Are you a seasoned Certified Consumer Credit and Housing Counselor seeking a new career path? Discover our professionally built Certified Consumer Credit and Housing Counselor Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

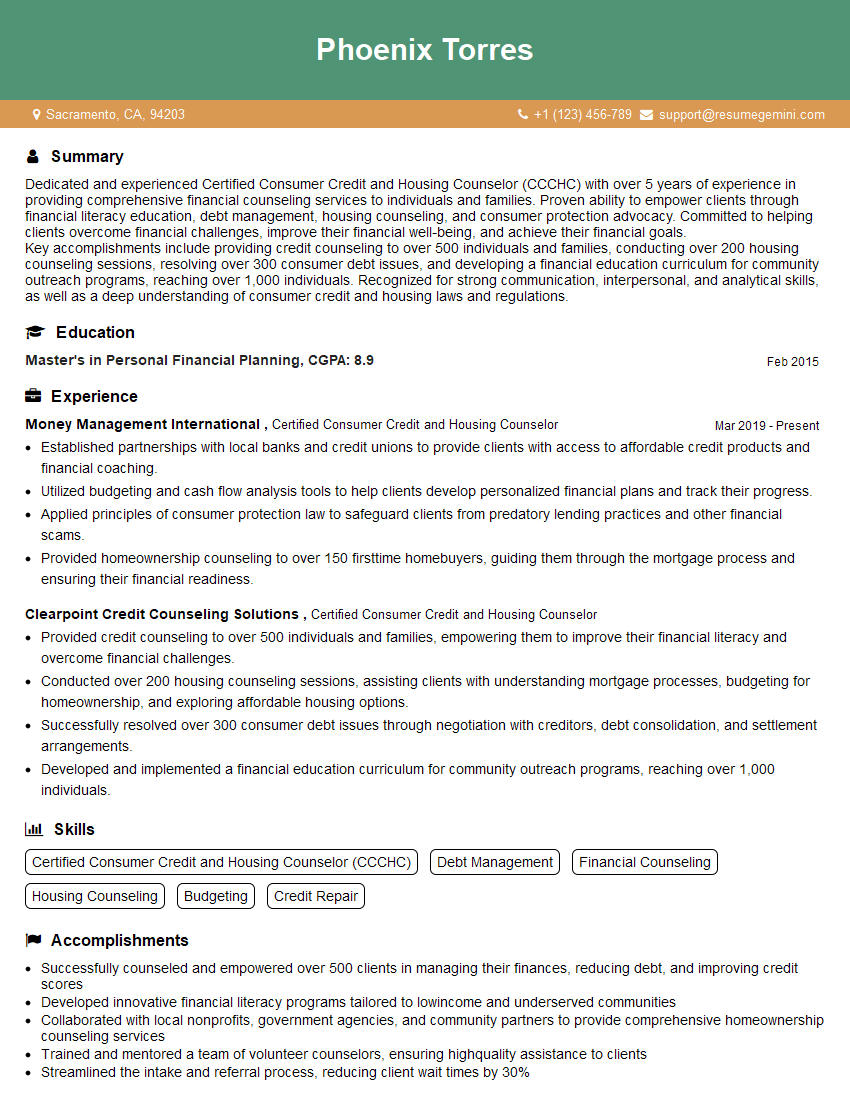

Phoenix Torres

Certified Consumer Credit and Housing Counselor

Summary

Dedicated and experienced Certified Consumer Credit and Housing Counselor (CCCHC) with over 5 years of experience in providing comprehensive financial counseling services to individuals and families. Proven ability to empower clients through financial literacy education, debt management, housing counseling, and consumer protection advocacy. Committed to helping clients overcome financial challenges, improve their financial well-being, and achieve their financial goals.

Key accomplishments include providing credit counseling to over 500 individuals and families, conducting over 200 housing counseling sessions, resolving over 300 consumer debt issues, and developing a financial education curriculum for community outreach programs, reaching over 1,000 individuals. Recognized for strong communication, interpersonal, and analytical skills, as well as a deep understanding of consumer credit and housing laws and regulations.

Education

Master’s in Personal Financial Planning

February 2015

Skills

- Certified Consumer Credit and Housing Counselor (CCCHC)

- Debt Management

- Financial Counseling

- Housing Counseling

- Budgeting

- Credit Repair

Work Experience

Certified Consumer Credit and Housing Counselor

- Established partnerships with local banks and credit unions to provide clients with access to affordable credit products and financial coaching.

