Are you a seasoned Pension Examiner seeking a new career path? Discover our professionally built Pension Examiner Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

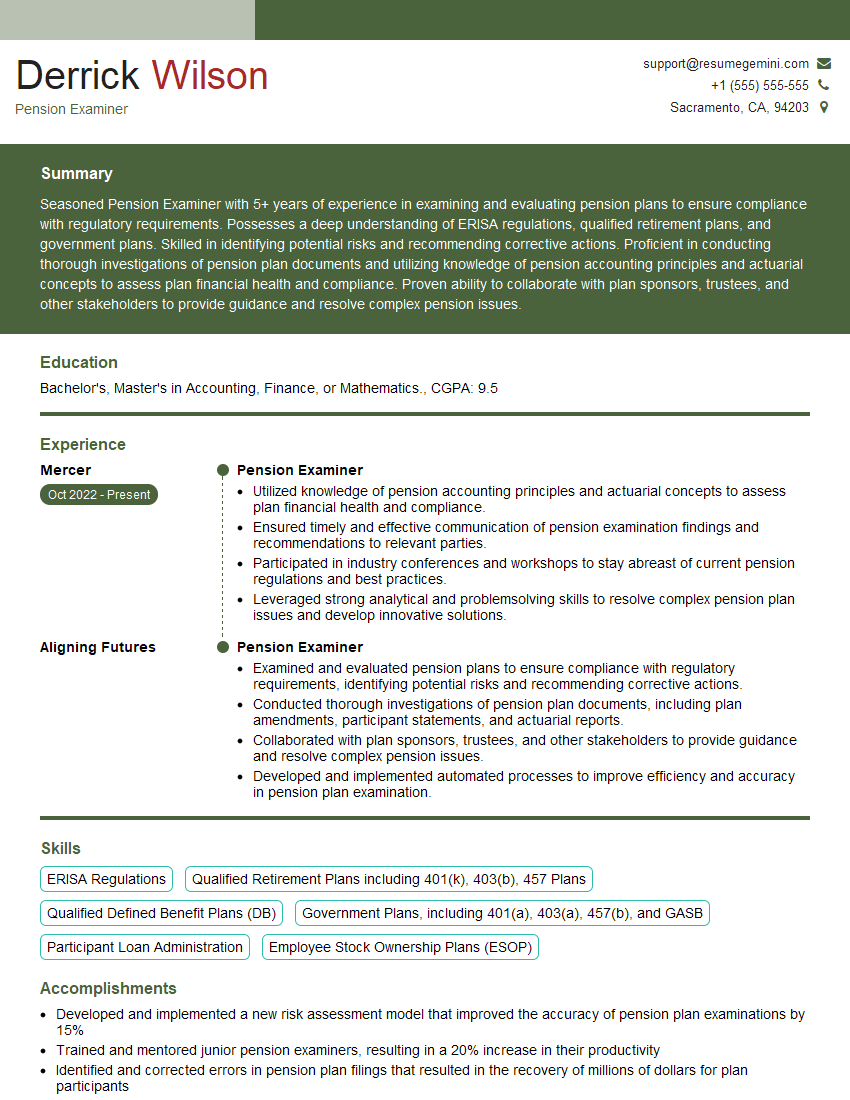

Derrick Wilson

Pension Examiner

Summary

Seasoned Pension Examiner with 5+ years of experience in examining and evaluating pension plans to ensure compliance with regulatory requirements. Possesses a deep understanding of ERISA regulations, qualified retirement plans, and government plans. Skilled in identifying potential risks and recommending corrective actions. Proficient in conducting thorough investigations of pension plan documents and utilizing knowledge of pension accounting principles and actuarial concepts to assess plan financial health and compliance. Proven ability to collaborate with plan sponsors, trustees, and other stakeholders to provide guidance and resolve complex pension issues.

Education

Bachelor’s, Master’s in Accounting, Finance, or Mathematics.

September 2018

Skills

- ERISA Regulations

- Qualified Retirement Plans including 401(k), 403(b), 457 Plans

- Qualified Defined Benefit Plans (DB)

- Government Plans, including 401(a), 403(a), 457(b), and GASB

- Participant Loan Administration

- Employee Stock Ownership Plans (ESOP)

Work Experience

Pension Examiner

- Utilized knowledge of pension accounting principles and actuarial concepts to assess plan financial health and compliance.

