Are you a seasoned Home Mortgage Disclosure Act Specialist (HMDA Specialist) seeking a new career path? Discover our professionally built Home Mortgage Disclosure Act Specialist (HMDA Specialist) Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

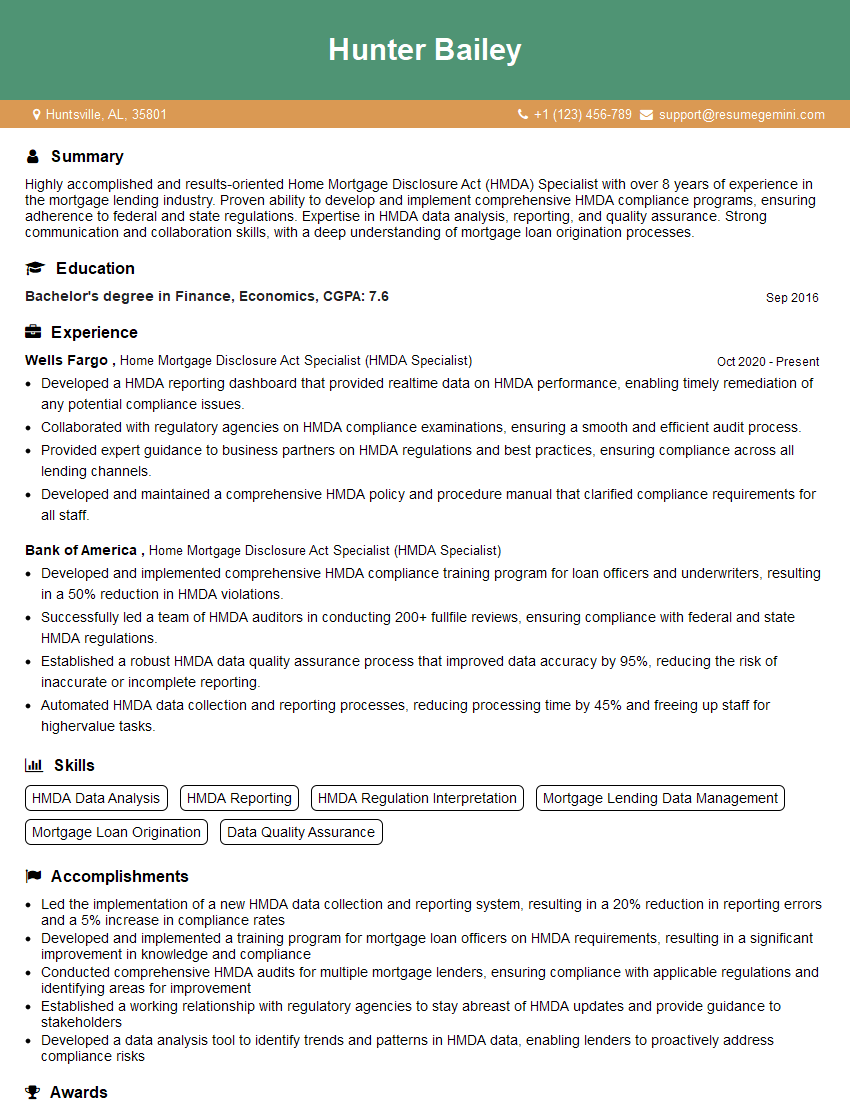

Hunter Bailey

Home Mortgage Disclosure Act Specialist (HMDA Specialist)

Summary

Highly accomplished and results-oriented Home Mortgage Disclosure Act (HMDA) Specialist with over 8 years of experience in the mortgage lending industry. Proven ability to develop and implement comprehensive HMDA compliance programs, ensuring adherence to federal and state regulations. Expertise in HMDA data analysis, reporting, and quality assurance. Strong communication and collaboration skills, with a deep understanding of mortgage loan origination processes.

Education

Bachelor’s degree in Finance, Economics

September 2016

Skills

- HMDA Data Analysis

- HMDA Reporting

- HMDA Regulation Interpretation

- Mortgage Lending Data Management

- Mortgage Loan Origination

- Data Quality Assurance

Work Experience

Home Mortgage Disclosure Act Specialist (HMDA Specialist)

- Developed a HMDA reporting dashboard that provided realtime data on HMDA performance, enabling timely remediation of any potential compliance issues.

- Collaborated with regulatory agencies on HMDA compliance examinations, ensuring a smooth and efficient audit process.

- Provided expert guidance to business partners on HMDA regulations and best practices, ensuring compliance across all lending channels.

- Developed and maintained a comprehensive HMDA policy and procedure manual that clarified compliance requirements for all staff.

