Are you a seasoned Securities Compliance Examiner seeking a new career path? Discover our professionally built Securities Compliance Examiner Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

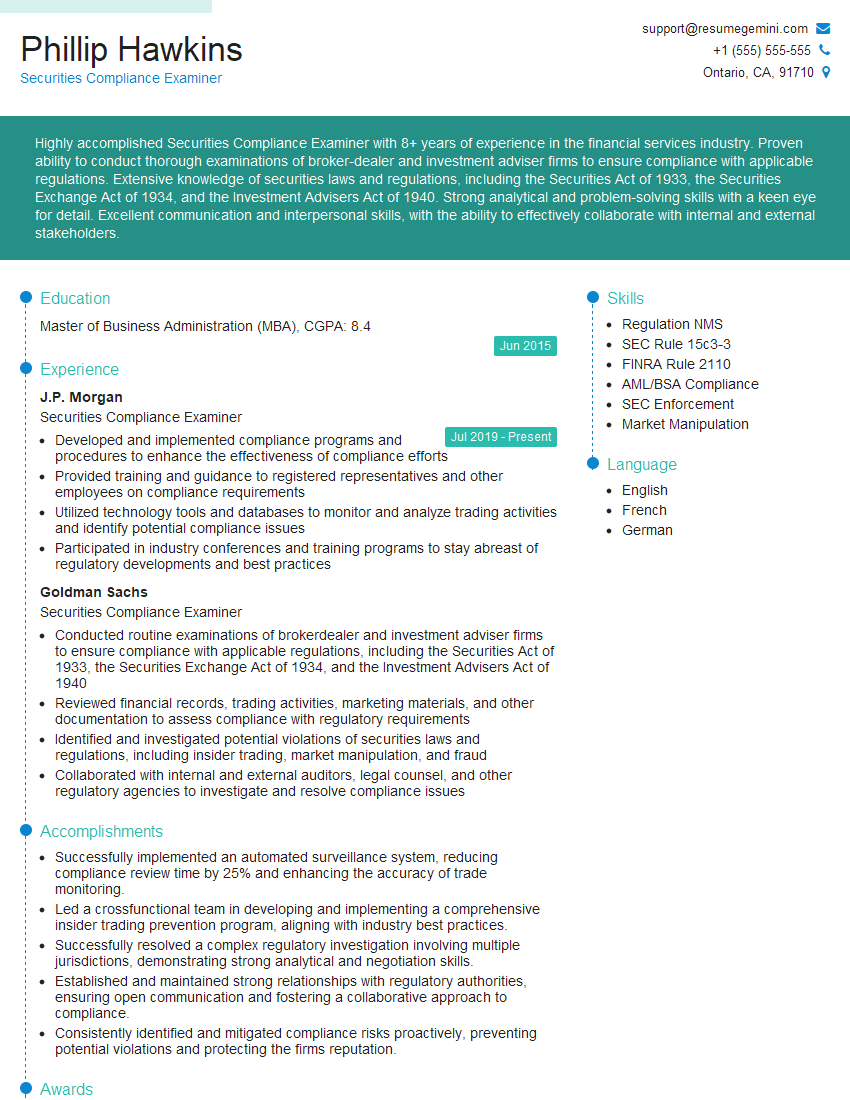

Phillip Hawkins

Securities Compliance Examiner

Summary

Highly accomplished Securities Compliance Examiner with 8+ years of experience in the financial services industry. Proven ability to conduct thorough examinations of broker-dealer and investment adviser firms to ensure compliance with applicable regulations. Extensive knowledge of securities laws and regulations, including the Securities Act of 1933, the Securities Exchange Act of 1934, and the Investment Advisers Act of 1940. Strong analytical and problem-solving skills with a keen eye for detail. Excellent communication and interpersonal skills, with the ability to effectively collaborate with internal and external stakeholders.