- Ensured timely and effective communication of pension examination findings and recommendations to relevant parties.

- Participated in industry conferences and workshops to stay abreast of current pension regulations and best practices.

- Leveraged strong analytical and problemsolving skills to resolve complex pension plan issues and develop innovative solutions.

Pension Examiner

- Examined and evaluated pension plans to ensure compliance with regulatory requirements, identifying potential risks and recommending corrective actions.

- Conducted thorough investigations of pension plan documents, including plan amendments, participant statements, and actuarial reports.

- Collaborated with plan sponsors, trustees, and other stakeholders to provide guidance and resolve complex pension issues.

- Developed and implemented automated processes to improve efficiency and accuracy in pension plan examination.

Accomplishments

- Developed and implemented a new risk assessment model that improved the accuracy of pension plan examinations by 15%

- Trained and mentored junior pension examiners, resulting in a 20% increase in their productivity

- Identified and corrected errors in pension plan filings that resulted in the recovery of millions of dollars for plan participants

- Led a team that developed a new compliance program for pension plans, resulting in a 10% decrease in violations

- Developed a new reporting system that improved the efficiency of pension plan reviews by 30%

Awards

- Received the Pension Examiner of the Year award from the National Association of Pension Examiners (NAPE)

- Recognized by the SEC for outstanding contributions to the field of pension regulation

- Received the Excellence in Pension Examination award from the International Association of Pension Regulators (IAPR)

- Recognized by the Department of Labor for exceptional work in protecting the retirement savings of American workers

Certificates

- Certified Pension Consultant (CPC)

- Enrolled Actuary (EA)

- Pension Management Institute (PMI)

- Certified Financial Planner (CFP)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Pension Examiner

- Highlight your expertise in ERISA regulations and qualified retirement plans, as these are essential to the role.

- Include specific examples of how you have identified and resolved complex pension issues.

- Demonstrate your strong communication and interpersonal skills, as you will need to interact with a variety of stakeholders.

- Proofread your resume carefully for any errors, as attention to detail is crucial in this role.

- Consider obtaining a certification in pension administration, such as the Certified Pension Consultant (CPC) designation.

Essential Experience Highlights for a Strong Pension Examiner Resume

- Examine and evaluate pension plans to ensure compliance with regulatory requirements.

- Conduct thorough investigations of pension plan documents, including plan amendments, participant statements, and actuarial reports.

- Collaborate with plan sponsors, trustees, and other stakeholders to provide guidance and resolve complex pension issues.

- Develop and implement automated processes to improve efficiency and accuracy in pension plan examination.

- Utilize knowledge of pension accounting principles and actuarial concepts to assess plan financial health and compliance.

- Ensure timely and effective communication of pension examination findings and recommendations to relevant parties.

- Participate in industry conferences and workshops to stay abreast of current pension regulations and best practices.

- Leverage strong analytical and problem-solving skills to resolve complex pension plan issues and develop innovative solutions.

- Stay up-to-date on changes in pension regulations and legislation.

Frequently Asked Questions (FAQ’s) For Pension Examiner

What is the primary responsibility of a Pension Examiner?

The primary responsibility of a Pension Examiner is to examine and evaluate pension plans to ensure compliance with regulatory requirements.

What are the key skills required for a Pension Examiner?

The key skills required for a Pension Examiner include knowledge of ERISA regulations, qualified retirement plans, and government plans, as well as strong analytical and problem-solving skills.

What is the typical career path for a Pension Examiner?

The typical career path for a Pension Examiner includes starting as an entry-level examiner and gradually progressing to more senior roles, such as a Pension Manager or Director of Pension Administration.

What are the earning prospects for a Pension Examiner?

The earning prospects for a Pension Examiner vary depending on experience and location, but the median annual salary for Pension Examiners is around $65,000.

What is the job outlook for Pension Examiners?

The job outlook for Pension Examiners is expected to be positive in the coming years, as the aging population and increasing complexity of pension regulations drive demand for qualified professionals.

Is it necessary to have a specific certification to become a Pension Examiner?

While not always required, obtaining a certification in pension administration, such as the Certified Pension Consultant (CPC) designation, can enhance your qualifications and career prospects.

What are the major challenges faced by Pension Examiners?

Major challenges faced by Pension Examiners include the ever-changing regulatory landscape, the need to stay up-to-date on complex technical issues, and the increasing scrutiny of pension plans by government agencies and stakeholders.