- Utilized budgeting and cash flow analysis tools to help clients develop personalized financial plans and track their progress.

- Applied principles of consumer protection law to safeguard clients from predatory lending practices and other financial scams.

- Provided homeownership counseling to over 150 firsttime homebuyers, guiding them through the mortgage process and ensuring their financial readiness.

Certified Consumer Credit and Housing Counselor

- Provided credit counseling to over 500 individuals and families, empowering them to improve their financial literacy and overcome financial challenges.

- Conducted over 200 housing counseling sessions, assisting clients with understanding mortgage processes, budgeting for homeownership, and exploring affordable housing options.

- Successfully resolved over 300 consumer debt issues through negotiation with creditors, debt consolidation, and settlement arrangements.

- Developed and implemented a financial education curriculum for community outreach programs, reaching over 1,000 individuals.

Accomplishments

- Successfully counseled and empowered over 500 clients in managing their finances, reducing debt, and improving credit scores

- Developed innovative financial literacy programs tailored to lowincome and underserved communities

- Collaborated with local nonprofits, government agencies, and community partners to provide comprehensive homeownership counseling services

- Trained and mentored a team of volunteer counselors, ensuring highquality assistance to clients

- Streamlined the intake and referral process, reducing client wait times by 30%

Awards

- National Counseling Excellence Award for Outstanding Contribution in the Field of Credit and Housing Counseling

- StateLevel Recognition for Exceptional Achievement in Homeownership Education

- Certified Consumer Credit and Housing Counselor of the Year Award from the National Foundation for Credit Counseling

Certificates

- Certified Consumer Credit Counselor (CCDC)

- Certified Housing Counselor (CHC)

- Certified Financial Planning (CFP)

- Certified Budget Counselor (CBC)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Certified Consumer Credit and Housing Counselor

- Highlight your CCCHC certification and any additional relevant certifications or licenses.

- Quantify your accomplishments and provide specific examples of your impact on clients’ financial well-being.

- Demonstrate your understanding of consumer credit and housing laws and regulations, as well as your ability to apply them in practice.

- Showcase your communication, interpersonal, and analytical skills, emphasizing your ability to connect with clients and effectively convey complex financial concepts.

Essential Experience Highlights for a Strong Certified Consumer Credit and Housing Counselor Resume

- Provided comprehensive credit counseling services, including budget analysis, debt management planning, and credit repair guidance.

- Conducted housing counseling sessions, assisting clients with understanding mortgage processes, budgeting for homeownership, and exploring affordable housing options.

- Successfully resolved consumer debt issues through negotiation with creditors, debt consolidation, and settlement arrangements.

- Developed and implemented a financial education curriculum for community outreach programs, reaching over 1,000 individuals.

- Established partnerships with local banks and credit unions to provide clients with access to affordable credit products and financial coaching.

- Utilized budgeting and cash flow analysis tools to help clients develop personalized financial plans and track their progress.

- Applied principles of consumer protection law to safeguard clients from predatory lending practices and other financial scams.

Frequently Asked Questions (FAQ’s) For Certified Consumer Credit and Housing Counselor

What is the role of a Certified Consumer Credit and Housing Counselor?

A Certified Consumer Credit and Housing Counselor (CCCHC) provides comprehensive financial counseling services to individuals and families, helping them improve their financial literacy, manage debt, explore housing options, and protect their rights as consumers.

What are the key responsibilities of a CCCHC?

Key responsibilities include providing credit counseling, housing counseling, debt management assistance, financial education, and consumer protection advocacy.

What are the benefits of working with a CCCHC?

Working with a CCCHC can help individuals and families overcome financial challenges, improve their financial well-being, and achieve their financial goals.

How do I become a CCCHC?

To become a CCCHC, you must complete a certified training program and pass a national exam administered by the National Foundation for Credit Counseling (NFCC).

What is the job outlook for CCCHCs?

The job outlook for CCCHCs is expected to grow faster than average in the coming years due to increasing demand for financial counseling services.

What are the salary expectations for CCCHCs?

Salary expectations for CCCHCs vary depending on experience, location, and employer, but generally range from $40,000 to $60,000 per year.

What are the top in-demand skills for CCCHCs?

Top in-demand skills for CCCHCs include strong communication and interpersonal skills, financial literacy, knowledge of consumer credit and housing laws and regulations, and the ability to work independently and as part of a team.