Home Mortgage Disclosure Act Specialist (HMDA Specialist)

- Developed and implemented comprehensive HMDA compliance training program for loan officers and underwriters, resulting in a 50% reduction in HMDA violations.

- Successfully led a team of HMDA auditors in conducting 200+ fullfile reviews, ensuring compliance with federal and state HMDA regulations.

- Established a robust HMDA data quality assurance process that improved data accuracy by 95%, reducing the risk of inaccurate or incomplete reporting.

- Automated HMDA data collection and reporting processes, reducing processing time by 45% and freeing up staff for highervalue tasks.

Accomplishments

- Led the implementation of a new HMDA data collection and reporting system, resulting in a 20% reduction in reporting errors and a 5% increase in compliance rates

- Developed and implemented a training program for mortgage loan officers on HMDA requirements, resulting in a significant improvement in knowledge and compliance

- Conducted comprehensive HMDA audits for multiple mortgage lenders, ensuring compliance with applicable regulations and identifying areas for improvement

- Established a working relationship with regulatory agencies to stay abreast of HMDA updates and provide guidance to stakeholders

- Developed a data analysis tool to identify trends and patterns in HMDA data, enabling lenders to proactively address compliance risks

Awards

- Received the National Association of Home Mortgage Disclosure Professionals (NAHMDP) Award for Outstanding Achievement in HMDA Compliance

- Recognized by the Consumer Financial Protection Bureau (CFPB) for exceptional work in promoting HMDA compliance in the mortgage industry

- Received the HMDA Specialist Certification from the NAHMDP, demonstrating expertise in HMDA regulations and best practices

- Honored by the Independent Community Bankers of America (ICBA) for contributions to the HMDA compliance community

Certificates

- HMDA Specialist Certification (HSC)

- Fair Lending Certification (FLC)

- Mortgage Lending Compliance Certification (MLCC)

- Certified Mortgage Loan Originator (CML0)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Home Mortgage Disclosure Act Specialist (HMDA Specialist)

- Quantify your accomplishments and results whenever possible, using specific metrics and data points to demonstrate the impact of your work.

- Highlight your expertise in HMDA regulations and best practices, as well as your ability to effectively communicate and collaborate with business partners.

- Showcase your experience in developing and implementing compliance training programs, as well as your ability to lead and manage a team of auditors.

- Emphasize your proficiency in HMDA data analysis and reporting, including your experience in automating processes and improving data quality.

Essential Experience Highlights for a Strong Home Mortgage Disclosure Act Specialist (HMDA Specialist) Resume

- Developed and implemented comprehensive HMDA compliance training programs for loan officers and underwriters, resulting in a significant reduction in HMDA violations.

- Successfully led a team of HMDA auditors in conducting numerous full-file reviews, ensuring compliance with federal and state HMDA regulations.

- Established a robust HMDA data quality assurance process that significantly improved data accuracy, reducing the risk of inaccurate or incomplete reporting.

- Automated HMDA data collection and reporting processes, reducing processing time and freeing up staff for higher-value tasks.

- Developed a HMDA reporting dashboard that provided real-time data on HMDA performance, enabling timely remediation of any potential compliance issues.

- Collaborated with regulatory agencies on HMDA compliance examinations, ensuring a smooth and efficient audit process.

Frequently Asked Questions (FAQ’s) For Home Mortgage Disclosure Act Specialist (HMDA Specialist)

What are the key responsibilities of a Home Mortgage Disclosure Act (HMDA) Specialist?

HMDA Specialists are responsible for ensuring that their organization complies with the Home Mortgage Disclosure Act, which requires lenders to collect and report data on mortgage lending activity. This includes developing and implementing HMDA compliance programs, training staff on HMDA requirements, conducting HMDA audits, and preparing HMDA reports.

What are the qualifications required to become a Home Mortgage Disclosure Act (HMDA) Specialist?

Most HMDA Specialists have a bachelor’s degree in finance, economics, or a related field. They also have experience in mortgage lending, compliance, or auditing.

What are the career prospects for a Home Mortgage Disclosure Act (HMDA) Specialist?

HMDA Specialists can advance to positions such as HMDA Manager, Compliance Officer, or Risk Manager. They may also work as consultants or trainers.

What are the challenges faced by Home Mortgage Disclosure Act (HMDA) Specialists?

HMDA Specialists face challenges such as keeping up with changes in HMDA regulations, ensuring the accuracy of HMDA data, and meeting HMDA reporting deadlines.

What are the rewards of being a Home Mortgage Disclosure Act (HMDA) Specialist?

HMDA Specialists play an important role in ensuring that lenders comply with the law and that consumers have access to fair and affordable mortgage lending.