees, resulting in a 15% increase in compliance knowledge.

- Conducted regular compliance audits and inspections, identifying and resolving potential compliance issues.

- Provided guidance and advice to bank management on all aspects of compliance.

Accomplishments

- Developed and implemented a new compliance monitoring and training program that reduced compliance violations by 20%

- Conducted comprehensive risk assessments to identify and mitigate compliance risks, leading to a significant reduction in regulatory penalties

- Established and maintained strong relationships with regulatory agencies, ensuring ongoing compliance and reducing audit findings

- Collaborated with the legal department to develop and review new products and services, ensuring compliance with all applicable laws and regulations

- Developed and delivered training programs on compliance best practices to employees across the organization, enhancing compliance awareness and reducing risk

Awards

- Received the Bank Compliance Officer of the Year Award from the American Bankers Association for outstanding contributions to the field

- Recognized by the Financial Crimes Enforcement Network (FinCEN) for exceptional work in combating money laundering and financial crime

- Awarded the Certified AntiMoney Laundering Specialist (CAMS) certification by the Association of Certified AntiMoney Laundering Specialists

- Received the Bank Compliance Officer Excellence Award from the California Bankers Association for exceptional leadership and innovation

Certificates

- Certified Anti-Money Laundering Specialist (CAMS)

- Certified Bank Compliance Professional (CBCP)

- Certified Compliance and Ethics Professional (CCEP)

- Certified Fraud Examiner (CFE)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Bank Compliance Officer

- Highlight your knowledge of AML and BSA regulations.

- Showcase your experience in developing and implementing compliance programs.

- Demonstrate your strong communication and interpersonal skills.

- Quantify your accomplishments with specific metrics to demonstrate your impact.

Essential Experience Highlights for a Strong Bank Compliance Officer Resume

- Develop and implement compliance programs to ensure adherence to regulatory requirements.

- Monitor and assess compliance risks and develop mitigation strategies.

- Conduct compliance audits and investigations to identify and resolve compliance issues.

- Provide training and guidance to bank employees on compliance policies and procedures.

- Represent the bank in meetings with regulators and other stakeholders.

- Stay abreast of changes in compliance regulations and industry best practices.

Frequently Asked Questions (FAQ’s) For Bank Compliance Officer

What are the key responsibilities of a Bank Compliance Officer?

The key responsibilities of a Bank Compliance Officer include developing and implementing compliance programs, monitoring and assessing compliance risks, conducting compliance audits and investigations, providing training and guidance to bank employees on compliance policies and procedures, representing the bank in meetings with regulators and other stakeholders, and staying abreast of changes in compliance regulations and industry best practices.

What are the educational requirements for a Bank Compliance Officer?

The educational requirements for a Bank Compliance Officer typically include a Bachelor’s degree in Finance, Accounting, or a related field.

What are the key skills and qualities of a successful Bank Compliance Officer?

The key skills and qualities of a successful Bank Compliance Officer include strong knowledge of AML and BSA regulations, experience in developing and implementing compliance programs, excellent communication and interpersonal skills, and the ability to stay abreast of changes in compliance regulations and industry best practices.

What are the career prospects for a Bank Compliance Officer?

The career prospects for a Bank Compliance Officer are generally positive. With the increasing focus on compliance in the financial industry, there is a growing demand for qualified compliance professionals.

What is the salary range for a Bank Compliance Officer?

The salary range for a Bank Compliance Officer can vary depending on factors such as experience, location, and the size of the financial institution. According to Salary.com, the average salary for a Bank Compliance Officer in the United States is $115,000.

What are the common challenges faced by Bank Compliance Officers?

The common challenges faced by Bank Compliance Officers include keeping up with the constantly changing regulatory landscape, managing compliance risks, and ensuring that the bank’s compliance program is effective and efficient.