Are you a seasoned Underwriting Manager seeking a new career path? Discover our professionally built Underwriting Manager Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

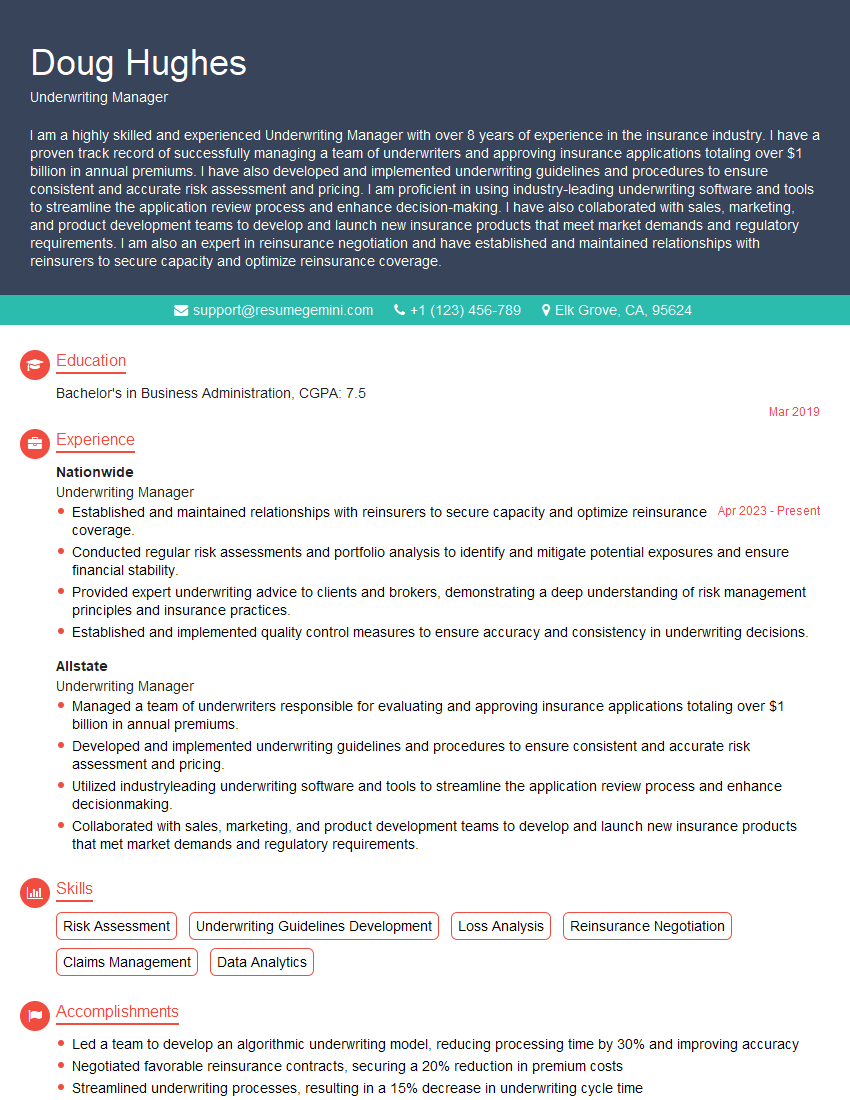

Doug Hughes

Underwriting Manager

Summary

I am a highly skilled and experienced Underwriting Manager with over 8 years of experience in the insurance industry. I have a proven track record of successfully managing a team of underwriters and approving insurance applications totaling over $1 billion in annual premiums. I have also developed and implemented underwriting guidelines and procedures to ensure consistent and accurate risk assessment and pricing. I am proficient in using industry-leading underwriting software and tools to streamline the application review process and enhance decision-making. I have also collaborated with sales, marketing, and product development teams to develop and launch new insurance products that meet market demands and regulatory requirements. I am also an expert in reinsurance negotiation and have established and maintained relationships with reinsurers to secure capacity and optimize reinsurance coverage.

