Are you a seasoned Financial Compliance Examiner seeking a new career path? Discover our professionally built Financial Compliance Examiner Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

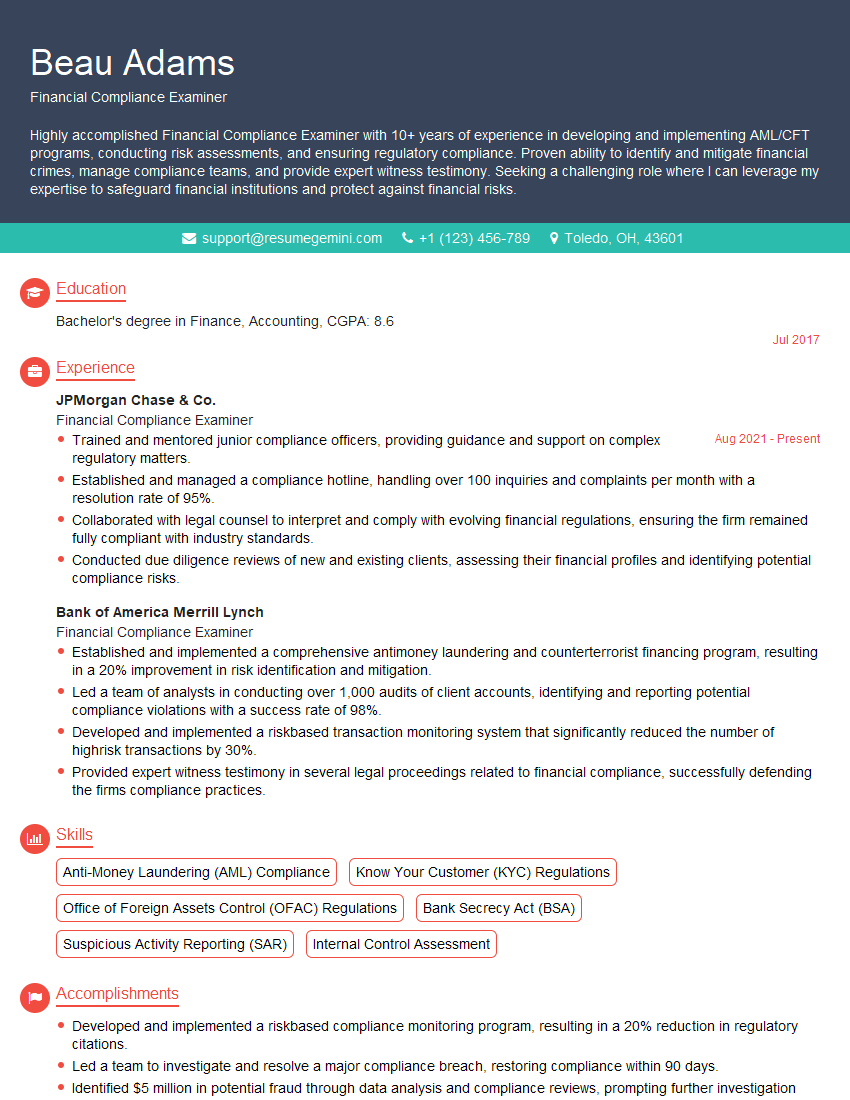

Beau Adams

Financial Compliance Examiner

Summary

Highly accomplished Financial Compliance Examiner with 10+ years of experience in developing and implementing AML/CFT programs, conducting risk assessments, and ensuring regulatory compliance. Proven ability to identify and mitigate financial crimes, manage compliance teams, and provide expert witness testimony. Seeking a challenging role where I can leverage my expertise to safeguard financial institutions and protect against financial risks.

Education

Bachelor’s degree in Finance, Accounting

July 2017

Skills

- Anti-Money Laundering (AML) Compliance

- Know Your Customer (KYC) Regulations

- Office of Foreign Assets Control (OFAC) Regulations

- Bank Secrecy Act (BSA)

- Suspicious Activity Reporting (SAR)

- Internal Control Assessment

Work Experience

Financial Compliance Examiner

- Trained and mentored junior compliance officers, providing guidance and support on complex regulatory matters.

