Are you a seasoned Bank Secrecy Act Anti-Money Laundering Officer (BSA/AML Officer) seeking a new career path? Discover our professionally built Bank Secrecy Act Anti-Money Laundering Officer (BSA/AML Officer) Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

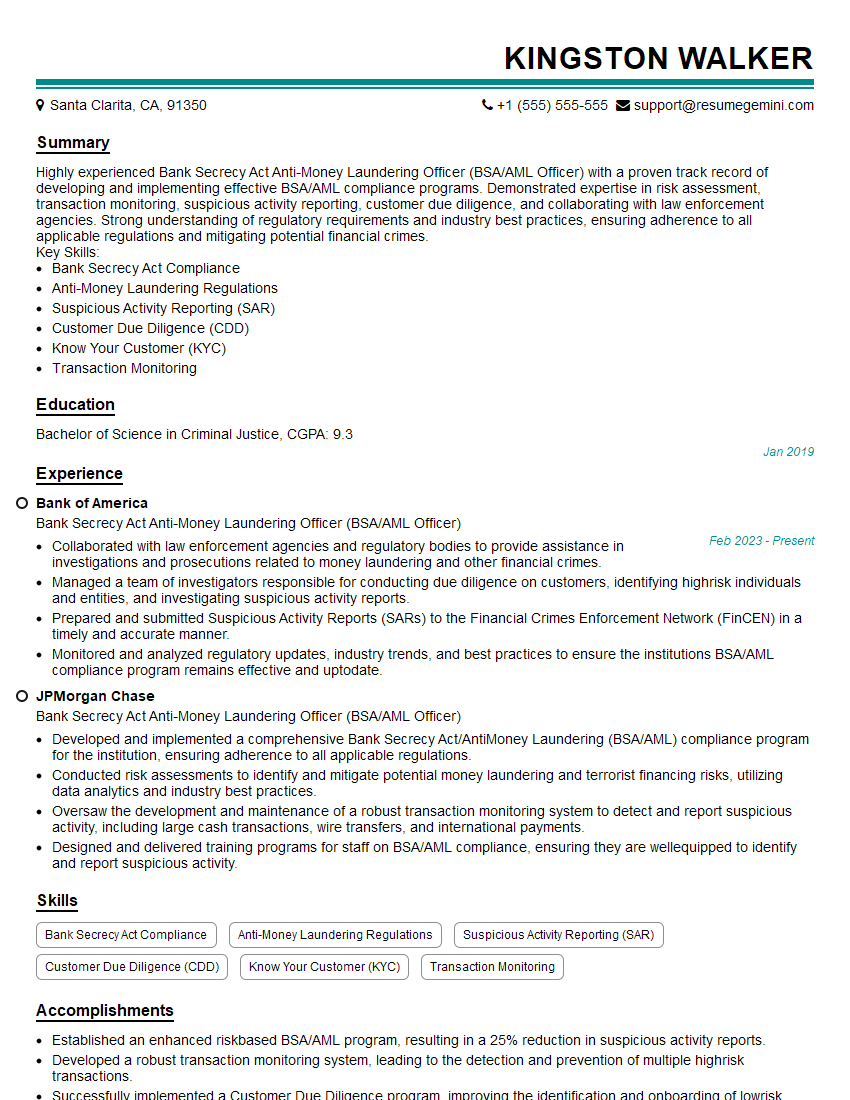

Kingston Walker

Bank Secrecy Act Anti-Money Laundering Officer (BSA/AML Officer)

Summary

Highly experienced Bank Secrecy Act Anti-Money Laundering Officer (BSA/AML Officer) with a proven track record of developing and implementing effective BSA/AML compliance programs. Demonstrated expertise in risk assessment, transaction monitoring, suspicious activity reporting, customer due diligence, and collaborating with law enforcement agencies. Strong understanding of regulatory requirements and industry best practices, ensuring adherence to all applicable regulations and mitigating potential financial crimes.

Key Skills:

- Bank Secrecy Act Compliance

- Anti-Money Laundering Regulations

- Suspicious Activity Reporting (SAR)

- Customer Due Diligence (CDD)

- Know Your Customer (KYC)

- Transaction Monitoring

Education

Bachelor of Science in Criminal Justice

January 2019

Skills

- Bank Secrecy Act Compliance

- Anti-Money Laundering Regulations

- Suspicious Activity Reporting (SAR)

- Customer Due Diligence (CDD)

- Know Your Customer (KYC)

- Transaction Monitoring

Work Experience

Bank Secrecy Act Anti-Money Laundering Officer (BSA/AML Officer)

- Collaborated with law enforcement agencies and regulatory bodies to provide assistance in investigations and prosecutions related to money laundering and other financial crimes.

- Managed a team of investigators responsible for conducting due diligence on customers, identifying highrisk individuals and entities, and investigating suspicious activity reports.