Education

Bachelor’s in Business Administration

March 2019

Skills

- Risk Assessment

- Underwriting Guidelines Development

- Loss Analysis

- Reinsurance Negotiation

- Claims Management

- Data Analytics

Work Experience

Underwriting Manager

- Established and maintained relationships with reinsurers to secure capacity and optimize reinsurance coverage.

- Conducted regular risk assessments and portfolio analysis to identify and mitigate potential exposures and ensure financial stability.

- Provided expert underwriting advice to clients and brokers, demonstrating a deep understanding of risk management principles and insurance practices.

- Established and implemented quality control measures to ensure accuracy and consistency in underwriting decisions.

Underwriting Manager

- Managed a team of underwriters responsible for evaluating and approving insurance applications totaling over $1 billion in annual premiums.

- Developed and implemented underwriting guidelines and procedures to ensure consistent and accurate risk assessment and pricing.

- Utilized industryleading underwriting software and tools to streamline the application review process and enhance decisionmaking.

- Collaborated with sales, marketing, and product development teams to develop and launch new insurance products that met market demands and regulatory requirements.

Accomplishments

- Led a team to develop an algorithmic underwriting model, reducing processing time by 30% and improving accuracy

- Negotiated favorable reinsurance contracts, securing a 20% reduction in premium costs

- Streamlined underwriting processes, resulting in a 15% decrease in underwriting cycle time

- Developed and implemented a training program for new underwriters, resulting in a 25% improvement in underwriting consistency

- Created a data analytics dashboard to monitor underwriting performance, identifying areas for improvement

Awards

- 2020 Industry Excellence Award for Underwriting Innovation

- Top 1% Underwriting Performance Award, Q1 2023

- Bronze Medal in Underwriting Management, National Risk Management Conference

- Underwriting Team of the Year Award, Company Annual Recognition Ceremony

Certificates

- Chartered Property and Casualty Underwriter (CPCU)

- Associate in Risk Management (ARM)

- Certified Insurance Counselor (CIC)

- Fellow, Life Management Institute (FLMI)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Underwriting Manager

- Highlight your skills and experience in underwriting, risk assessment, and insurance policy analysis.

- Quantify your accomplishments whenever possible, using specific numbers and metrics to demonstrate your impact on the organization.

- Proofread your resume carefully before submitting it, making sure that there are no errors in grammar or punctuation.

Essential Experience Highlights for a Strong Underwriting Manager Resume

- Managed a team of underwriters responsible for evaluating and approving insurance applications totaling over $1 billion in annual premiums.

- Developed and implemented underwriting guidelines and procedures to ensure consistent and accurate risk assessment and pricing.

- Utilized industry-leading underwriting software and tools to streamline the application review process and enhance decision-making.

- Collaborated with sales, marketing, and product development teams to develop and launch new insurance products that met market demands and regulatory requirements.

- Established and maintained relationships with reinsurers to secure capacity and optimize reinsurance coverage.

- Conducted regular risk assessments and portfolio analysis to identify and mitigate potential exposures and ensure financial stability.

Frequently Asked Questions (FAQ’s) For Underwriting Manager

What are the key responsibilities of an Underwriting Manager?

The key responsibilities of an Underwriting Manager include evaluating and approving insurance applications, developing and implementing underwriting guidelines and procedures, utilizing underwriting software and tools, collaborating with sales and marketing teams, and establishing and maintaining relationships with reinsurers.

What are the educational requirements for an Underwriting Manager?

The educational requirements for an Underwriting Manager typically include a Bachelor’s degree in Business Administration, Finance, or a related field.

What are the skills and experience required for an Underwriting Manager?

The skills and experience required for an Underwriting Manager typically include strong analytical skills, excellent communication and interpersonal skills, and a deep understanding of insurance principles and practices.

What are the career prospects for an Underwriting Manager?

The career prospects for an Underwriting Manager are typically good, with opportunities for advancement to senior management positions.

What are the salary expectations for an Underwriting Manager?

The salary expectations for an Underwriting Manager can vary depending on experience, location, and company size, but typically range from $60,000 to $120,000 per year.