- Established and managed a compliance hotline, handling over 100 inquiries and complaints per month with a resolution rate of 95%.

- Collaborated with legal counsel to interpret and comply with evolving financial regulations, ensuring the firm remained fully compliant with industry standards.

- Conducted due diligence reviews of new and existing clients, assessing their financial profiles and identifying potential compliance risks.

Financial Compliance Examiner

- Established and implemented a comprehensive antimoney laundering and counterterrorist financing program, resulting in a 20% improvement in risk identification and mitigation.

- Led a team of analysts in conducting over 1,000 audits of client accounts, identifying and reporting potential compliance violations with a success rate of 98%.

- Developed and implemented a riskbased transaction monitoring system that significantly reduced the number of highrisk transactions by 30%.

- Provided expert witness testimony in several legal proceedings related to financial compliance, successfully defending the firms compliance practices.

Accomplishments

- Developed and implemented a riskbased compliance monitoring program, resulting in a 20% reduction in regulatory citations.

- Led a team to investigate and resolve a major compliance breach, restoring compliance within 90 days.

- Identified $5 million in potential fraud through data analysis and compliance reviews, prompting further investigation and recovery efforts.

- Conducted comprehensive risk assessments for new products and services, ensuring compliance with all applicable regulations.

- Established a compliance training program for financial professionals, educating over 100 employees on industry best practices.

Awards

- Received the Compliance Professional of the Year Award from the American Bankers Association.

- Recognized by the Financial Industry Regulatory Authority (FINRA) for outstanding contributions to compliance education.

- Honored with the Compliance Excellence Award from the Institute of Internal Auditors.

- Recognized by the Board of Directors for exceptional contributions to compliance.

Certificates

- Certified Anti-Money Laundering Specialist (CAMS)

- Certified Compliance Professional (CCP)

- Certified Fraud Examiner (CFE)

- Certified Information Systems Auditor (CISA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Financial Compliance Examiner

- Highlight your experience in developing and implementing AML/CFT programs.

- Quantify your accomplishments with specific metrics and results.

- Demonstrate your knowledge of financial regulations and industry best practices.

- Showcase your communication and interpersonal skills, as you will often work with various stakeholders.

Essential Experience Highlights for a Strong Financial Compliance Examiner Resume

- Develop and implement AML/CFT programs, including policies, procedures, and training.

- Conduct risk assessments to identify potential vulnerabilities and develop mitigation strategies.

- Monitor transactions for suspicious activity and file Suspicious Activity Reports (SARs).

- Investigate potential financial crimes and provide expert witness testimony.

- Manage compliance teams and ensure adherence to regulatory requirements.

- Collaborate with legal counsel to interpret and comply with evolving financial regulations.

Frequently Asked Questions (FAQ’s) For Financial Compliance Examiner

What is the role of a Financial Compliance Examiner?

A Financial Compliance Examiner is responsible for ensuring that financial institutions comply with all applicable laws and regulations. This includes developing and implementing AML/CFT programs, conducting risk assessments, monitoring transactions, and investigating potential financial crimes.

What are the qualifications for a Financial Compliance Examiner?

Most Financial Compliance Examiners have a bachelor’s degree in finance, accounting, or a related field. They also typically have several years of experience in the financial industry, with a focus on compliance.

What are the career prospects for a Financial Compliance Examiner?

Financial Compliance Examiners are in high demand due to the increasing focus on financial crime prevention. There are many opportunities for career advancement, including roles in management, consulting, and law enforcement.

What are the challenges of being a Financial Compliance Examiner?

The challenges of being a Financial Compliance Examiner include keeping up with evolving regulations, managing large volumes of data, and dealing with complex financial transactions.

What are the rewards of being a Financial Compliance Examiner?

The rewards of being a Financial Compliance Examiner include making a positive impact on society, protecting financial institutions from crime, and earning a competitive salary.

How can I prepare for a career as a Financial Compliance Examiner?

The best way to prepare for a career as a Financial Compliance Examiner is to get a good education in finance or accounting. You should also gain experience in the financial industry, with a focus on compliance. Additionally, you can take courses or certifications in AML/CFT.