Education

Master of Business Administration (MBA)

June 2015

Skills

- Regulation NMS

- SEC Rule 15c3-3

- FINRA Rule 2110

- AML/BSA Compliance

- SEC Enforcement

- Market Manipulation

Work Experience

Securities Compliance Examiner

- Developed and implemented compliance programs and procedures to enhance the effectiveness of compliance efforts

- Provided training and guidance to registered representatives and other employees on compliance requirements

- Utilized technology tools and databases to monitor and analyze trading activities and identify potential compliance issues

- Participated in industry conferences and training programs to stay abreast of regulatory developments and best practices

Securities Compliance Examiner

- Conducted routine examinations of brokerdealer and investment adviser firms to ensure compliance with applicable regulations, including the Securities Act of 1933, the Securities Exchange Act of 1934, and the Investment Advisers Act of 1940

- Reviewed financial records, trading activities, marketing materials, and other documentation to assess compliance with regulatory requirements

- Identified and investigated potential violations of securities laws and regulations, including insider trading, market manipulation, and fraud

- Collaborated with internal and external auditors, legal counsel, and other regulatory agencies to investigate and resolve compliance issues

Accomplishments

- Successfully implemented an automated surveillance system, reducing compliance review time by 25% and enhancing the accuracy of trade monitoring.

- Led a crossfunctional team in developing and implementing a comprehensive insider trading prevention program, aligning with industry best practices.

- Successfully resolved a complex regulatory investigation involving multiple jurisdictions, demonstrating strong analytical and negotiation skills.

- Established and maintained strong relationships with regulatory authorities, ensuring open communication and fostering a collaborative approach to compliance.

- Consistently identified and mitigated compliance risks proactively, preventing potential violations and protecting the firms reputation.

Awards

- Received recognition for exceptional performance as a Securities Compliance Examiner, consistently exceeding expectations in regulatory compliance and risk management.

- Recipient of the Compliance Excellence Award for outstanding contributions to the enhancement of the firms compliance risk management framework.

- Honored with the Industry Innovation Award for developing a groundbreaking artificial intelligencepowered compliance analytics tool.

- Recognized as a Rising Star in Compliance for exceptional contributions to the industry and demonstrated leadership in regulatory compliance.

Certificates

- Series 24

- Series 57

- Series 63

- Series 79

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Securities Compliance Examiner

- Highlight your experience and expertise in securities compliance by quantifying your accomplishments and providing specific examples.

- Tailor your resume to each job you apply for by emphasizing the skills and experience that are most relevant to the position.

- Proofread your resume carefully for any errors in grammar, spelling, or formatting.

- Consider getting feedback on your resume from a career counselor or professional resume writer.

Essential Experience Highlights for a Strong Securities Compliance Examiner Resume

- Conducted routine examinations of broker-dealer and investment adviser firms to ensure compliance with applicable regulations, including the Securities Act of 1933, the Securities Exchange Act of 1934, and the Investment Advisers Act of 1940.

- Reviewed financial records, trading activities, marketing materials, and other documentation to assess compliance with regulatory requirements.

- Identified and investigated potential violations of securities laws and regulations, including insider trading, market manipulation, and fraud.

- Collaborated with internal and external auditors, legal counsel, and other regulatory agencies to investigate and resolve compliance issues.

- Developed and implemented compliance programs and procedures to enhance the effectiveness of compliance efforts.

- Provided training and guidance to registered representatives and other employees on compliance requirements.

- Utilized technology tools and databases to monitor and analyze trading activities and identify potential compliance issues.

Frequently Asked Questions (FAQ’s) For Securities Compliance Examiner

What is the role of a Securities Compliance Examiner?

Securities Compliance Examiners are responsible for ensuring that broker-dealer and investment adviser firms comply with applicable securities laws and regulations. They conduct examinations of these firms to assess their compliance with regulatory requirements, identify and investigate potential violations, and develop and implement compliance programs and procedures.

What are the qualifications for becoming a Securities Compliance Examiner?

Most Securities Compliance Examiners have a bachelor’s degree in business administration, finance, or a related field. They also typically have several years of experience in the financial services industry, including experience in compliance or auditing.

What are the key skills for a Securities Compliance Examiner?

Securities Compliance Examiners should have strong analytical and problem-solving skills, as well as a keen eye for detail. They should also have excellent communication and interpersonal skills, and be able to effectively collaborate with internal and external stakeholders.

What is the job outlook for Securities Compliance Examiners?

The job outlook for Securities Compliance Examiners is expected to be good over the next few years. This is due to the increasing complexity of securities laws and regulations, as well as the growing need for compliance professionals in the financial services industry.

What is the average salary for a Securities Compliance Examiner?

The average salary for a Securities Compliance Examiner is $85,000 per year. However, salaries can vary depending on experience, location, and employer.

What are the career advancement opportunities for Securities Compliance Examiners?

Securities Compliance Examiners can advance their careers by moving into management positions, such as Compliance Officer or Chief Compliance Officer. They can also move into other areas of the financial services industry, such as investment banking or wealth management.