- Prepared and submitted Suspicious Activity Reports (SARs) to the Financial Crimes Enforcement Network (FinCEN) in a timely and accurate manner.

- Monitored and analyzed regulatory updates, industry trends, and best practices to ensure the institutions BSA/AML compliance program remains effective and uptodate.

Bank Secrecy Act Anti-Money Laundering Officer (BSA/AML Officer)

- Developed and implemented a comprehensive Bank Secrecy Act/AntiMoney Laundering (BSA/AML) compliance program for the institution, ensuring adherence to all applicable regulations.

- Conducted risk assessments to identify and mitigate potential money laundering and terrorist financing risks, utilizing data analytics and industry best practices.

- Oversaw the development and maintenance of a robust transaction monitoring system to detect and report suspicious activity, including large cash transactions, wire transfers, and international payments.

- Designed and delivered training programs for staff on BSA/AML compliance, ensuring they are wellequipped to identify and report suspicious activity.

Accomplishments

- Established an enhanced riskbased BSA/AML program, resulting in a 25% reduction in suspicious activity reports.

- Developed a robust transaction monitoring system, leading to the detection and prevention of multiple highrisk transactions.

- Successfully implemented a Customer Due Diligence program, improving the identification and onboarding of lowrisk customers.

- Collaborated with law enforcement agencies to investigate and prosecute financial crimes, contributing to the conviction of multiple individuals.

- Led a team in conducting comprehensive BSA/AML audits, ensuring compliance with regulatory requirements and mitigating risks.

Awards

- Received Top Performer Award for outstanding contributions to BSA/AML compliance.

- Recognized with the Excellence in AML Award for innovative solutions in preventing money laundering and terrorist financing.

- Honored with the Compliance Officer of the Year Award for exceptional leadership in BSA/AML compliance.

- Awarded the Distinguished Service Award for contributions to the development of industryleading BSA/AML regulations.

Certificates

- CAMS (Certified Anti-Money Laundering Specialist)

- CSO (Certified Sanctions Officer)

- ACAMS (Association of Certified Anti-Money Laundering Specialists)

- CFE (Certified Fraud Examiner)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Bank Secrecy Act Anti-Money Laundering Officer (BSA/AML Officer)

- Highlight your expertise in BSA/AML compliance and regulatory requirements.

- Showcase your experience in conducting risk assessments and developing transaction monitoring systems.

- Quantify your accomplishments, such as the number of SARs filed or the amount of suspicious activity detected.

- Demonstrate your ability to collaborate effectively with law enforcement agencies and regulatory bodies.

- Stay up-to-date on the latest BSA/AML regulations and industry best practices.

Essential Experience Highlights for a Strong Bank Secrecy Act Anti-Money Laundering Officer (BSA/AML Officer) Resume

- Developed and implemented a comprehensive BSA/AML compliance program, ensuring adherence to all applicable regulations.

- Conducted risk assessments to identify and mitigate potential money laundering and terrorist financing risks.

- Oversaw the development and maintenance of a robust transaction monitoring system to detect and report suspicious activity.

- Managed a team of investigators responsible for conducting due diligence on customers, identifying high-risk individuals and entities, and investigating suspicious activity reports.

- Collaborated with law enforcement agencies and regulatory bodies to provide assistance in investigations and prosecutions related to money laundering and other financial crimes.

- Prepared and submitted Suspicious Activity Reports (SARs) to the Financial Crimes Enforcement Network (FinCEN) in a timely and accurate manner.

Frequently Asked Questions (FAQ’s) For Bank Secrecy Act Anti-Money Laundering Officer (BSA/AML Officer)

What is the primary responsibility of a BSA/AML Officer?

A BSA/AML Officer is responsible for developing, implementing, and maintaining an effective Bank Secrecy Act and Anti-Money Laundering compliance program within their institution.

What are the key skills required to be a successful BSA/AML Officer?

A successful BSA/AML Officer should possess a strong understanding of BSA/AML regulations, customer due diligence, transaction monitoring, and suspicious activity reporting.

What is the typical career path for a BSA/AML Officer?

A BSA/AML Officer can advance to roles such as BSA/AML Manager, Compliance Manager, or Chief Compliance Officer.

What are the certifications available for BSA/AML Officers?

There are several certifications available for BSA/AML Officers, including the Certified Anti-Money Laundering Specialist (CAMS) and the Anti-Money Laundering Certified Professional (AMLCP).

What are the major challenges faced by BSA/AML Officers?

BSA/AML Officers face challenges such as the evolving regulatory landscape, increasing financial crime sophistication, and the need to balance compliance with customer service.

What is the future of BSA/AML?

The future of BSA/AML involves the use of technology, such as artificial intelligence and machine learning, to enhance risk assessment and transaction monitoring.